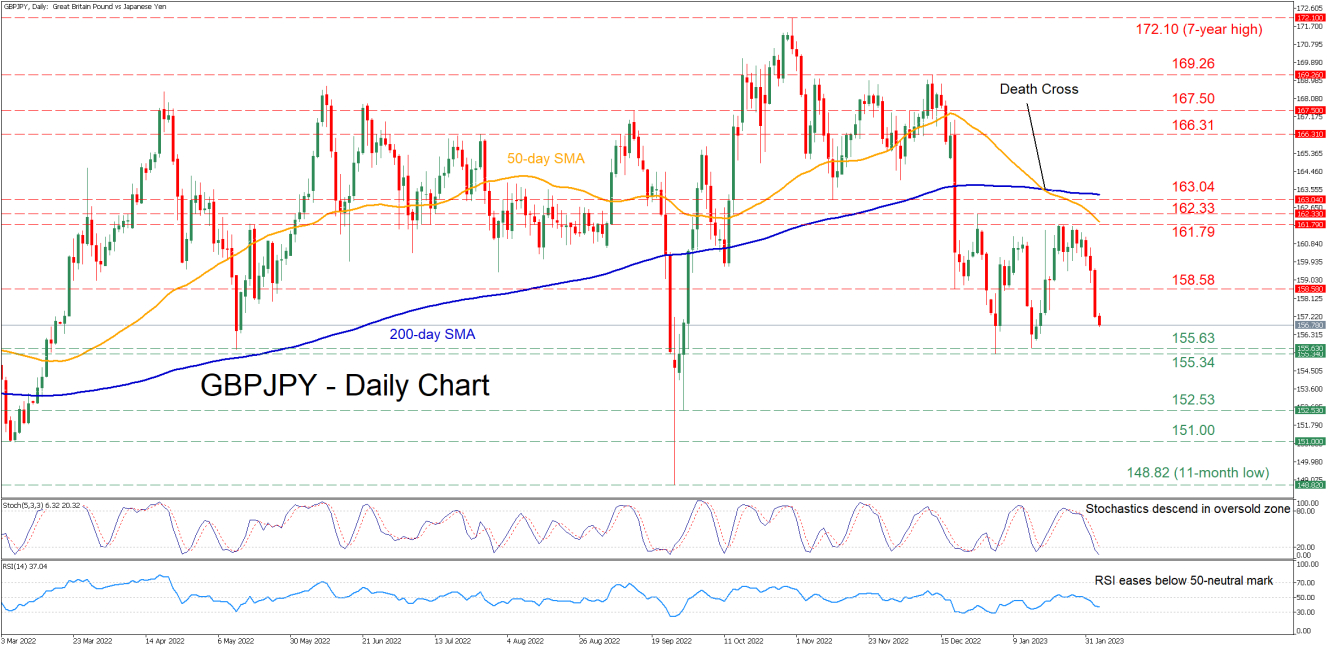

GBPJPY has been losing ground since early November when it posted a fresh seven-year high of 172.10. In the short-term, the pair’s downtrend accelerated after the BoE delivered an anticipated 50 basis points hike, albeit with dovish commentary that disappointed GBPJPY’s bulls.

The momentum indicators currently suggest that bearish forces have taken the upper hand. Specifically, the stochastic oscillator is descending within the oversold zone, while the RSI is flatlining beneath its 50-neutral mark.

Should the negative momentum strengthen, the pair could descend towards its recent support of 155.63. Diving beneath that floor, the price could challenge the 2023 low of 155.34 before the spotlight turns to the 152.53 hurdle. A break below the latter could pave the way for the March low of 151.00.

To the upside, bullish actions might initially propel the price towards the 158.58 zone, which provided support both in December and January but could now act as resistance. Surpassing that zone, the pair could test the January resistance region of 161.79. Conquering this barricade, the bulls may then aim at 162.33.

In brief, GBPJPY experienced a significant retreat after trading without a clear direction during the past month. For that bearish sentiment to reverse, the price needs to cross above the strong ceiling of 161.79, which rejected multiple advances in January.