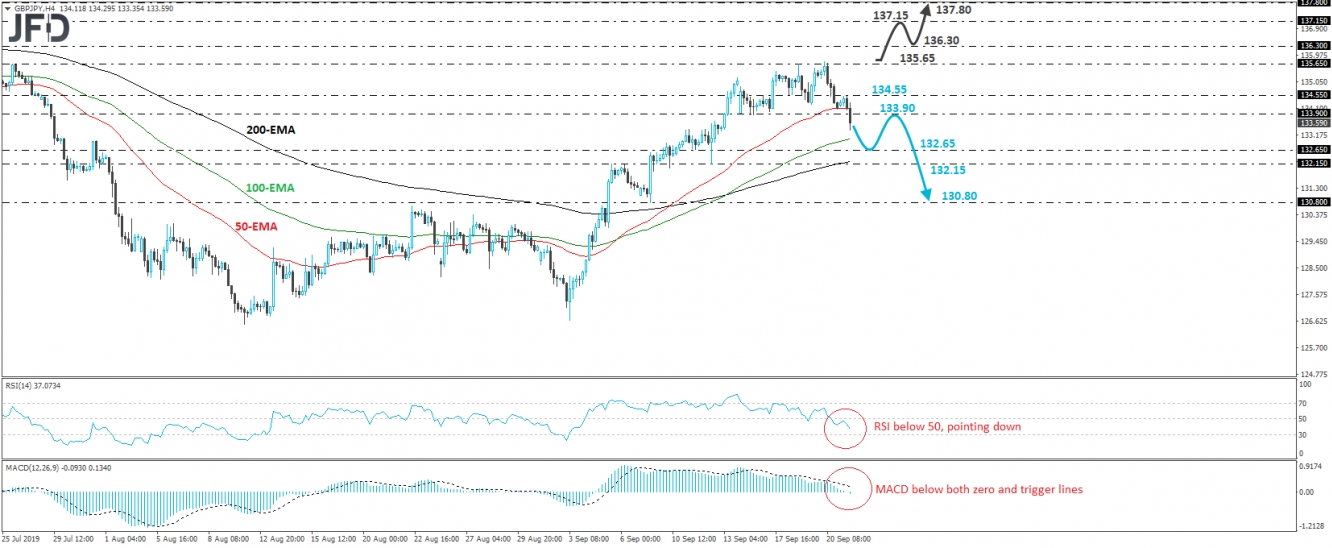

GBP/JPY traded lower today, breaking below the 133.90 zone, which provided support last Monday and Tuesday. The dip has confirmed a forthcoming lower low on the 4-hour chart and in our view, has shifted the short-term picture somewhat to the downside. Thus, we will adopt a cautiously-bearish stance for now.

If the bears are willing to stay behind the steering wheel, we may see them aiming for the 132.65 territory soon. That said, in order to get confident on larger declines, we would like to see a decisive dip below 132.15, marked by the low of September 12th. Such a move may carry extensions towards the low of September 9th, at around 130.80.

Taking a look at our short-term momentum studies, we see that the RSI lies below 50 and points down, while the MACD, already below its trigger line, has just touched its toe below zero. Both indicators suggest downside speed and corroborate our view for some further declines in the near term.

On the upside, we would like to see a strong recovery above 135.65 before we start examining whether the bulls have gained back full control. This would confirm a forthcoming higher high on the 4-hour chart and could initially aim for the 136.30 zone, near the peak of July 9th and also marked by the inside swing low of June 28th. Another break, above 136.30, may see scope for more bullish extensions, perhaps toward the 137.15 barrier, or the high of July 1st, at around 137.80.