- GBP/JPY marks new higher high; remains restricted

- Resistance near 198.50; support seen around 196.00

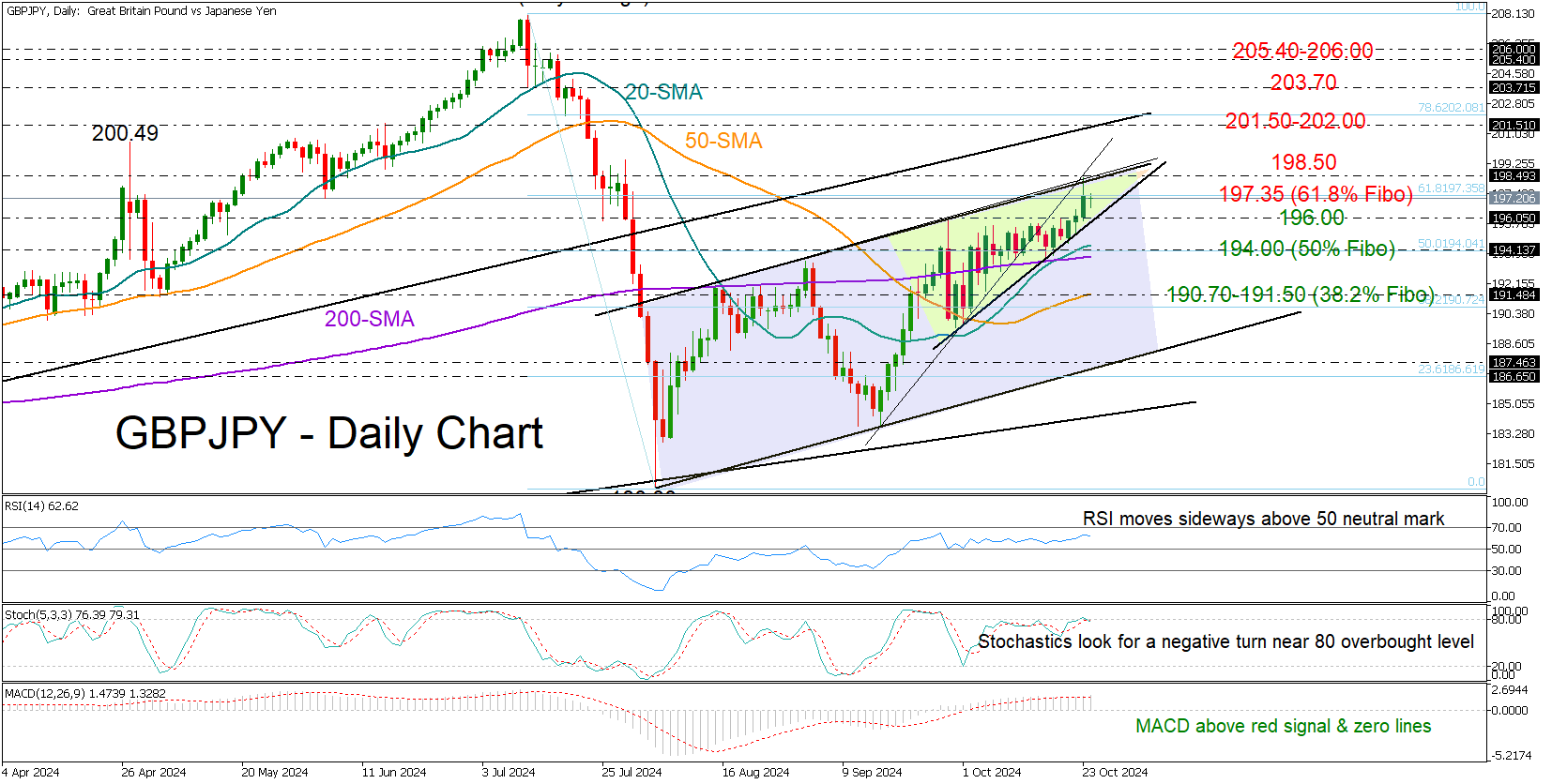

GBP/JPY charted a three-month high of 198.42 at the top of a bullish channel, increasing speculation that a new bearish wave could soon start, especially after the close below the 61.8% Fibonacci retracement at 197.35.

Technical indicators are showing mixed signals: the stochastic oscillator is poised for a decline, while the RSI and MACD remain in bullish territory. The 20-day SMA crossing above the 50- and 200-day SMAs suggests potential trend continuation, but a bearish rising wedge is currently creating uncertainty.

If the price breaks above 198.50, the next resistance could occur between 201.50 and 202.00. Continued buying may then push the pair to 203.70 and then towards the 205.40-206.00 zone.

Alternatively, a slide below the 196.00 number could find initial support around the 194.00 area, where the 20- and 200-day SMAs as well as the 50% Fibonacci level are positioned. Further losses could retest the 50-day SMA and the 38.2% Fibonacci of 190.70, a break of which could cause a dramatic downfall towards the channel’s lower band currently seen at 187.20.

In short, GBP/JPY is in a cautious area, with decisive movements above 198.50 or below 196.00 likely guiding future price action.