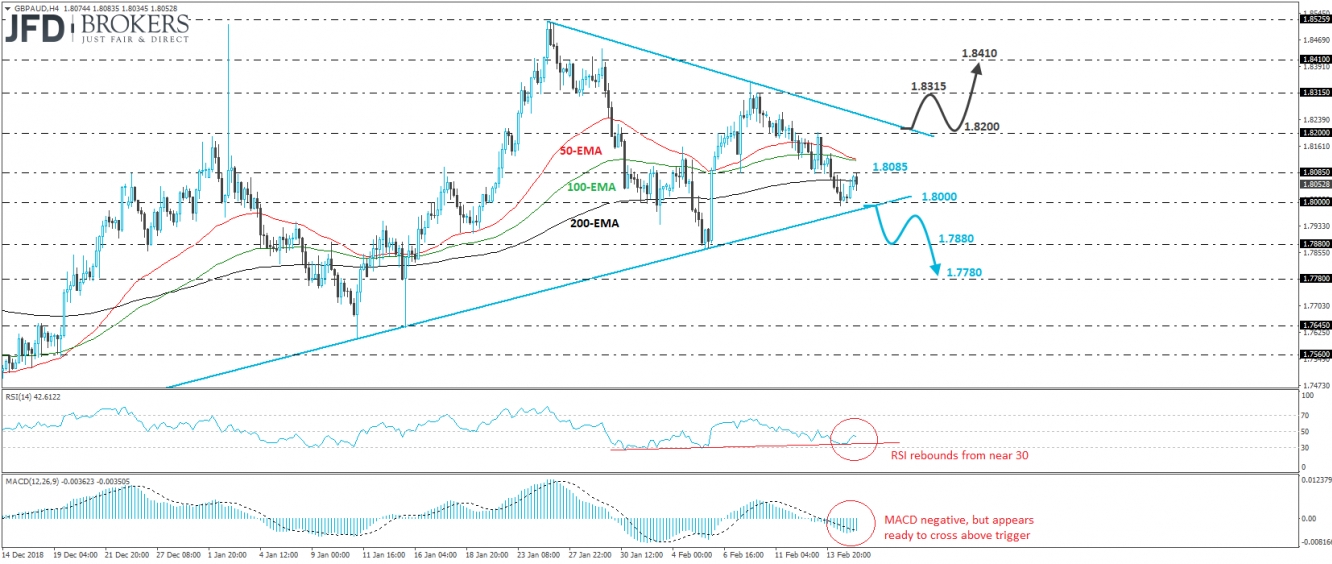

GBP/AUD traded slightly higher today, after it hit support near the psychological zone of 1.8000 yesterday. That said, the recovery was halted near the 1.8085 level, from which the rate started pulling back again. Although GBP/AUD remains above the uptrend line taken from the low of December 3rd, it is also trading below a downside resistance line drawn from the high of January 24th, which suggests weakness among the bulls to aim for higher highs. Thus, having all this in mind, we prefer to remain sidelined for now and wait for a decisive break of one of those two lines.

A clear and decisive dip below the aforementioned uptrend line could also place the rate below the psychological hurdle of 1.8000. Such a move may encourage the bears to aim for the 1.7880 area, which is near the lows of February 5th and 6th. Another dip below that zone would confirm a forthcoming lower low on the daily chart and may carry bearish extensions towards our next support zone, at around 1.7780.

Taking a look at our short-term oscillators, we see that the RSI rebounded from near 30, but turned down again from near 50. The MACD, although negative, has bottomed and now lies near its trigger line. These mixed momentum signals add more credence to our choice to stand on the sidelines for now and wait for clearer directional signs.

On the upside, we would like to see a clear break above 1.8200, as well as above the downside line taken from the high of January 24th, before we start examining the positive case. This could hint that the bulls are gaining back some of their recently lost strength and could pave the way for the 1.8315 territory. Another break, above 1.8315, may allow the rally to extend towards the 1.8410 area.