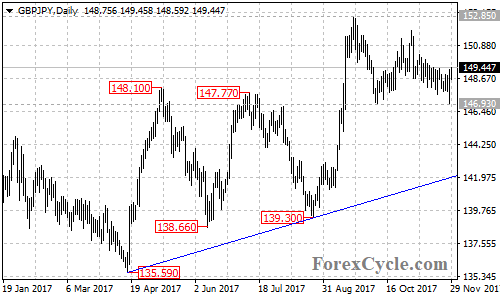

GBP/JPY failed in its attempt to break below 146.93 support, and stayed in a trading range between 146.93 and 152.85. As long as 146.93 support holds, the price action in the range could be treated as consolidation of the uptrend from 135.59 and another rise could be expected after the consolidation.

The GBP/JPY pair recently breakout of the top trend line of the price channel on its 4-hour chart, suggest that the downside movement from 151.93 had completed at 146.97 already. Further rise would likely be seen in the coming days and next target would be at 150.31. A break of this level could take price to next resistance level at 151.93. Above this level would aim 152.85.

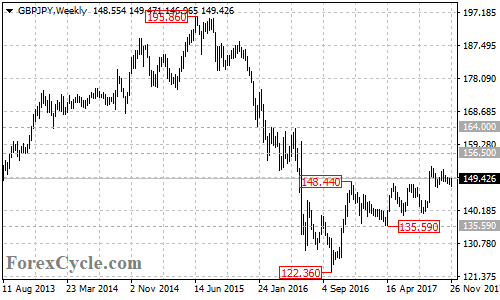

A breakout of 152.85 resistance will confirm that the whole uptrend from 122.36 has resumed, then the following upside movement could take price to 156.50, followed by 164.00.

Near term support is at 148.00, a breakdown below this level could bring price back to test 146.93 support. Below this level could trigger further decline towards the bullish trend line from 135.59 to 139.30 on the daily chart, now at around 142.00. Only a clear break below this trend line support will indicate that the uptrend from 122.36 had completed at 152.85 already. Then the following downside movement could take price back to next support level at 135.59.

Technical levels

Support levels: 148.00, 146.93, 142.00, 139.30, 135.59, 122.36.

Resistance levels: 150.31, 151.93, 152.85, 156.50, 164.00.