Key Points:

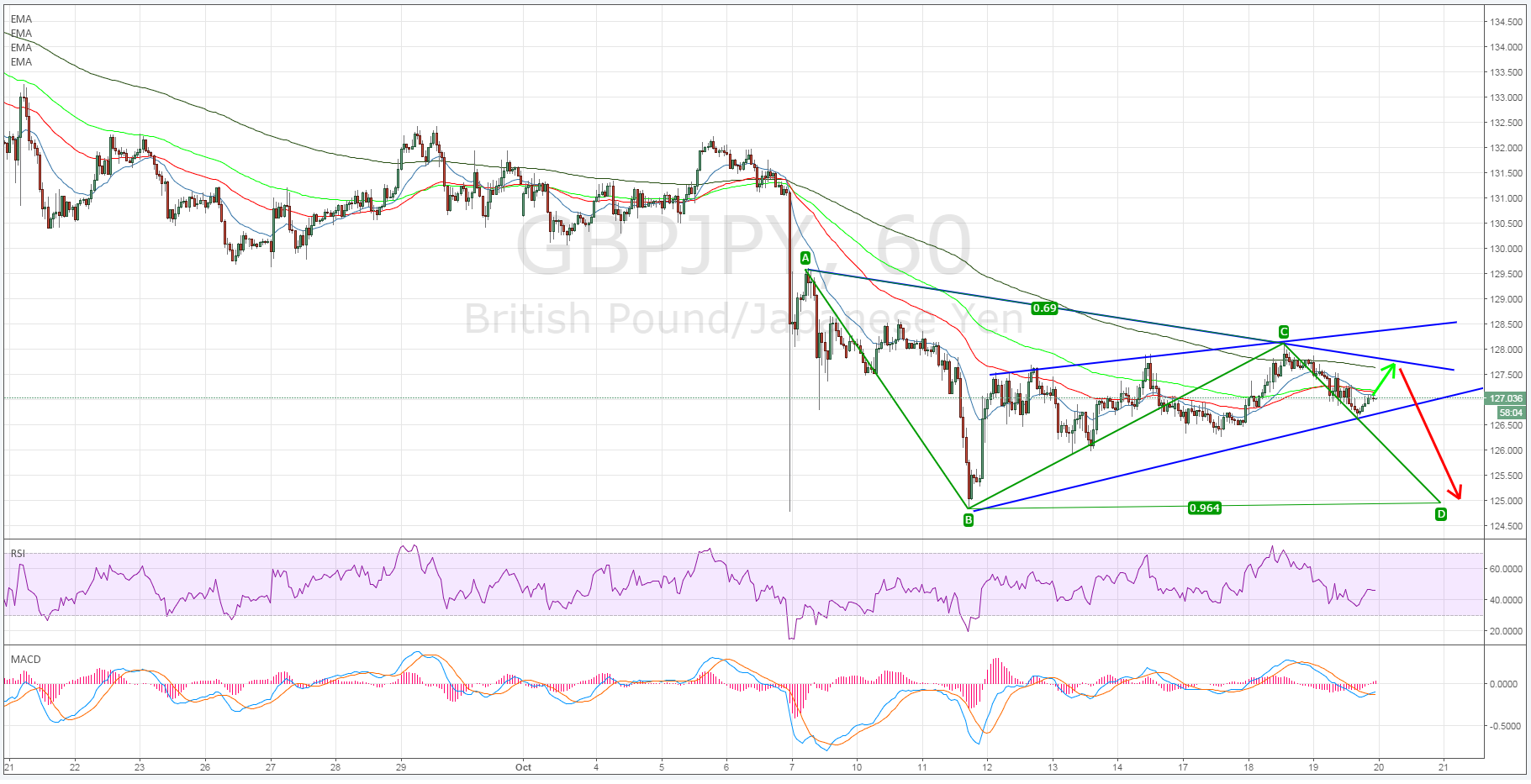

- Price action trading within a wedge pattern.

- “C” leg has completed.

- Watch for a break of the bottom channel constraint.

The GBP/JPY has largely stabilised since the veritable flash crash a few weeks back which saw price action collapse and form a new low just below the 1.25 handle. Price action has subsequently managed to claw its way higher, within an ascending channel, and is currently trading just above the 127.00 handle. However, some concerning signals are starting to appear and a break down could be just around the corner.

In fact, the pair’s technical indicators are painting a relatively clear picture for the days ahead when considering the current progress of the ABCD pattern. A cursory glance at the hourly chart shows the formation of the ABCD pattern in early October. Subsequently, the “C” leg has just completed near the upper channel constraint which suggests that the “D” leg is in progress and price action is therefore likely to head towards completion around the 125.00 handle. Lending further credence to the bearish contention is the fact that the 20 EMA just crossed the 100 EMA, on the downside, and is now acting as dynamic resistance in the short term.

However, the RSI Oscillator is currently trending higher away from oversold levels which suggest that we may see a period of moderation prior to any concerted breaches of the lower channel constraint. In fact, this tends to be supported by the pair’s historical moves which have largely been in a wave format and suggest that price will rally back towards the bearish trend line before reversing to challenge supports.

Ultimately, the start of a sharp move lower will need to commence with a breach of the channel and, at this point, that is yet to occur. Subsequently, keep a close watch on the pair in the coming session because if a shift occurs, it will happen rapidly. However, once the decline starts it’s unlikely to cease until, at the very least, price drops below the 126.00 handle. Subsequently, wait for a break and get ready to ride the pair significantly lower over the coming days.