Investing.com’s stocks of the week

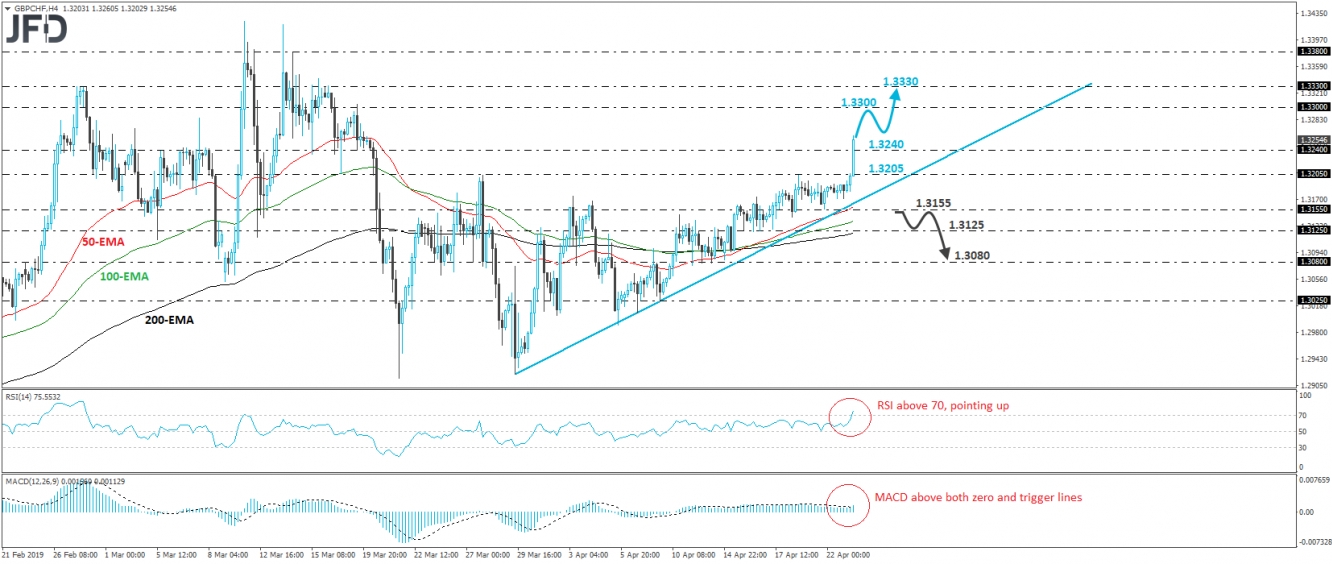

GBP/CHF rallied during the European morning Tuesday, breaking above the key resistance (now turned into support) barrier of 1.3205, marked by the highs of March 27th and April 18th, as well as the inside swing low of March 18th. Then, the rate emerged above the 1.3240 level, defined by the low of March 19th, something that may have opened the path towards higher resistance areas. On the 4-hour chart, the price structure remains higher peaks and higher troughs above the upside support line drawn from the low of March 29th and thus, we would stay positive over the near term.

We believe that the break above 1.3240 may have opened the path towards the 1.3300 hurdle, which is slightly below the high of March 19th. Another break, above 1.3300, is possible to extend the advance towards the high of the previous day, at around 1.3330. That said, after the rate challenges the 1.3300 area, we may see a pullback before the next positive leg. The rally already appears overstretched, which suggests that the bulls may decide to lock some profits soon, before initiating fresh positions.

The RSI lies above 70 and points up, while the MACD, already positive, has crossed above its trigger line. It points north as well. Both indicators detect strong upside speed and corroborate our view for further advances, but the fact that the RSI lies within its above-70 territory adds to our concerns for a small retreat soon, before the bulls decide to shoot again.

In order to start examining the case of a short-term reversal, we would like to see a dip below 1.3155. Such a move could confirm the break below the aforementioned upside support line and may initially aim for the 1.3125 level, marked by the lows of April 16th and 17th. If that level fails to stop the slide, then a break lower may set the stage for the 1.3080 zone, near the lows of April 11th and 12th.