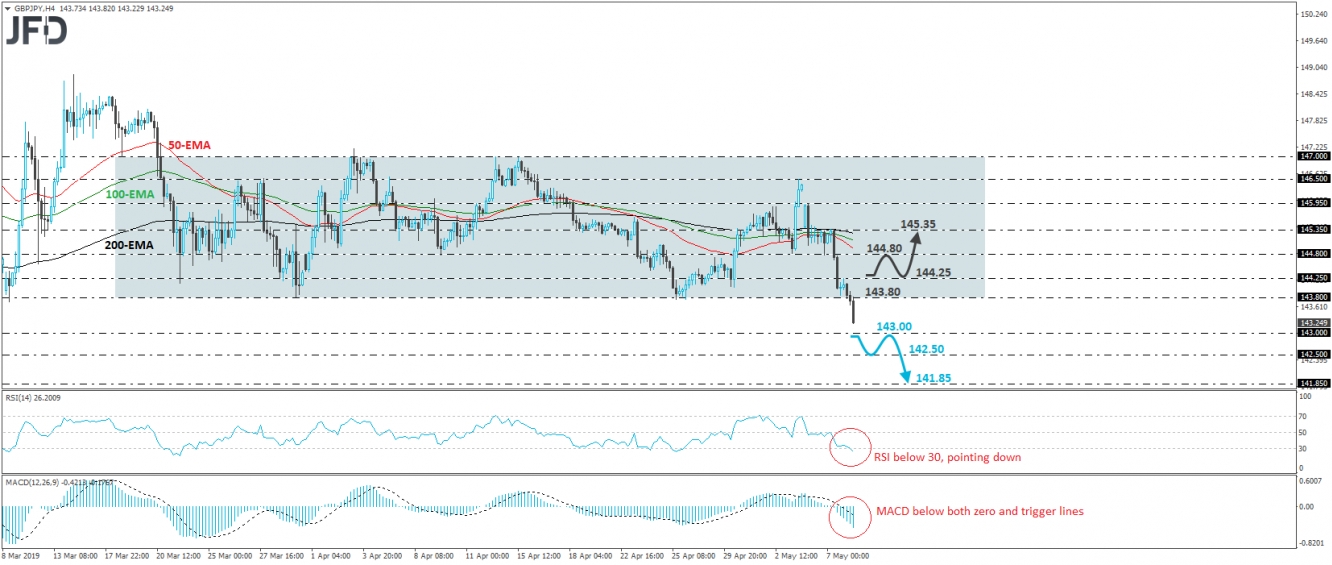

GBP/JPY has been on a steep downslide since yesterday, after it hit the 145.35 resistance hurdle. The tumble continued today as well, with the rate breaking below 143.80, the lower end of the sideways range that was containing the price action since March 20th. In our view, the downside exit out of the range has turned the short-term outlook to negative.

At the time of writing, the pair looks to be heading towards the 143.00 key support zone, defined by the inside swing high of February 18th. If the bears are not willing to hit the brakes near 143.00, its break may open the path towards the lows of that day and the next, at around 142.50. Another break, below 142.50, could carry more bearish implications, perhaps allowing the sellers to put the 141.85 zone on their radars.

Our short-term momentum indicators detect strong downside speed and enhance the case for further declines. The RSI moved lower, broke below 30, and it still points down. The MACD lies below both its zero and trigger lines, pointing south as well.

On the upside, we would like to see a clear recovery above 144.25 before we abandon the bearish case. Such a move could signal the rate’s return within the aforementioned range and may encourage some buyers to aim for the 144.80 level, marked by the inside swing lows of May 3rd and 6th. Further recovery above that resistance could pave the way for another test near the 145.35 zone.