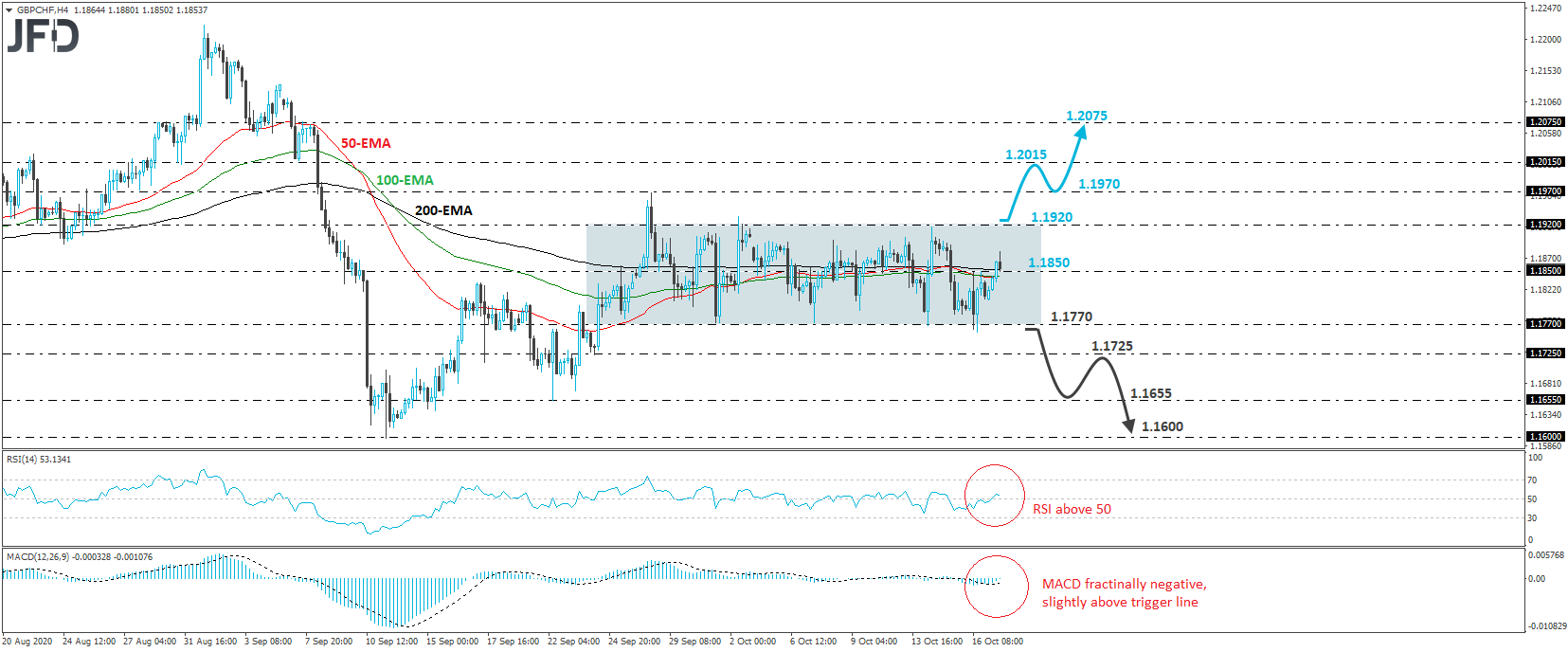

GBP/CHF traded higher on Monday, breaking above the 1.1850 resistance (now turned into support) level. Overall though, the pair continues to trade within a sideways range, between the 1.1770 and 1.1920 levels, that’s been in place since September 24th, and thus, we would consider the short-term picture to be neutral for now.

In order to start examining the bullish case, we would like to see a strong break above the upper end of the range, at 1.1920. Such a move would confirm a forthcoming higher high and may initially target the high of September 28th, at 1.1970. Another rise, above 1.1970, could pave the way towards the 1.2015 barrier, marked as a resistance by the inside swing lows of August 31st and September 7th, the break of which may see scope for extensions towards the peak of September 8th, at around 1.2075.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50, but it has just ticked down, while the MACD is very close to both its zero and trigger lines. The RSI detect slightly positive momentum, but the MACD’s neutrality supports our view for standing pat at the moment, waiting for the exit out of the aforementioned range.

On the downside, we would like to see a decisive dip below 1.1770 before we assess whether the outlook has turned negative. This will confirm a forthcoming lower low and may initially aim for the low of September 24th, at 1.1725. If that level is not able to stop the slide, the bears may push the battle towards the 1.1655 zone, marked by the low of September 22nd. If they don’t abandon the field near that zone either, the next level to consider as a support may be the 1.1600 zone, defined by the low of September 11th.