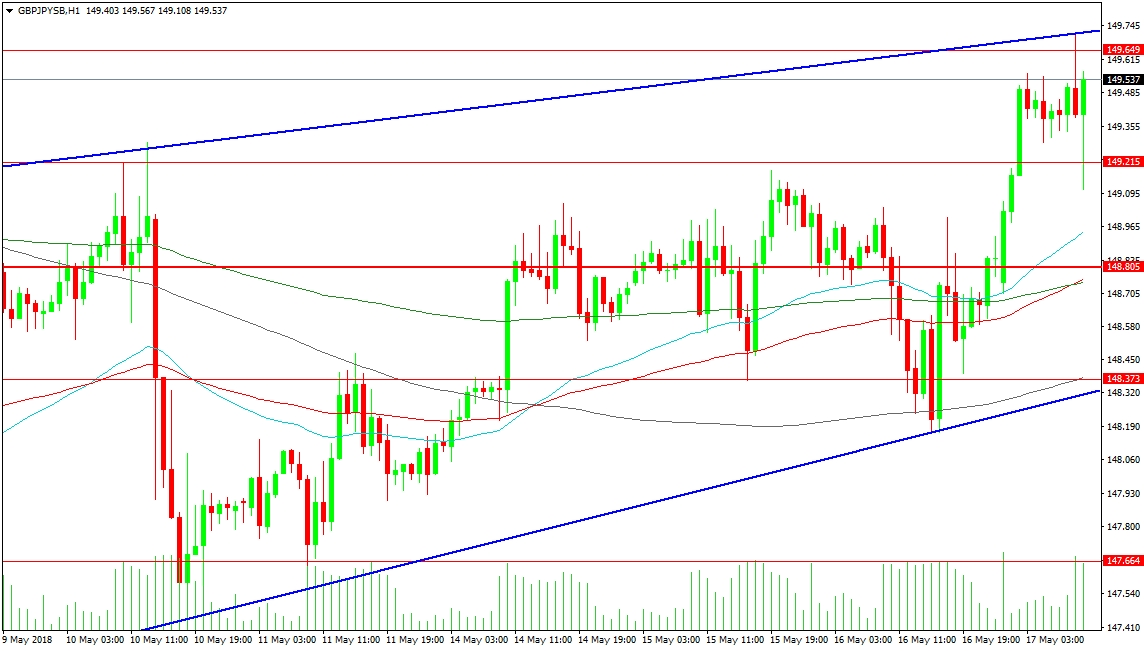

The GBP/JPY pair has rallied to the resistance trend line at 149.710, only to rebound lower and test Tuesday’s high at 149.182. The rally was the result of reports that the British Government is to maintain the Customs Union with the EU past 2021. While this is positive news, it does lead to questions about the unity of the cabinet and the future of PM May’s Government. The uptrend seen here on the 1-Hour chart is still intact and long traders will hope to breach the 150.000 level soon, with targets at 150.655 and 151.280.

Support has been established around the 149.000 area, with rising 1-Hour moving averages centred on 148.800. The rising trend line support is at 148.370, with a breach of 148.000 painting a bearish picture for the pair. This would target initial support at the 147.500 area, followed by 147.000 and 146.450 in extension.

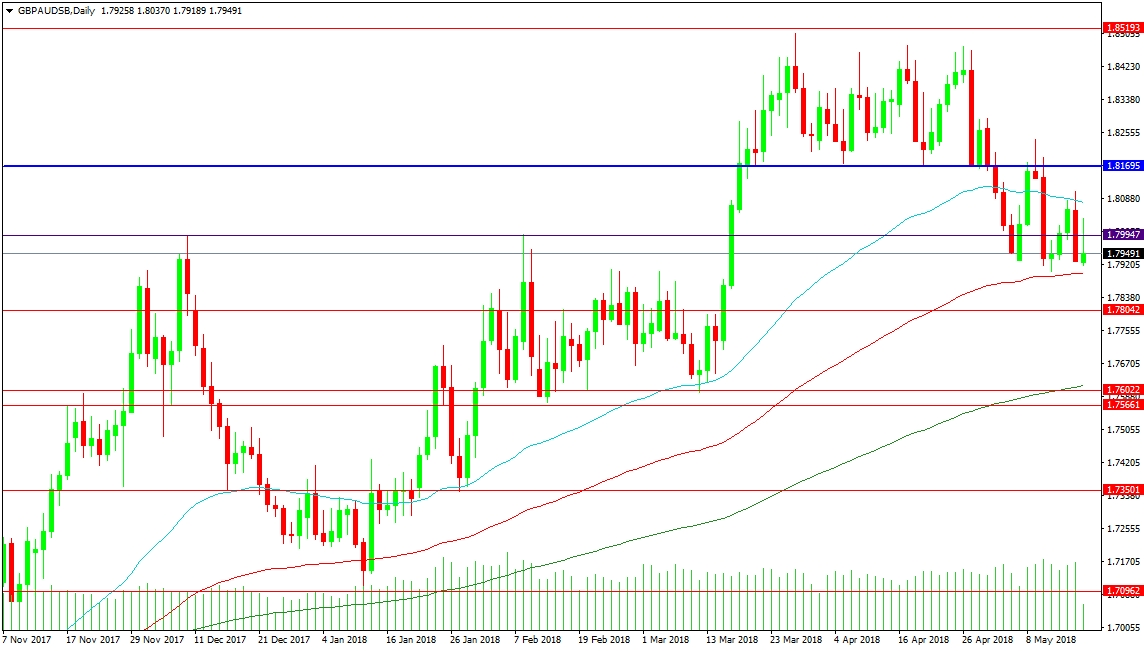

This pair has slipped under previous support at 1.81695 and is trading in a range, with a floor at 1.79000. This floor corresponds with some of the highs achieved in late February and early March. The 100 DMA is also supporting price at 1.78994. While price consolidates here, support and resistance are building up, with the next supportive zone at 1.76000, strengthened by the 200 DMA. A loss of that area would target the 1.73500 level, followed by the 1.71000 area in extension.

Resistance at the 50 DMA comes in at 1.80780 and this needs to be overcome to target the ceiling of the range at 1.81695. A break higher would be strengthened by a move above 1.83000, which would enable traders to reach for the highs at 1.85000.