Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

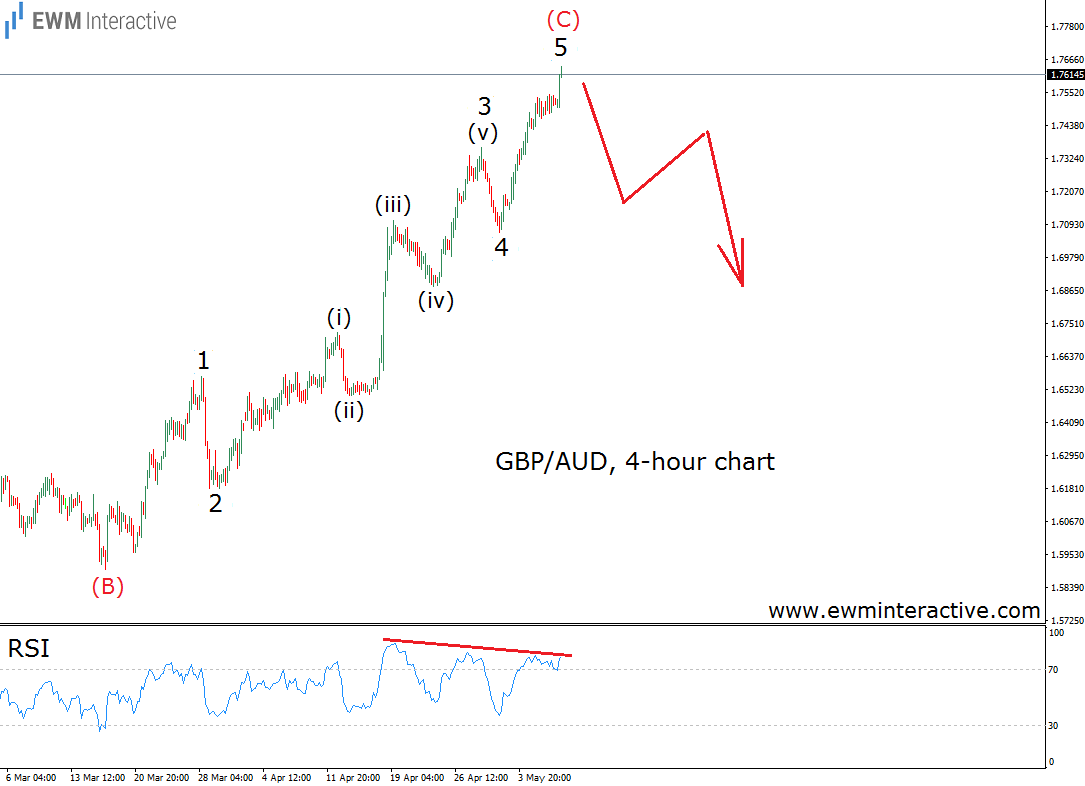

It has been a little over a month since GBP/AUD reached 1.7650 on May 10th. The day before, May 9th, we published “GBP/AUD About to Change Direction”, sharing our Elliott Wave-based opinion, that instead of joining the bulls above 1.7600, traders should stay aside and get ready for a major bearish reversal. Here is the chart that motivated the negative outlook.

There were two reasons for pessimism. First, the 4-hour chart of GBP/AUD was showing a clear five-wave impulse to the north. According to the theory, every impulse is followed by a reversal. And second, the relative strength index allowed us to see the typical bearish divergence between waves 3 and 5, which meant the bulls were running out of steam. These two combined, were more than enough to convince us the pound’s uptrend against the Australian dollar was not as strong as it appeared. A month later, we now know it was not.

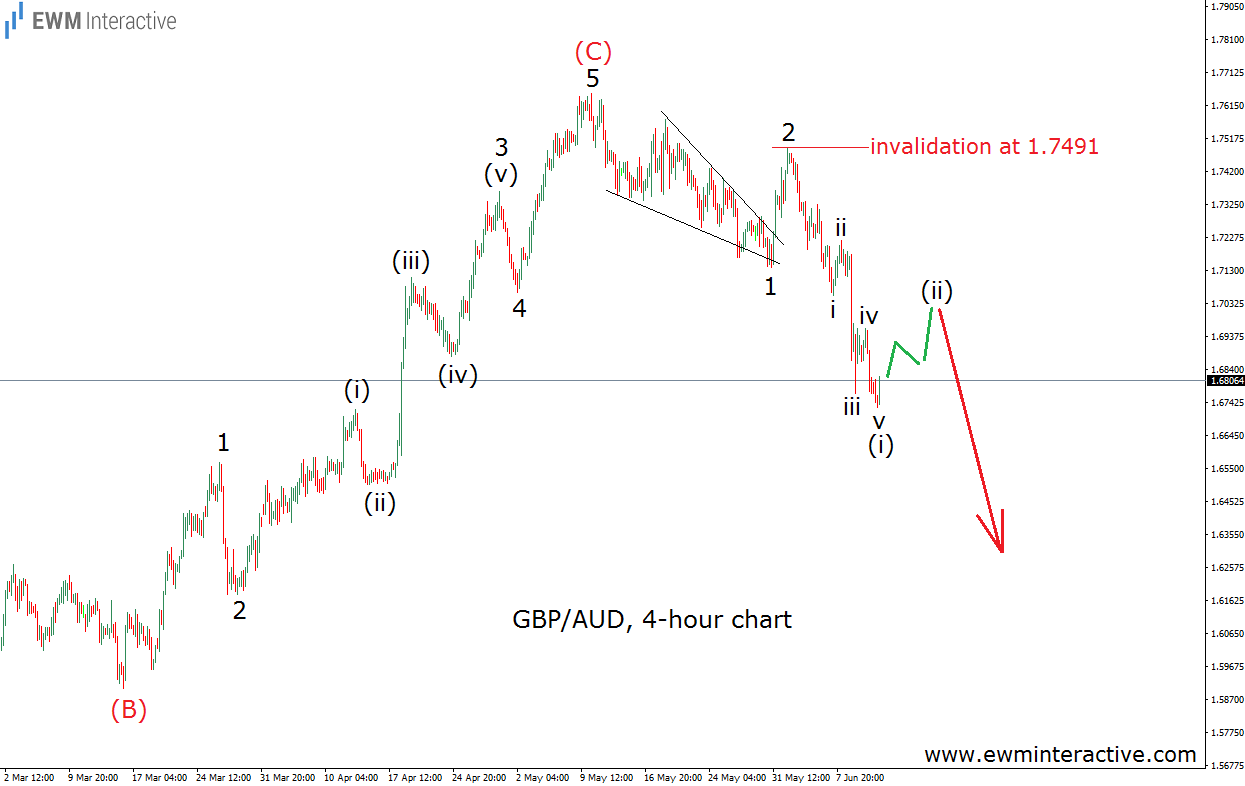

The pair plunged to as low as 1.6728 earlier today, representing a 922-pip selloff from its May high. The decline consists of only three waves and under normal circumstances, the uptrend should have been expected to resume. However, the big picture outlook shows the impulsive rally to 1.7650 is actually part of a larger correction within an even larger downtrend. That is why instead of “buying the dip”, we believe more weakness should follow, as long as the top of wave 2 at 1.7491 is intact. Unless the pair returns to break this invalidation level, GBP/AUD would remain under heavy pressure.