GBP/AUD inched to a fresh multi-year high in early trading on Monday, briefly reaching levels last seen in June of 2016 before reversing. The pair powered higher on Friday after the decisive Conservative Party victory in the UK general election boosted sterling across the board.

Meanwhile, the Australian dollar has been underpinned by news that the US and China have reached a ‘Phase One’ trade deal. China has agreed to purchase billions of dollars worth of farm goods from the US and President Trump refrained from imposing new tariffs on Chinese goods. China is Australia’s largest trading partner and positive news for China typically lifts the Aussie dollar.

Employment Reports from both the UK and Australia are on tap this week. On Tuesday, the UK Office for National Statistics (ONS) is scheduled to release its claimant count change and unemployment rate figures. Analysts expect UK unemployment to rise to 3.9 per cent over the prior reading of 3.8 per cent. On Thursday, the Australian Bureau of Statistics will release the November unemployment rate, expected to hold steady at 5.3%.

The Reserve Bank of Australia (RBA) Monetary Policy Meeting Minutes are scheduled for release on Tuesday. On December 3rd the RBA left the official cash rate at the historic low 0.75 per cent, following three rate cuts in 2019. Any hints of a further rate cut in the RBA minutes would be bearish for the Australian dollar.

On Thursday, the Bank of England (BOE) Monetary Policy Committee is expected to hold interest rates at 0.75 percent. Some analysts expect a more hawkish stance after the recent Tory victory eased some of the political uncertainty surrounding Brexit. In addition, ministers will reportedly decide on the next BOE governor within days. Minouche Shafik, Andrew Bailey and Kevin Warsh are among the leading candidates to replace Mark Carney on January 31st.

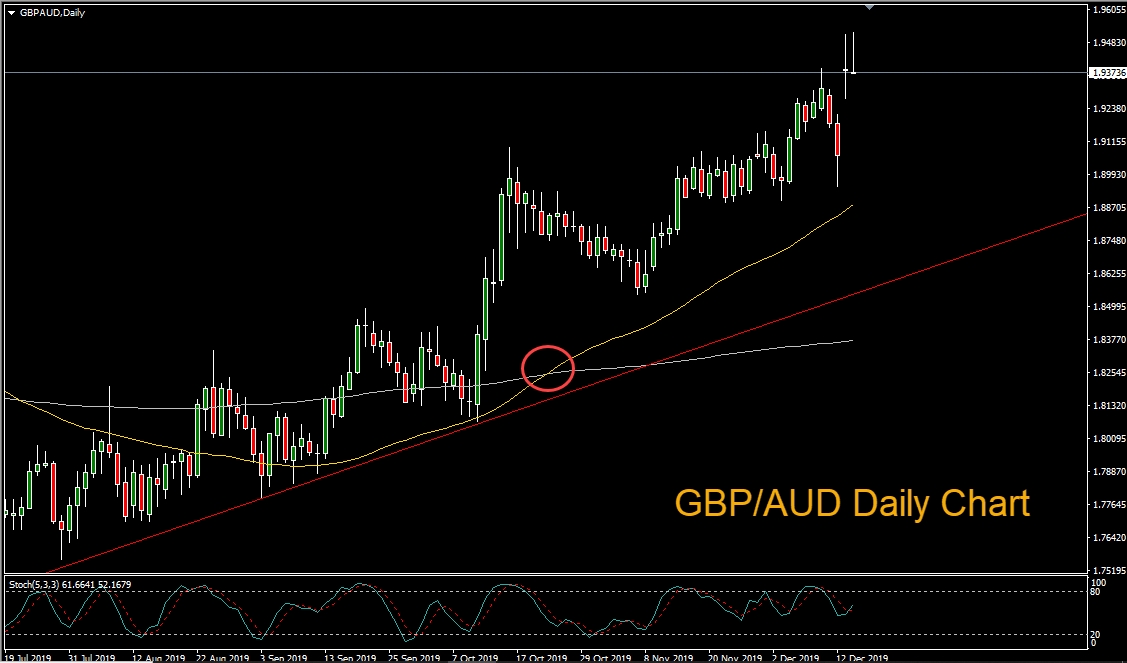

Looking at the daily chart we can see the fluid uptrend in GBP/AUD since late July. A golden cross (50 period moving average crossing above the 200 period moving average) in late October ushered in the recent leg of the upward move. The daily candles now reflect uncertainty. Potential resistance lies overhead at 2.0071 and trendline support currently sits below at 1.8544.