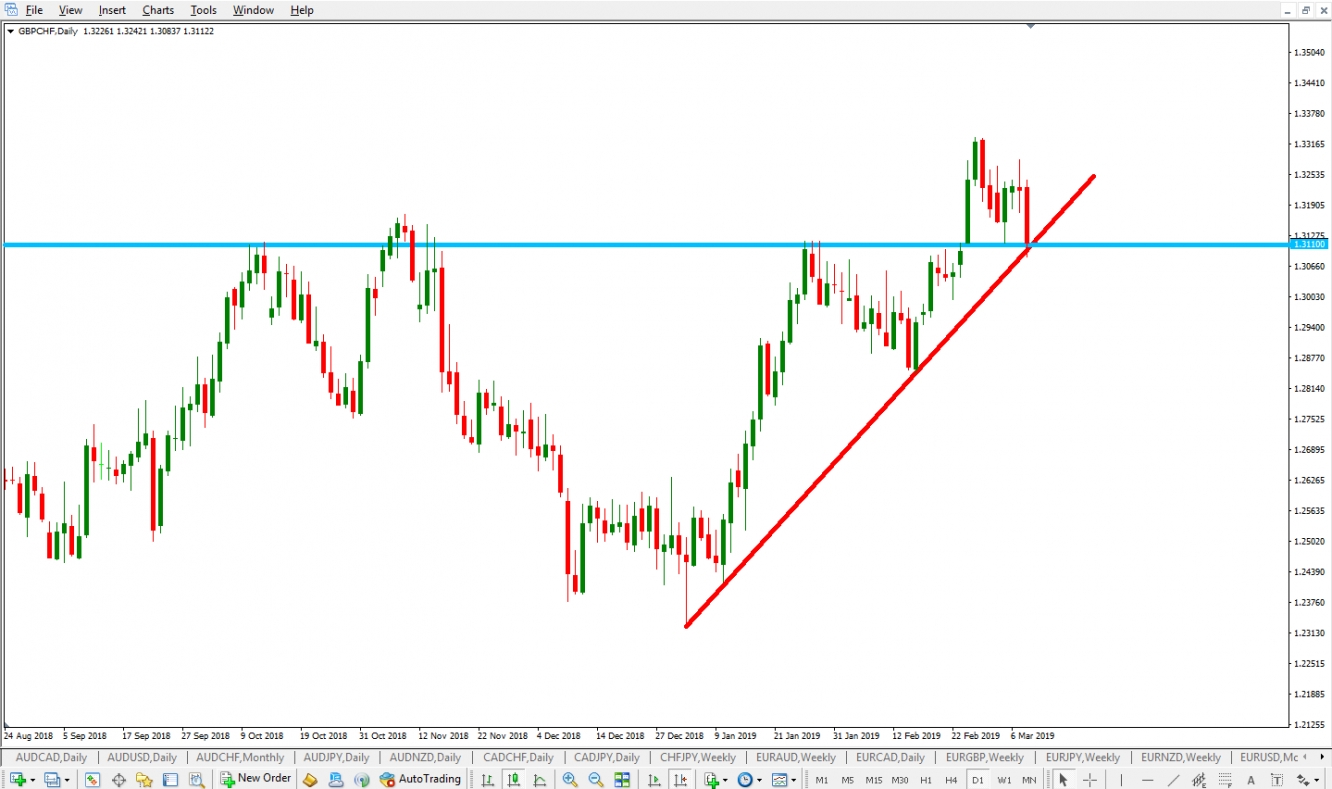

There is a potential long opportunity on GBP/CHF on the Daily Time frame. This is a purely technical overview since fundamentals do not affect long term technical setups. Since the beginning of 2019 GBP/CHF has been on a steady bulls rally, with two consecutive swings to the upside, making higher highs and higher lows. More importantly, we can draw a clearly definable ascending trendline on the Daily Time Frame, so we are definitely looking at a long term uptrend.

Previously the price has tested this trendline on two occasions and both times, the bulls held their ground. Last week, the price was in retracement mode, after making a higher high for this pair. Currently, the price is retesting the trend line, with the latest candle making a fake breakout and immediately coming back above the trendline. There are multiple levels of confluence of support located at that area, which I am going to discuss a bit later, for now, what is important to notice is that if the bulls hold off the current attack from the bears, we could be seeing another consecutive swing to the upside.

Confluence Of Support

At the major psychological level (area) of 1.3100, we have few different elements of support coming together.

- Trendline

- Previous Swing High

- Fibonacci Retracement of 50%

The confluence of support combined with the longevity of this trend gives this pair a very healthy bias towards the upside.

Action Plan

I am only looking for one possible outcome in the shape of a “Railway Tracks” price formation. So Monday’s candle needs to be equal size more or less to Friday’s candle but in green. If this happens, then it is a clear sign of heavy market rejection, and more often than not continuation candles in the trend’s direction. If this happens, I am going to place a “Buy Stop” pending order 5 pips above the high of the entire “Railway Tracks formation”, and my Stop Loss will be located either 5 pips bellow the lowest point of the formation, or 5 pips bellow the 50% of the entire length of the formation. Also, I might consider entering a short position since this also might turn in to a "Head and Shoulders" formation. In that scenario, the trendline would need to break with a momentum filled candle, and the if price comes back to retest breakout levels, we might have an opportunity to enter short.

Summary

I was making a classic rookie mistake previously by not conducting properly my long term analysis because once you have the general outlook of the asset, it makes the entire process smoother. These days, the majority of my Forex time is dedicated to Long Term analysis.