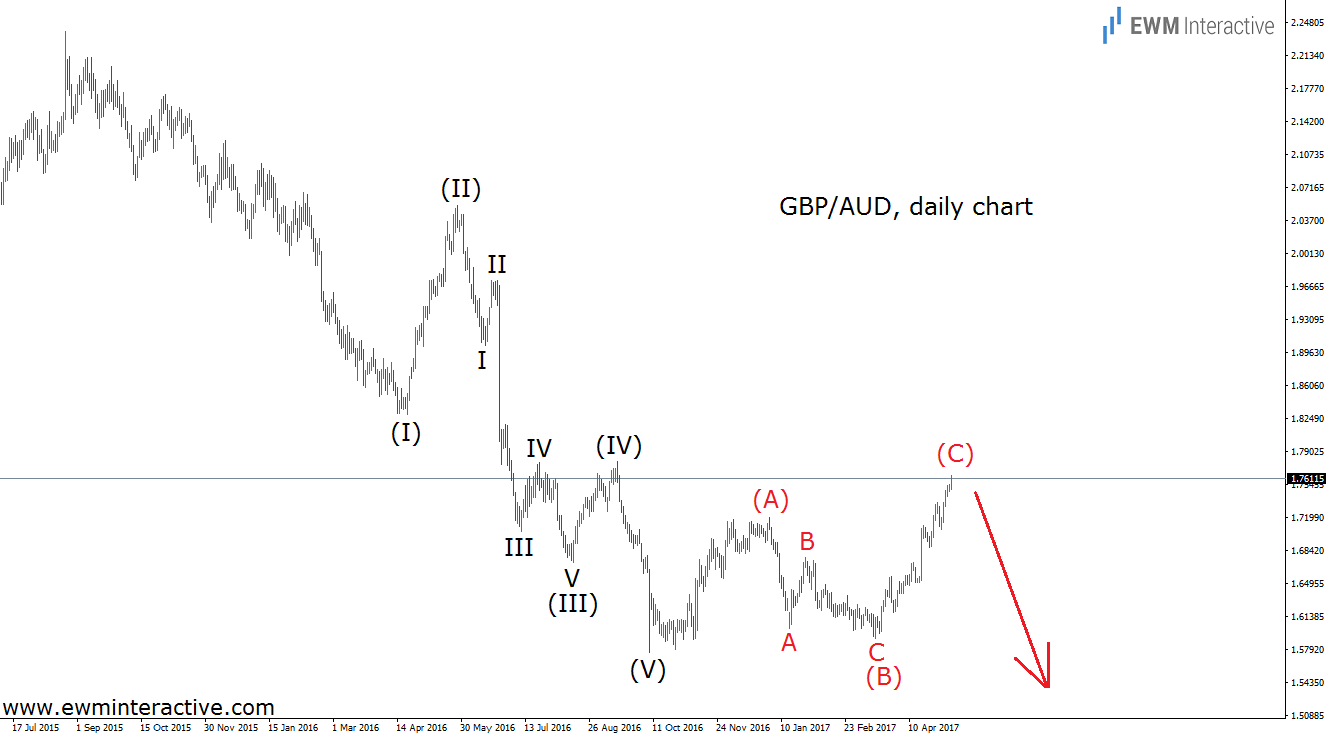

The GBP/AUD exchange rate climbed to levels not seen since September, 2016. The pair is currently trading close to 1.7600, nearly 19 figures above the bottom at 1.5757 registered in October last year. Rising prices could be tempting, but also dangerous. In fact, the daily chart below suggests the British pound is at a critical juncture against the Australian dollar.

In order to arrive at a meaningful conclusion, we have to put the current recovery in the context of the big picture. The daily chart allows us to see the wave structure of the decline from the August, 2015 top of 2.2389. It could easily be recognized as a five-wave impulse, labeled (I)-(II)-(III)-(IV)-(V). The sub-waves of wave (III) are also clearly visible.

