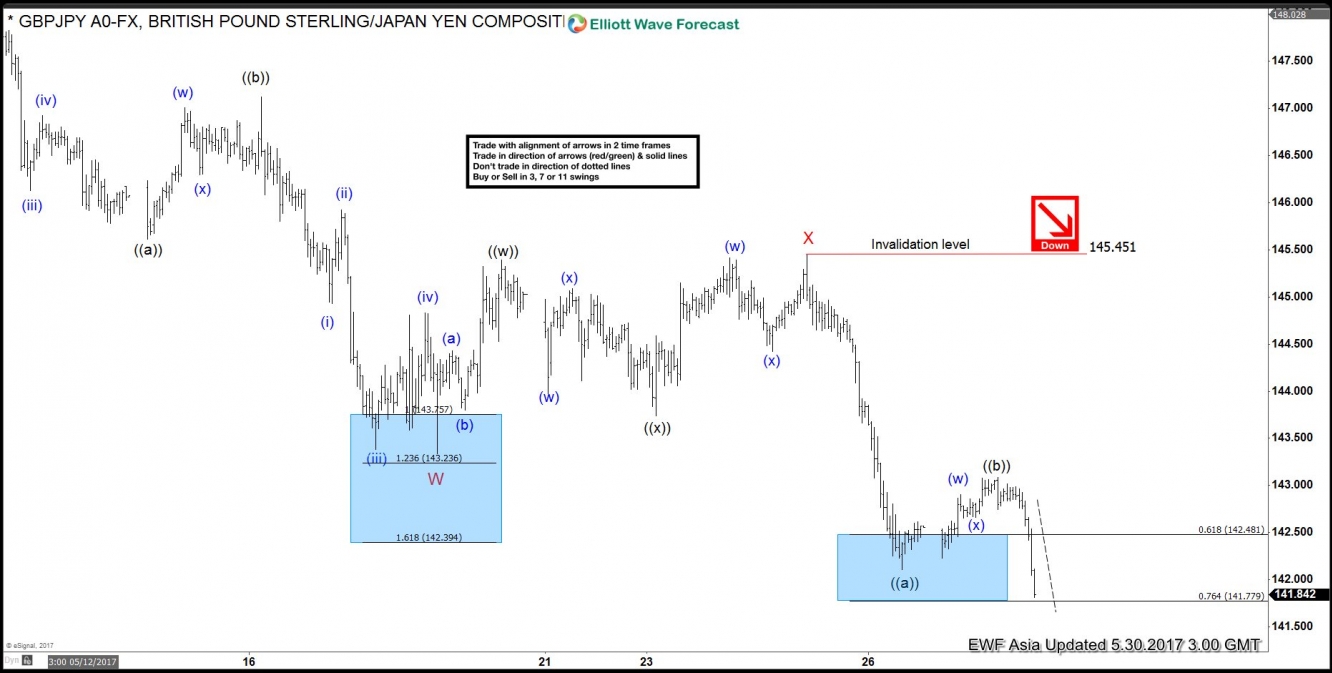

Short Term Elliott Wave view in GBP/JPY suggests the decline from 5/10 peak is unfolding as a double three Elliott Wave structure where Minor wave W ended at 143.33 and Minor wave X ended at 145.45. The subdivision of Minor wave W unfolded as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 145.61 and Minute wave ((b)) ended at 147.12.

After ending Minor wave X at 145.45, pair has since resumed lower and broken below 143.33. This creates a bearish 5 swing incomplete sequence from 5/10 peak and favors more downside in the near term.

The decline from 145.45 looks to be unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 142.11 and Minute wave ((b)) ended at 143.08. Pair has also broken below 142.11 which suggests that Minute wave ((c)) lower has already started. Near term, while bounces stay below 143.08 in the first degree, but more importantly below 5/25 high (145.45), expect pair to continue lower towards 139.51 - 140.65 area before cycle from 5/10 peak ends.

Buyers should then appear from the aforementioned area for at least a 3 waves bounce at later stage. In case pair breaks above 143.08 now, then the move from 5/26 low can be labelled as a Flat and pair should extend higher to correct cycle down from 5/25 high (145.45) but it still expected to turn lower again afterwards provided that pivot at 145.45 high stays intact.

GBP/JPY 1 Hour Elliott Wave Chart