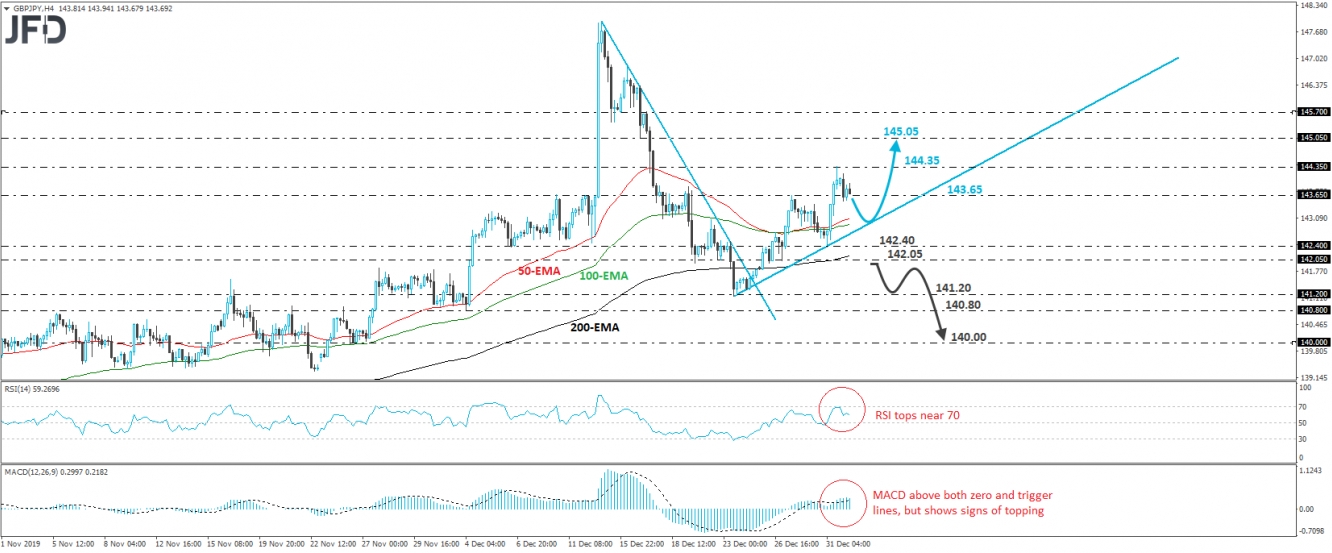

After rallying on the last day of 2019, GBP/JPY entered the new year on a negative footing. On Tuesday, the rate hit resistance near the 144.35 zone, and then, it started correcting lower, something that continued today as well. At the time of writing, it appears ready to fall back below the 143.65 barrier. However, it is still trading above the short-term upside support line drawn from the low of December 23rd, and thus, we would treat any further declines as just a correction before a possible upcoming advance.

As we already noted, the rate appears ready to dip below 143.65, something that may extend the current retreat towards the aforementioned upside line. The bulls may take charge from there and perhaps push back up for another test near the 144.35 zone. A break above that zone would confirm a forthcoming higher high on the 4-hour chart and may allow extensions towards the 145.05 level, which is marked as a resistance by the inside swing low of August 16th.

Taking a look at our short-term oscillators, we see that the RSI turned down after it hit resistance near its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. Both indicators suggest slowing upside speed and support the notion for some further retreat before the next leg north.

We will start examining the bearish case only if we see a decisive dip below the low of December 27th, at around 142.05. The rate would already be below the pre-mentioned upside line and would have also confirmed a forthcoming lower low. The bears could initially aim for the low of December 23rd, at around 141.20, the break of which could allow them to put the 140.80 line on their radars, which is marked by the low of December 4th. Another break, below 140.80, could carry more bearish implications, perhaps paving the way towards the psychological round number of 140.00, which provided support on November 26th and 27th.