Life has been tough on GBP/AUD bulls recently. The pair reached a two-year high of 1.8733 on October 11th, but failed to maintain the uptrend. On December 3rd, the Pound fell to 1.7210 against the Australian dollar – a crash of over 1500 pips in less than two months.

As of this writing, the pair is hovering around 1.7540. Is this the beginning of a larger recovery or merely a correction within an ongoing downtrend? That is the question we hope the Elliott Wave Principle will help us answer.

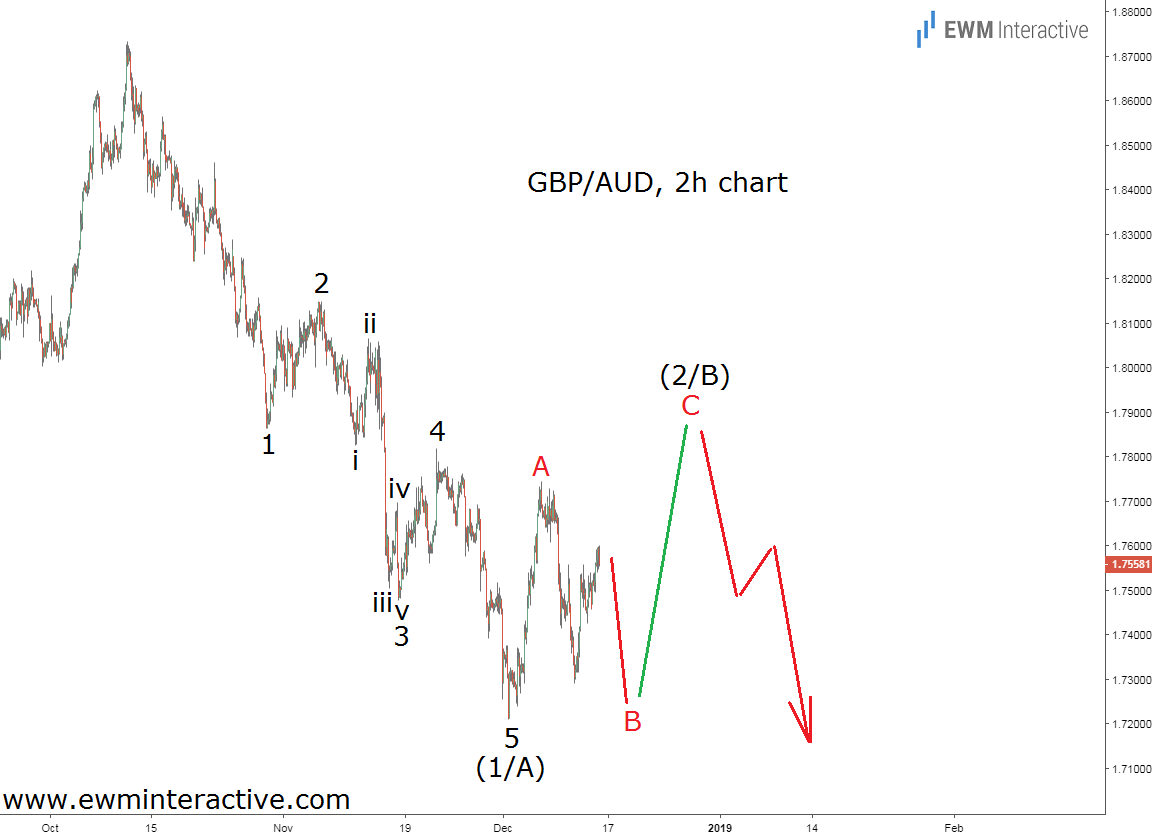

The 2-hour chart of GBPAUD makes the structure of the decline from 1.8733 visible. It looks like the drop to 1.7210 took the shape of a five-wave impulse pattern in wave (1/A), labeled 1-2-3-4-5. To Elliotticians, this pattern means that GBPAUD is still in a downtrend, but a three-wave recovery can be expected before the bears return.

The rally from 1.7210 to 1.7745 cannot be seen as a complete correction. It seems to be just the first phase – wave A – of the larger wave (2/B) retracement. The decline from the top of wave A does not look compete, either.

If this count is correct, we should expect more weakness in wave B towards the support near 1.7250, followed by a rally to 1.7800 – 1.8000 in wave C. Once wave (2/B) is over, the entire 5-3 wave cycle would be over, as well, and the stage would be set for another selloff in wave (3/C).