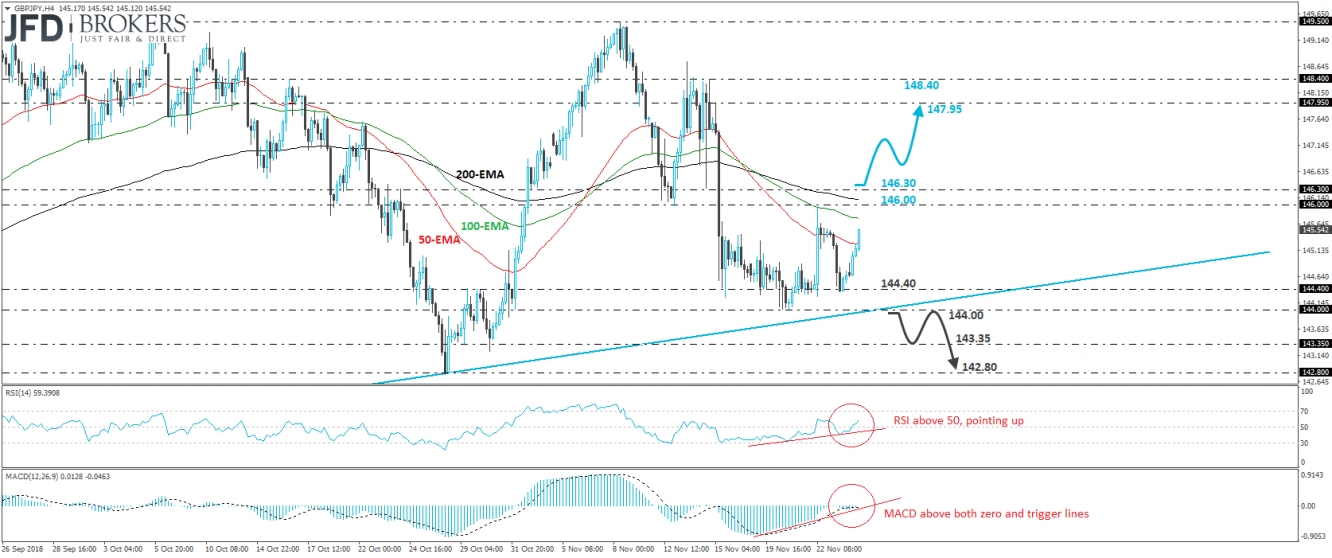

GBP/JPY edged north on Monday, after it hit support near the 144.40 zone on Friday. The move confirmed a higher low on the 4-hour chart, which combined with the fact that the rate continues to trade above the tentative upside support line drawn from the low of the 15th of August suggest that there is room for some further recovery, at least towards Thursday’s peak, at around 146.00.

Having said that though, we would like to see a decisive break above the 146.30 zone, defined by the inside swing low of the 14th of November, before we get confident on larger bullish extensions. Such a break could encourage the bulls to drive the battle all the way up to the 147.95 barrier, marked by the peak of the 15th of November.

Looking at our short-term oscillators, we see that the RSI emerged above its 50 line and continues to point up. The MACD has just poked its nose above both its zero and trigger lines. These indicators suggest that the momentum has shifted to positive and support the notion for the pair to continue travelling north for a while more, at least towards 146.00 or 146.30.

On the downside, we would like to see a clear dip below 144.00, the low of the 20th of November, before we start examining whether the bears have gained the upper hand. Such a dip could confirm the break of the aforementioned medium-term upside support line and may initially aim for the 143.35 support territory. Another break below 143.35 could set the stage for more bearish extensions, perhaps towards the low of the 26th of October, at around 142.80.