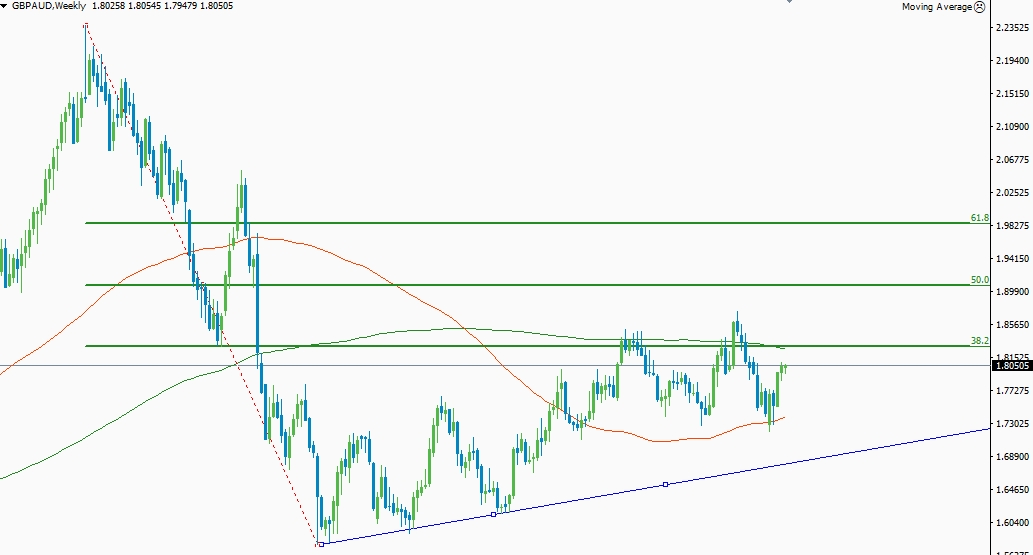

After securing a record high at 2.23501, the GBP/AUD pair started its extensive bearish rally. Most of the professional price action traders made a decent profit by shorting the GBP/AUD pair considering the Brexit event. The pair found some solid support at 1.57686 and started its bullish correction. In the weekly chart, the medium term bullish trend clearly suggest the bulls are trying to take control of this market from the major support level at 1.57686.

Currently, the pair is slowly heading towards the 38.2% bearish Fibonacci retracement level drawn from the high of 23rd August 2015 to the low of 2nd October 2016. A weekly closing of the price above the major resistance level at 1.82940 will eventually lead this pair towards the 50% Fibonacci retracement level. On the contrary, any bearish price action confirmation signal near the major resistance level at 1.82940 will lead this pair towards the medium term bullish trend line support at 1.67762.

GBP/AUD technical chart analysis

Figure: GBP/AUD slowly heading towards the 200 weekly SMA

From the above figure, you can clearly see a bullish correction is in place for this pair but until it clears the 38.2% Fibonacci retracement level, the sellers might push this pair towards the bullish trend line support. If the pair falls from that level, the bullish trend line might present an excellent buying opportunity. According to the leading analyst of the Rakuten broker, buying the pair near 1.67762 (medium-term trend line support) with bullish price action confirmation signal will provide excellent profit-taking opportunity. If the bulls manage to clear out the resistance level at 1.90593, the next potential target for this pair is the 61.8% retracement level. This level is going to play a vital role since a weekly closing of the price above that level will confirm the establishment of the temporary bottom at 1.57941. This will eventually help the GBP/AUD bulls in the long run.

On the downside, we need to break below the medium term trend line support at 1.67762 to establish fresh selling pressure. A weekly closing of the price below this level will eventually lead this pair towards the next major support level at 1.58068. This level is going to provide an extreme level of buying momentum to this pair and any bullish price action signal will be a good opportunity to execute long orders. On the contrary, a clear break of the price below the support level at 1.58068 will eventually lead the pair towards the next major support level at 1.43787. This level is going to provide a significant amount of support to this pair since we have plenty of supportive candles in the higher time frame. However, buying the pair at that level without having any clear bullish reversal signal will be an immature act.

Fundamental factors

Fundamentally, the bears are still the favorite for the GBP/AUD pair since the Brexit event is pushing the British economy against most of its major rivals. However, due to the recent holiday season, the market volatility is most likely to be thin and the long-term traders are advised not to place any trade. However, the short-term traders might look for selling opportunity, provided that the pair headed towards the 38.2% Fibonacci retracement level. Though the traders across the globe are celebrating holiday season we might see some decent market volatility prior to the closing of this trading week. On Friday we have NFP data release for the U.S economy which is most likely to affect this pair to a certain extent. Though the effect is most likely to be on the U.S dollar related pair due to correlation theory, we might see some decent trading opportunity in the GBP/AUD pair. Considering all the fundamental parameters, the long-term traders are advised to stay in the sideline until the market restore is normal volatility.