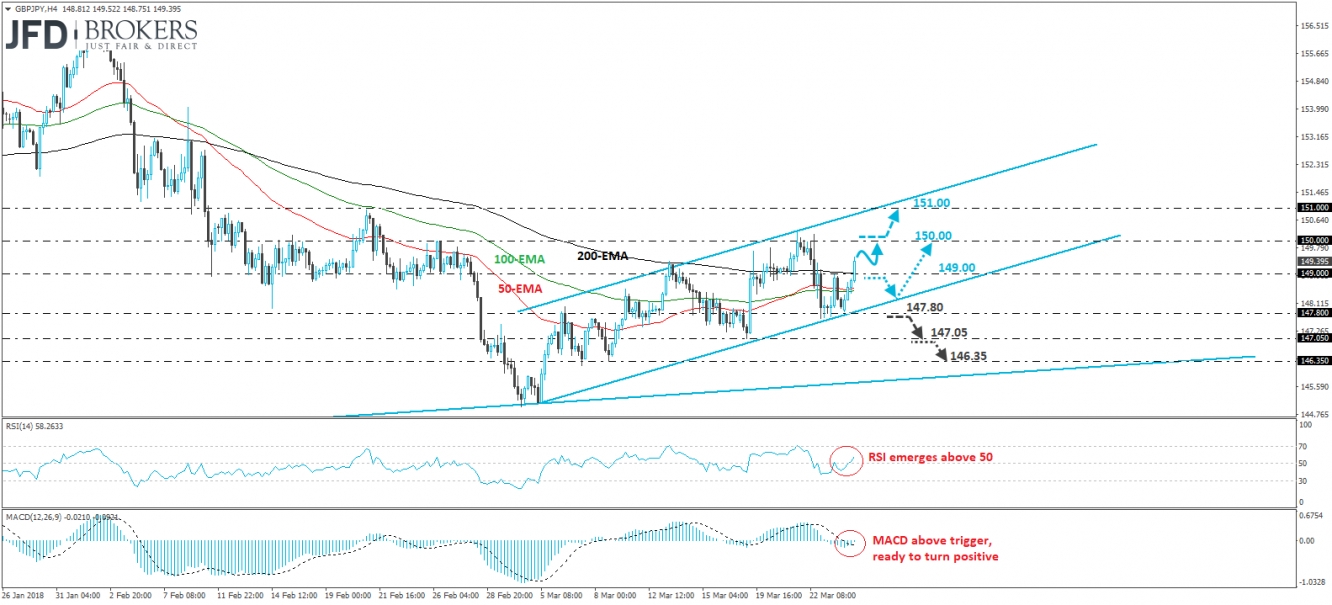

GBP/JPY traded north on Monday after it hit support near the lower bound of the short-term upside channel that has been containing the price action since the beginning of March. The rate emerged above the resistance (now turned into support) barrier of 149.00, and now looks to be heading towards the psychological zone of 150.00. Taking into account that the rate continues to trade within the aforementioned channel, and also bearing in mind that the recovery marked by this channel started after the pair rebounded from the longer-term upside support line drawn from the low of the 17th of April 2017, we believe that there is scope for some further upside extensions.

A clear break above the psychological zone of 150.00 is likely to pave the way for our next resistance zone of 151.00, defined by the peak of the 21st of February, or the upper bound of the short-term upside channel.

Our short-term oscillators support the notion as well. The RSI turned up and crossed above its 50 line, while the MACD, although negative, lies above its trigger line and looks ready to obtain a positive sign soon.

On the downside, a move back below 149.00 could signal a retreat towards the lower end of the channel. However, even in that case, we would still consider the short-term outlook to be somewhat positive as the possibility for the bulls to jump in near the lower bound would still be on the table.

We would like to see a clear dip below 147.80 before we abandon the bullish case. Such a dip could confirm the downside exit off the channel and could initially aim for our next support of 147.05. Another move below 147.05 could set the stage for the 146.35 obstacle.

Article written by Charalambos Pissouros, Senior Market Analyst at JFD Brokers