Our last update of GBP/JPY came out on December 5th, 2017. It was focused on the long-term perspective and based on the daily chart of the pair, which did not look very encouraging for the bulls at the time to say the least. While the pair was trading above 151.10, the Elliott Wave Principle suggested that a major bearish reversal should soon be expected. The Pound had been successfully ignoring the increased possibility of a hard Brexit, but we thought it was only a matter of time before the bad news catches up with the bulls.

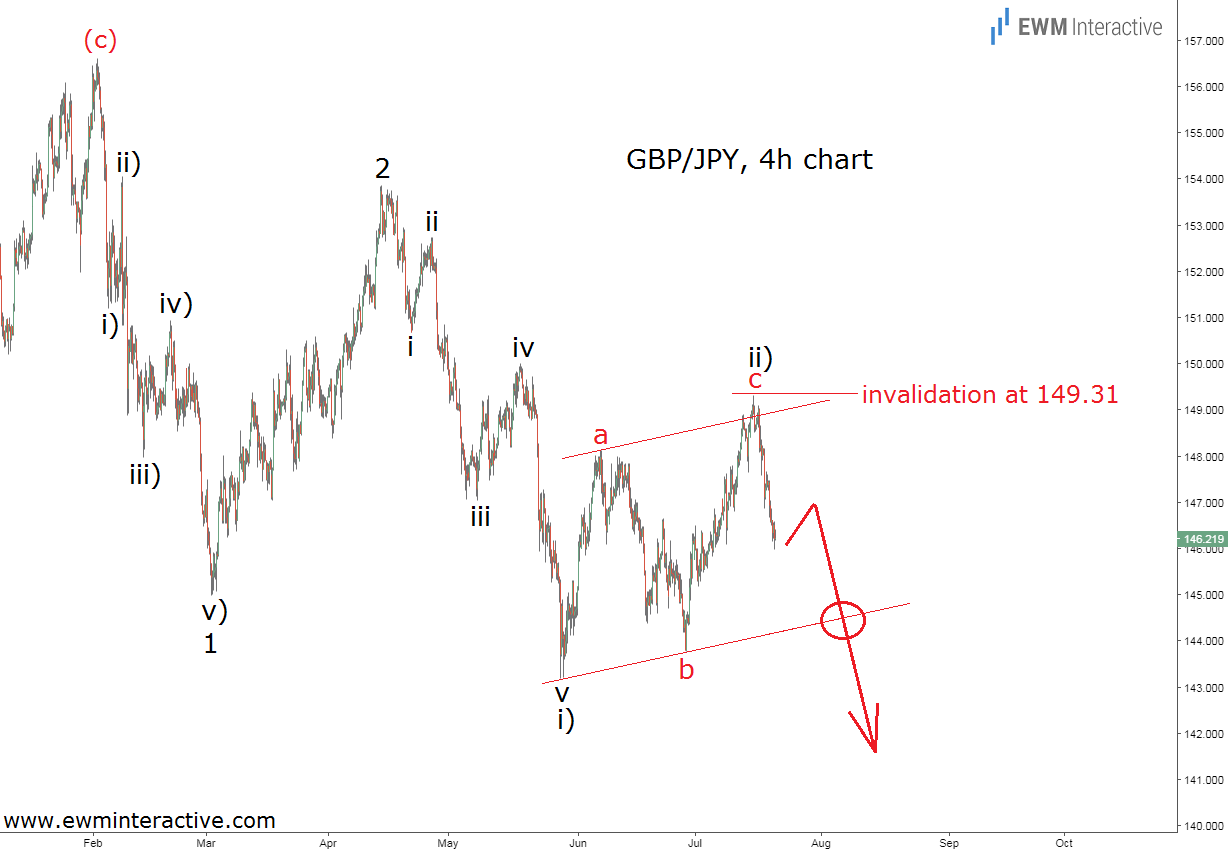

It has been over seven months since we published this analysis. As of this writing, GBP/JPY is hovering around 146.20, following a decline from 156.61 to 143.20 that took place between February and May 2018. In order to see if the bigger picture negative outlook is still valid, we need to take a closer look at this drop. The 4-hour chart of the British Pound against the Japanese Yen will come in handy.

Obviously, the decline in question is not a five-wave impulse. Under other circumstances we could conclude it was just a three-wave correction within a larger uptrend and decide to join the bulls. The bigger picture, however, puts things into a better perspective and indicates that we are actually seeing a series of first and second waves to the south, labeled 1-2-i)-ii).

The impulsive structure of waves 1 and i) is out of doubt, while wave ii) looks like a simple a-b-c zigzag, which has been developing between the parallel lines of a corrective channel. The upper line of this channel put the bulls to rest and gave the start to what is supposed to be wave iii) of 3 to the south.

Third waves are usually the fastest and strongest part of the Elliott Wave cycle. This count suggests that as long as GBP/JPY trades below the top of wave “c” of ii) at 149.31, much lower levels should be anticipated as wave iii) progresses. It appears the bears have just been warming up so far in 2018.