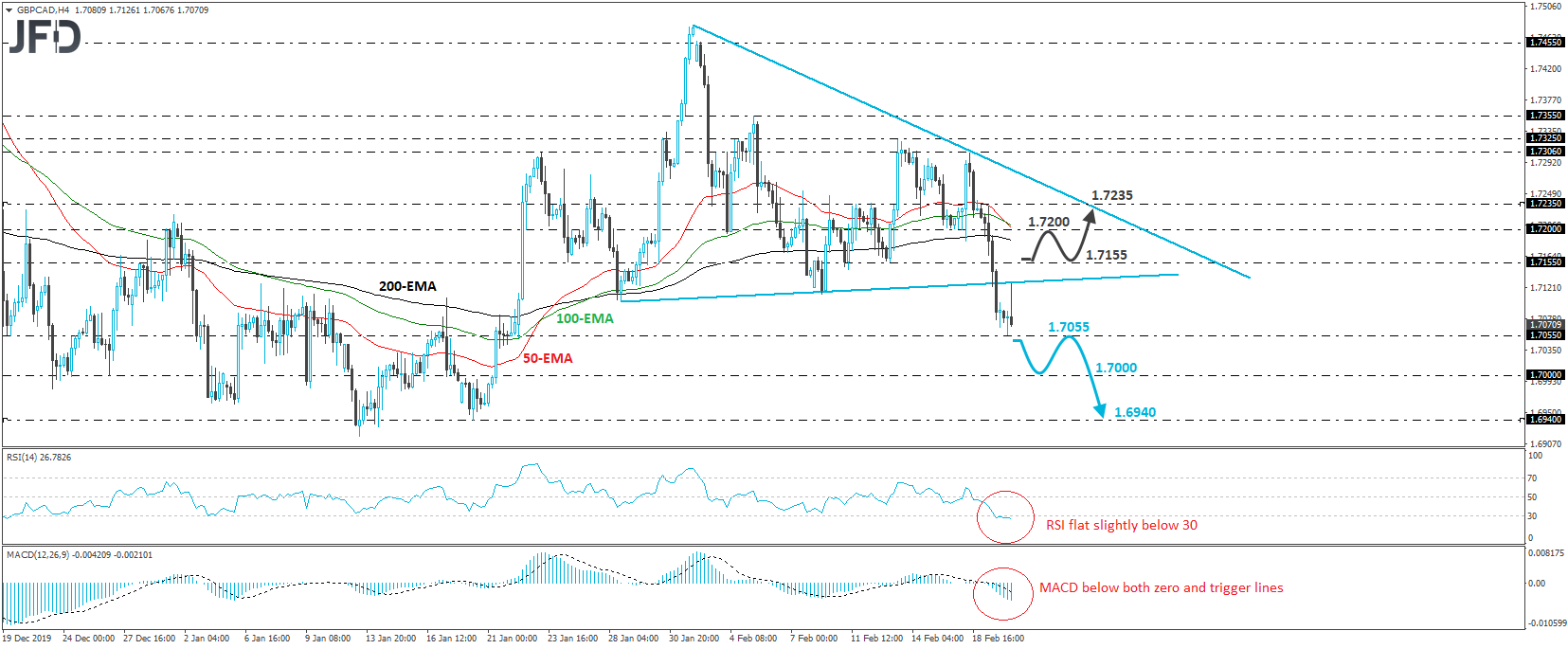

GBP/CAD tumbled yesterday, breaking below the 1.7155 support (now turned into resistance) barrier, and then below the upside support line taken from the low of January 28th. That said, the slide was stopped at 1.7055 today, and subsequently, the rate rebounded to test the aforementioned upside line as resistance. Overall, the pair was trading above that line, but also below a tentative downside one drawn from the high of January 31st. Thus, in our view, the dip below the upside line has turned the short-term outlook to the downside.

A clear and decisive dip below today’s low of 1.7055 may pave the way towards the psychological zone of 1.7000, which is slightly above the inside swing high of January 20th. The rate may rebound somewhat from there, but if the bears are still willing to jump back into the action, we would expect the forthcoming negative wave to drive the rate below 1.7000 and perhaps aim for the low of January 20th, at around 1.6940.

Shifting attention to our short-term momentum studies, we see that the RSI lies below 30, but it is somewhat flat, while the MACD, although below both its zero and trigger lines, shows signs of slowing down. These indicators suggest that the pair’s tumble may have lost some steam, which make us cautious over a possible corrective bounce before the sellers decide to aim for territories below 1.7055.

That said, the move that would throw us back to the sidelines is a recovery above 1.7155. Such a move would drive GBP/CAD back above the upside line drawn from the low of January 28th, and may allow advances towards the 1.7200 hurdle, which provided decent support on Monday and Tuesday. Another break, above 1.7200, may extend the recovery towards yesterday’s peak, at around 1.7235.