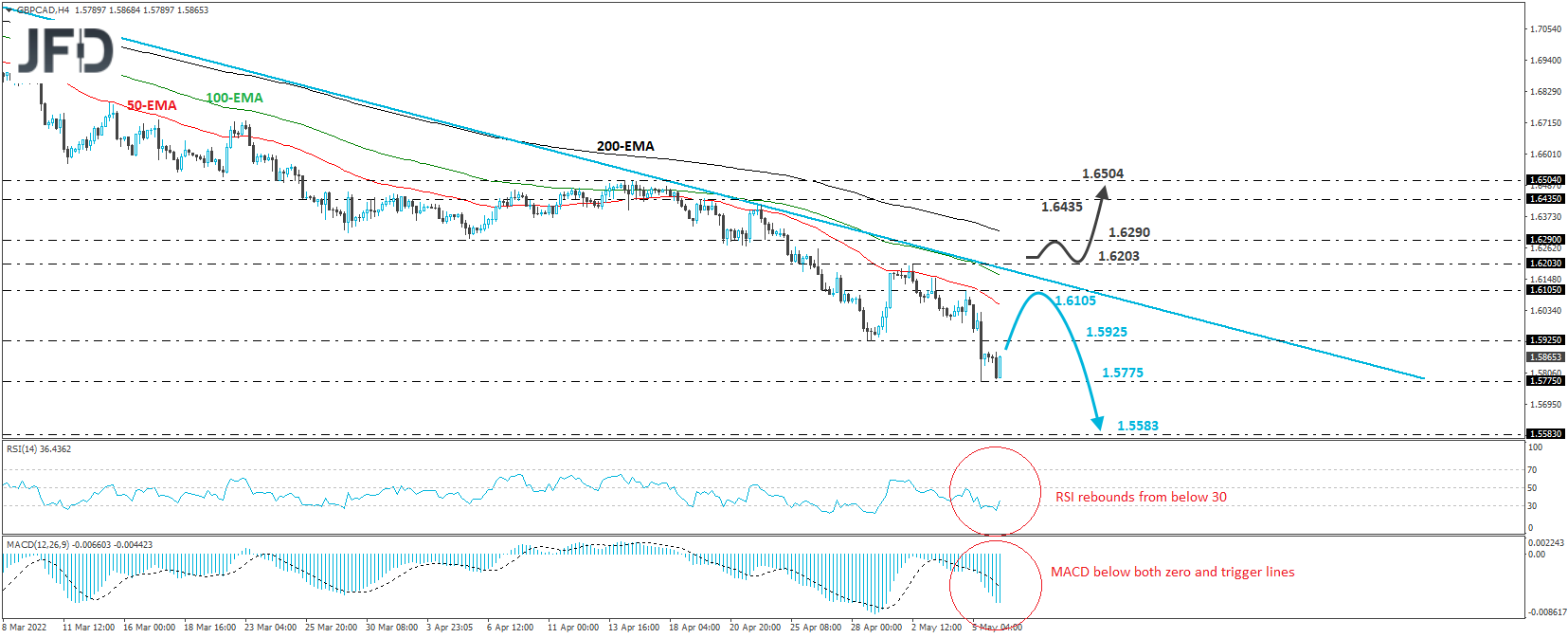

GBP/CAD traded lower yesterday after the BoE hiked interest rates but warned over recession risks to the UK economy. The dip brought the rate below the 1.5925 barrier, marked by the low of Apr. 28, which confirmed a forthcoming lower low on both the 4-hour and daily charts. This, combined with the fact that we can draw a downside resistance line from the high of Feb. 22, paints a positive near-term picture.

Today, the rate rebounded somewhat after nearly hitting support at 1.5775 again, and thus, we cannot rule out further recovery, even back above 1.5925. However, as long as the pair stays below the aforementioned downside line, we will see decent chances for the bears to jump back into the action, perhaps from near the high of May 4, at 1.6105. A possible slide could result in another test near the 1.5775 zone, the break of which would confirm another forthcoming lower low and perhaps set the stage for declines towards the low of Aug. 1, 2013, at 1.5583.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and exited its below-30 zone, while the MACD, although below both its zero and trigger lines, shows signs of bottoming. Both indicators detect slowing negative speed, which adds more credence to the view that some further recovery may be on the cards before the next leg south.

On the upside, we would like to see a clear recovery back above 1.6203 before examining a bullish-reversal case. This would confirm a forthcoming higher high on the daily chart and the break above the downside resistance line drawn from the high of Feb. 22.

The bulls could then get encouraged to test the 1.6290 hurdle, the break of which could carry extensions towards the 1.6435 or 1.6504 areas, marked as resistances by the highs of Apr. 22 and 14, respectively.