According to the Elliott Wave Principle, every impulse is followed by a correction of three waves in the opposite direction. That is what we believe the recovery from 1.5757 represents – an (A)-(B)-(C) simple zig-zag retracement. The theory says that once the corrective phase of the cycle is over, the trend resumes in the direction of the impulsive sequence. This means that if this count is correct, a bearish reversal should be expected in GBP/AUD. In addition, wave (C) has reached the resistance area of wave (IV). Now let’s take a look at the structure of wave (C) from up close.

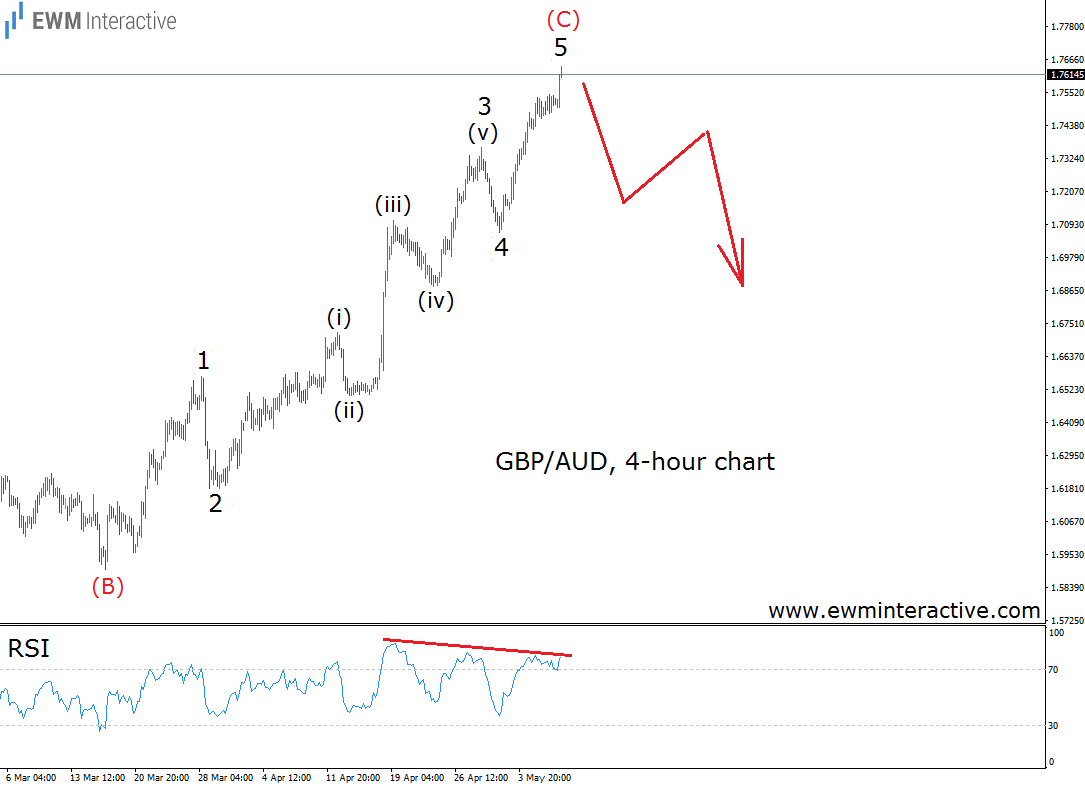

Wave (C) looks like a complete impulse pattern with an extended third wave. In our opinion, this is the worst possible time to join the bulls. Even without the big picture in mind, the 4-hour chart would be enough to prepare us for a change in direction. Besides, the relative strength index shows a bearish divergence between waves 3 and 5 of (C), which gives us another reason not to be bullish on GBPAUD.

It has been a good run, but the bulls seem exhausted now. The analysis suggests it is time for the bears to take the wheel and drag the pair lower. In the long-term, GBP/AUD is supposed to decline to a new low, beneath 1.5750. Nevertheless, picking tops is very risky. Staying aside and waiting for the reversal to actually occur sounds like the better idea.