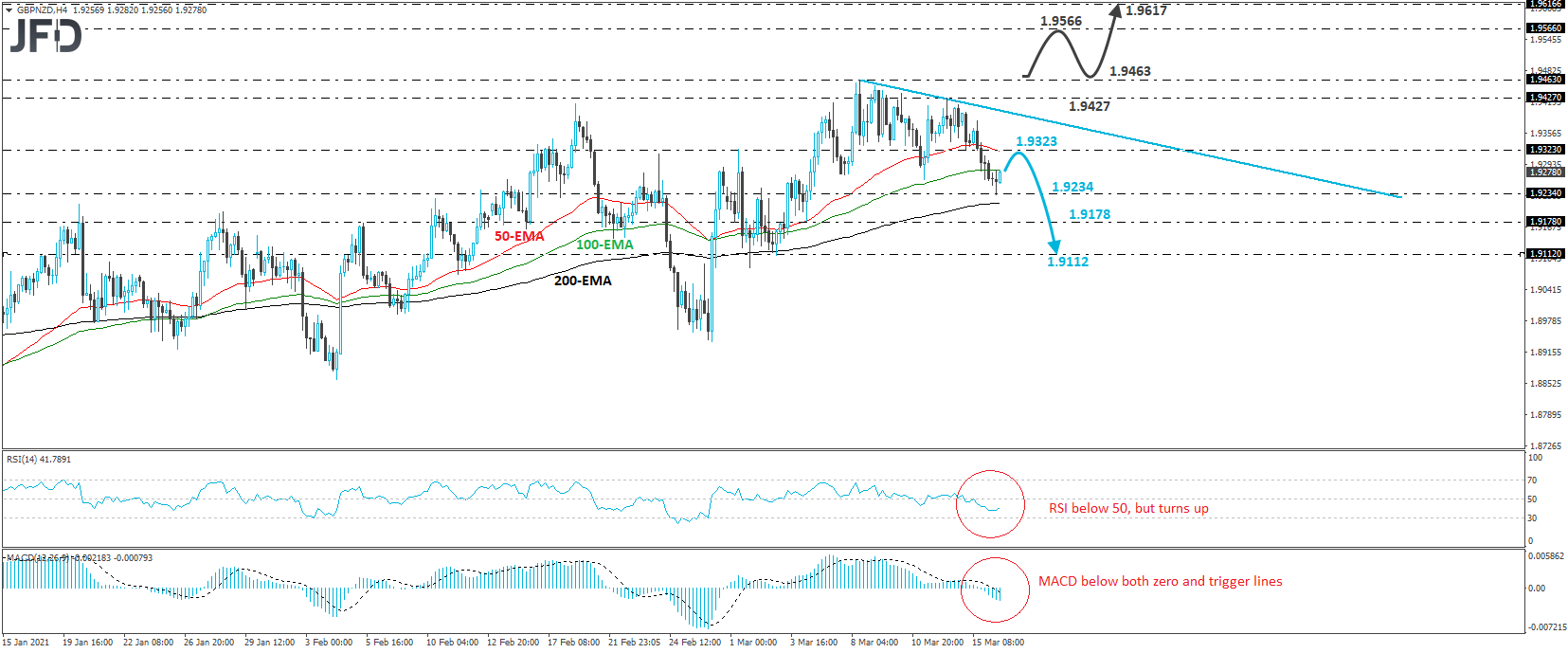

GBP/NZD traded lower on Monday, and continued to do so on Tuesday. It managed however to hit support at 1.9234, and then, it rebounded somewhat. The latest slide has confirmed a forthcoming lower low on the 4-hour chart, while the rate has already been forming lower highs, as marked by the downside line drawn from the high of Mar. 8. With that in mind, we would consider the short-term outlook to have just turned somewhat negative.

Even if the current rebound continues for a while more, we see decent chances for the bears to take the reins back from near the 1.9323 zone, or near the aforementioned downside line. If so, the forthcoming leg south may target once again the 1.9234 area, the break of which may extend the decline towards the low of Mar. 4, at 1.9178, or the low of the day before, at 1.9112.

Turning our gaze to the short-term oscillators, we see that the RSI runs below 50, but has bottomed and seems to be able to move somewhat higher. The MACD, although below both its zero and trigger lines, shows signs that it could bottom as well. Both indicators detect slowing downside speed, which supports the notion for some further recovery before the next leg south.

In order to abandon the bearish case, we would like to see a strong move above 1.9463. The rate would already be above the downside line, while such a break will confirm a forthcoming higher high on the daily chart. The bulls may then get encouraged to target the 1.9566 territory, defined as a resistance by the high of Nov. 4, the break of which may allow extensions towards the peaks of Oct. 29 and 30, at around 1.9617.