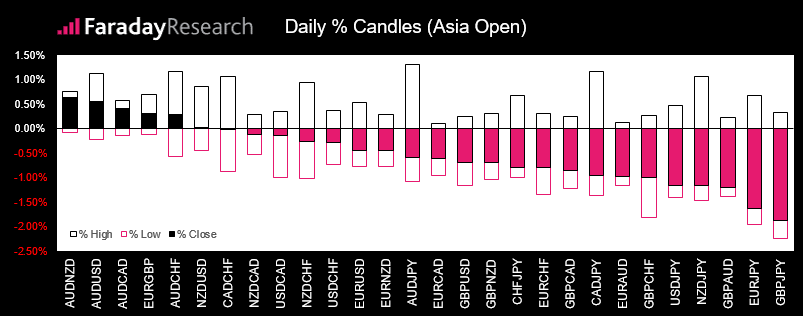

At the time of writing, GBP/JPY has been the week’s most volatile pair and the break of two key levels suggest further losses could be ahead.

In our previous analysis we highlighted the importance of 147, so we see yesterday’s break (and close) beneath it as constructively bearish. We suspect the ‘rally’ from the 2016 low is a correction against a larger, bearish trend and with momentum now aligned with it, we’ll seek short setups.

The daily trend structure has carved out three lower highs (LH) and momentum is increasingly bearish. Interestingly, the rise towards the 149.99 LH respected a 38.2% Fibonacci level and the retracement could be part of a bear flag. If successful, the bear flag suggests a target just beneath the February low at 144.97.

Bearish range expansion made easy work of the April trendline and 147 support level, although we could expect some mean reversion after such a strong move. Today’s high has respected 147.03 resistance (prior support) but, even if it were to give way, the broken trendline becomes the bears next line of defence.

A break of yesterday’s low still allows just over 100 pips of potential profit if it falls to 144.97. But with momentum now aligned with the longer-term bearish trend, we’d be looking for a break of this key level too which could leave plenty of opportunity to trade towards 143, 141.17 or 139.30.