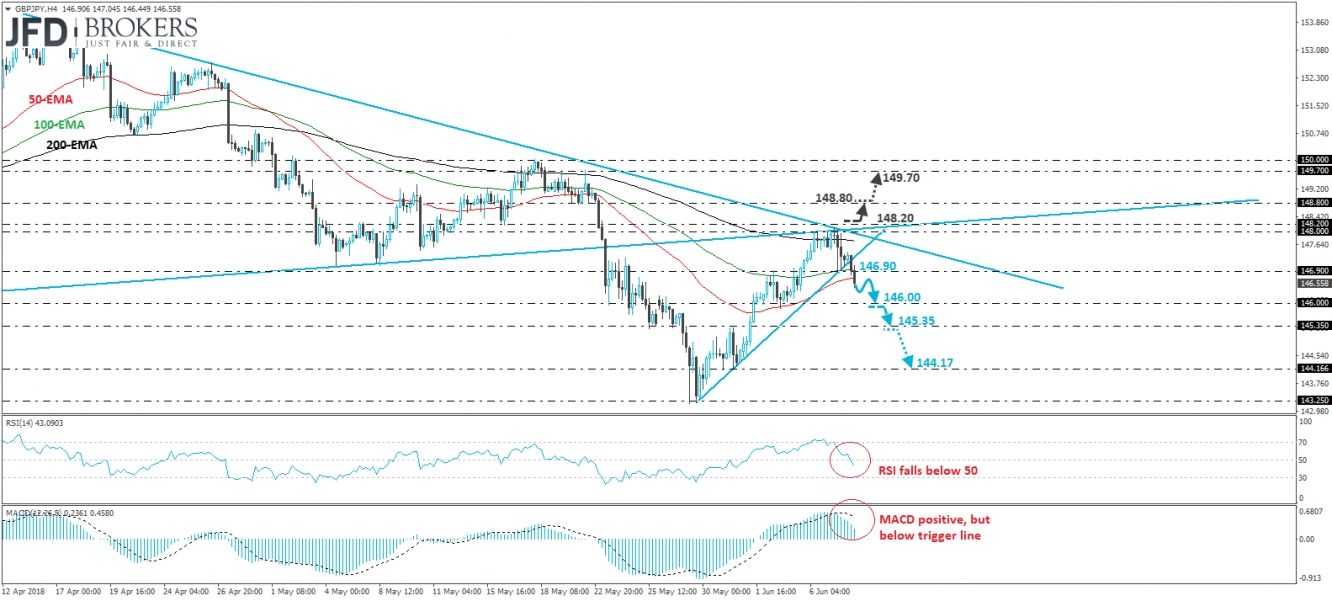

GBP/JPY edged south on Thursday, after it hit resistance near the crossroads of the 148.00 hurdle, the prior long-term upside support line drawn from the low of the 17th of April 2017, and the near-term downtrend line taken from the peak of the 18th of April this year. What’s more, during the European morning Friday, the pair slid below the support (now turned into resistance) barrier of 146.90 and the very short-term upside line taken from the low of the 29th of May. So, taking all these into account, we believe that the short-term bias is to the downside.

We believe that the dip below 146.90 may have opened the way for the 146.00 zone, the break of which could trigger more downside extensions, perhaps towards the 145.35 support, defined by the inside swing peak of the 31st of May. If the bears prove strong enough to overcome that obstacle as well, then we may see them setting the stage for the 144.17 zone.

Turning our gaze to our short-term momentum indicators, we see that the RSI slid and crossed below its 50 line, while the MACD, even though within its positive territory, lies below its trigger line and points down. These technical studies reveal negative momentum and corroborate our view that GBP/JPY may be poised to continue drifting south for a while more.

On the upside, we would like to see a clear and decisive move above 148.20 before we abandon the bearish case. Such a break could initially aim for the 148.80 level, where a break could pave the way for the 149.70 zone, marked by the peaks of the 21st and 22nd of May.