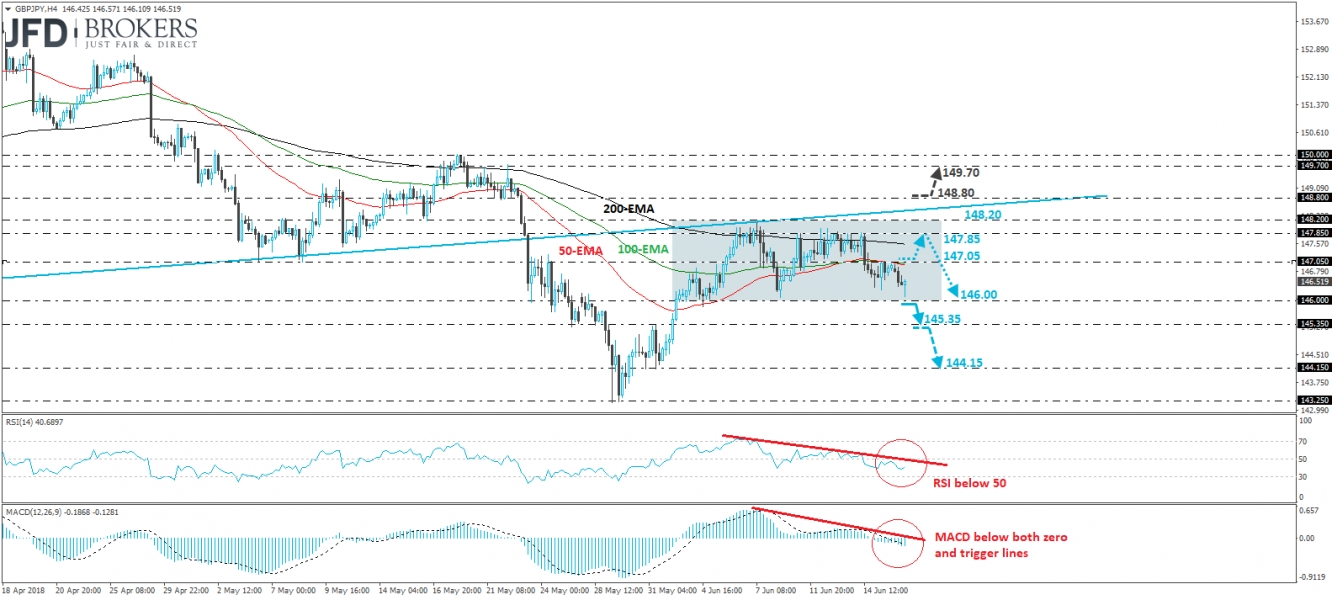

GBP/JPY has been trading in a sideways manner since the 1st of June, between 146.00 and 148.20, and thus we would hold a flat stance for now with regards to this pair’s short-term outlook. Having said this though, in the bigger picture, the rate continues to trade below the long-term upside support line drawn from the low of the 17th of April 2017, which keeps the medium-term outlook somewhat negative. So, having all these in mind, we believe that there is more chance for the pair to exit the range to the downside rather than to the upside.

After hitting resistance near the 147.05 level on Friday, the pair traded somewhat lower, but today, the slide was paused slightly above 146.00, the lower bound of the aforementioned sideways range. In our view, a decisive dip below 146.00 is needed to turn the short-term picture negative. Such a dip could initially aim for our next support level of 145.35, marked by the inside swing peak of the 31st of May. Another dip below 145.35 could carry more bearish extensions and may pave the way towards the 144.15 zone.

Looking at our short-term oscillators, we see that the RSI lies below 50, but has turned somewhat up today. The MACD lies below both its zero and trigger lines. Although both these indicators suggest negative momentum, the fact that the RSI has turned up make as cautious of a possible recovery within the short-term range.

A break above 147.05 could confirm the case and is possible to pave the way for the 147.85 barrier, or the upper bound of the range, at 148.20. However, even if this is the case, GBP/JPY would still be trading below the long-term upside line taken from the low of the 17th of April last year. Thus, we would still see a decent likelihood for another leg down from near those levels.

In order to assume that the bears have totally abandoned the battlefield, at least in the short run, we would like to see a clear move above 148.80. Such a break could confirm the return of the rate above the long-term upside line and could initially aim for the 149.70 resistance, marked by the peaks of the 21st and 22nd of May.