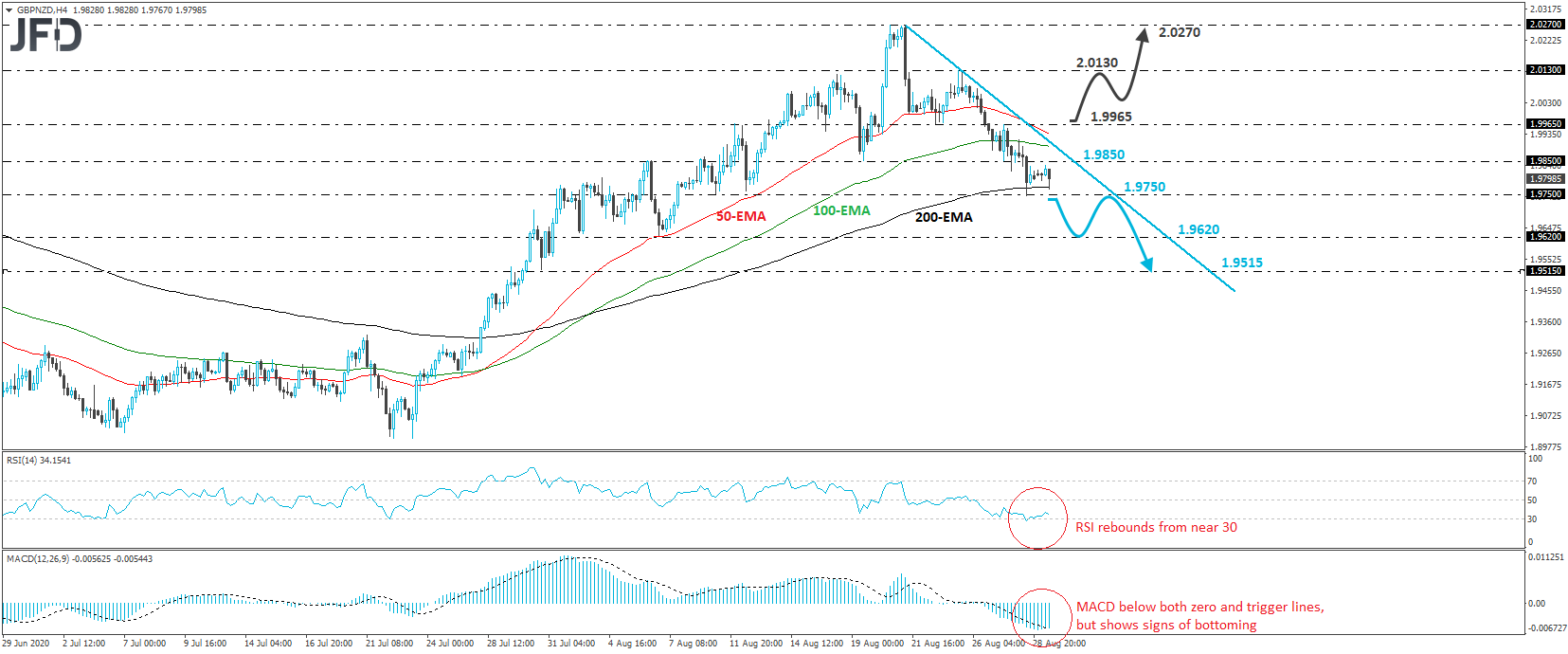

GBP/NZD slid on Friday, breaking below the key support (now turned into resistance) zone of 1.9850, marked by the low of August 19th. In our view, the move has signaled a short-term trend reversal, which can be also marked by a short-term tentative downside resistance line taken from the high of August 21st.

That said, in order to start examining lower areas, we would like to see a strong dip below Friday’s low, at around 1.9750. Such a move would confirm a forthcoming lower low and may encourage the bears to pull the trigger, targeting the 1.9620 obstacle, defined as a support by the low of August 6th. They may decide to take a small break after testing that zone, thereby allowing a corrective bounce, but as long as the rate would be trading below the aforementioned tentative downside line, we would see decent chances for another leg south. If this is the case, and the 1.9620 barrier breaks this time, we may see extensions towards the 1.9515 level, marked by an intraday swing low formed on July 30th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded somewhat after testing its 30 line, while the MACD, although below both its zero and trigger lines, shows signs of bottoming as well. Both indicators detect slowing downside speed and suggest that a minor recovery maybe in the works before the next negative leg, perhaps for the rate to test the 1.9850 from underneath, or even the downside resistance line.

In order to abandon the bearish case and start examining whether the bulls have gained the upper hand, we would like to see a strong break above 1.9965. The rate would already be above the downside resistance line, which may encourage advances towards the 2.0130 obstacle, marked by the high of August 25th. Another break, above 2.0130, could see scope for extensions towards the peaks of August 20th and 21st, at around 2.0270.