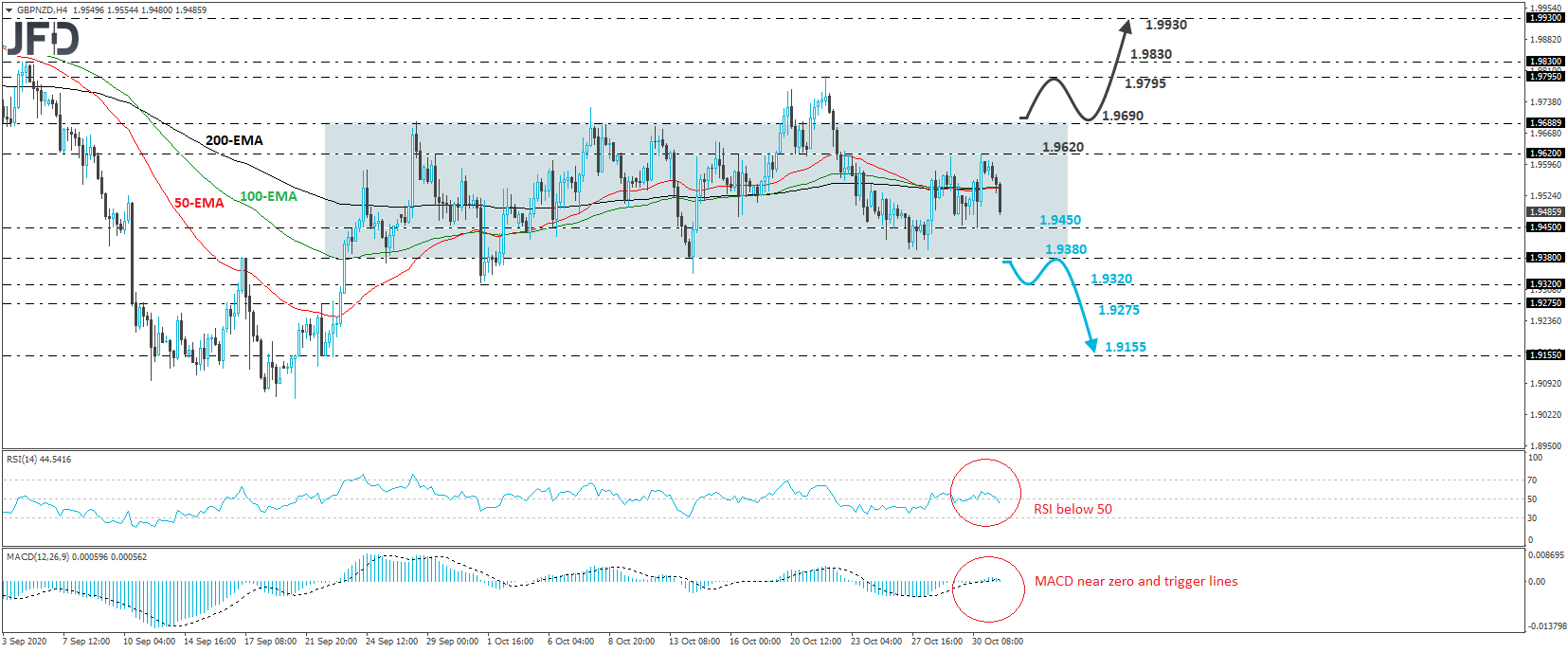

GBP/NZD moved lower on Monday, after hitting resistance at 1.9620 on Friday. Overall, since September 23rd, the pair is trading in a trendless mode, with most of the price action staying roughly between the 1.9380 and 1.9690 levels. Having that in mind, we prefer to adopt a neutral stance with regards to the short-term outlook of this pair.

In order to start examining the bearish case, we would like to see a decisive dip below the lower end of the range, at around 1.9380. Such a move may initially pave the way towards the 1.9320 level, marked by the low of October 1st, or towards the 1.9275 barrier, defined as a support by the inside swing high of September 22nd. If the latter level is not able to halt the slide either, then a break lower could carry larger bearish implications, perhaps paving the way towards the low of September 23rd, at 1.9155.

Shifting attention to our short-term oscillators, we see that the RSI has turned down again and just crossed below its 50 line. However, the MACD points east, lying very close to both its trigger and zero lines, adding more credence to our choice of staying sidelined until the rate exits the aforementioned range.

On the upside, a strong move above 1.9690 could initially target the 1.9795 zone, marked by the high of October 22nd, or the 1.9830 area, defined as a resistance by the high of September 4th. Another break, above 1.9830, may set the stage for bullish extensions towards the 1.9930 hurdle, marked by the peak of September 1st.