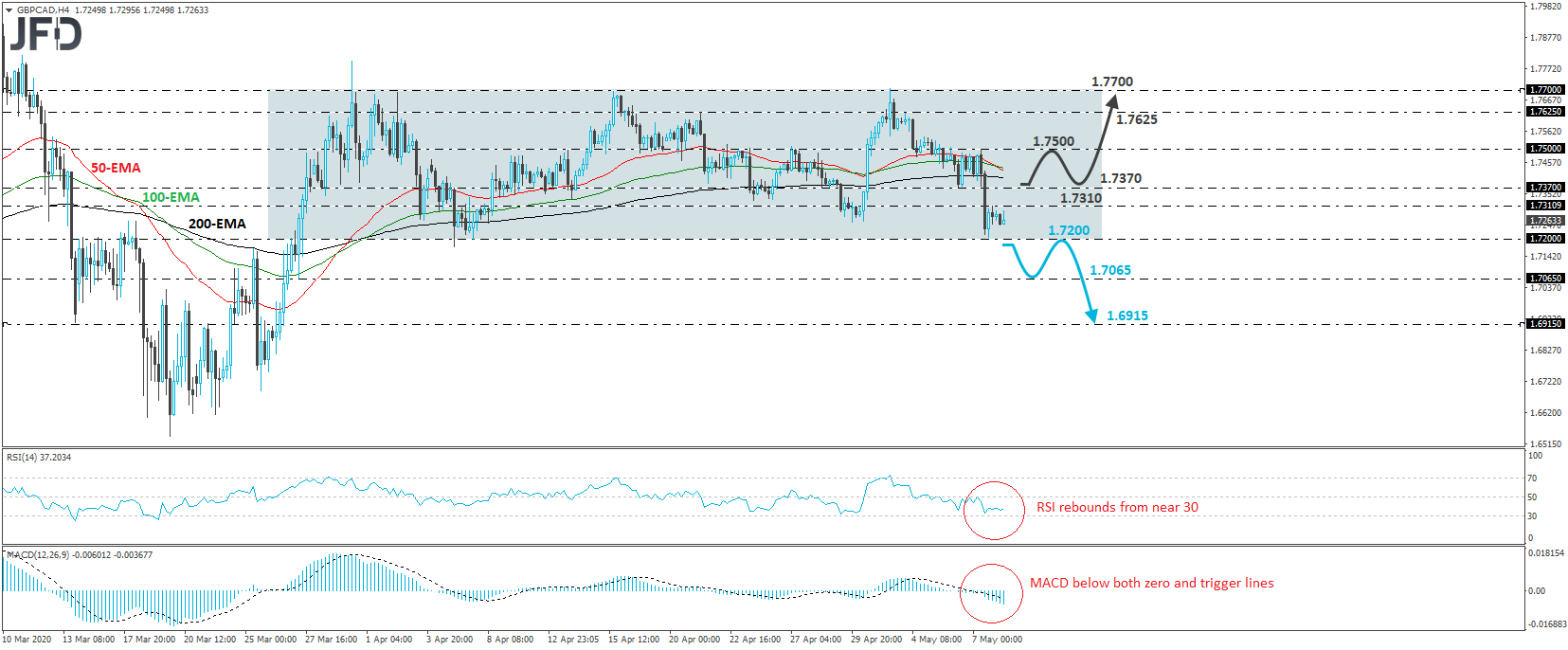

GBP/CAD traded lower yesterday, but the slide was halted near the 1.7200 barrier, which is also the lower bound of the sideways range that’s been in place since March 27th. Then the rate rebounded, with the recovery staying limited near the 1.7310 level. Although the pair continues to trade near the lower end of the range, we would like to see a decisive break below that bound before we start examining further extensions to the downside.

If, indeed, the bears manage to overcome the 1.7200 zone, we could see them aiming for the low of March 27, at around 1.7065. The rate could rebound somewhat after testing that zone, but if it fails to overcome the 1.7200 area, the bears could jump back into the game and push for another leg down. If this time they manage to overcome the 1.7065 hurdle, we may see them diving towards the 1.6915 area, marked by an intraday swing low formed on March 26.

Shifting attention to our oscillators, we see that the RSI runs below 50, while the MACD lies below both its zero and trigger lines. Both indicators detect negative momentum, but the RSI appears to have bottomed slightly above its 30 line, which suggests that a small bounce may be on the cards before the bears decide to take charge again, perhaps for the rate to test the 1.7370 level, defined as a resistance by Wednesday’s inside swing low.

Having said that though, in order to start examining whether traders want to keep this exchange rate range-bound for a while more, we would like to see a clear recovery above 1.7370. The bulls may take charge temporarily and aim for yesterday’s high, near the psychological zone of 1.7500. Another break, above 1.7500, could extend the advance towards Monday’s high, at 1.7625, or the upper bound of the range, at around 1.7700.