- GBP - Smooth Sailing to 1.70?

- Dollar Vulnerable to Weak Retail Sales

- Why is the Euro So Weak?

- A$ Hangs Tight Ahead of Employment Report

- NZD: Shrugs Off Weaker Data

- CAD: Supported by Rise in House Prices and Oil

- Weaker Data Drives Profit Taking in Yen Crosses

GBP: Smooth Sailing to 1.70?

The Bank of England's decision to drop their 7% unemployment-rate threshold and upgrade its growth forecasts created significant demand for sterling today. The British pound traded higher against all of the major currencies and we believe there's further room to the upside. From a fundamental perspective, investors are pleased to see the central bank accepting its mistake of tying monetary policy to a specific level of unemployment. The policy was introduced with significant fanfare when Mark Carney took office in the summer of 2013. Since then, the unemployment rate has fallen faster than the central bank anticipated with growth exceeding their low expectations. However with a great degree of spare capacity in the economy, the Monetary Policy Committee is reluctant about raising interest rates this year. Still by significantly upgrading their growth forecasts for 2014, the BoE is telling the market that rates could rise faster than they anticipated. In other words, the Bank of England may not want to raise interest rates in late 2014 / early 2015 but could be forced to do so if the unemployment rate drops to 6.5% this year. The BoE now sees the economy growing more than 3% this year. Their 0.5% upgrade in their GDP forecast for 2014 is sizable and represents less concern about downside risks. They believe that the unemployment rate will drop to 6.5% by 2015 but if the current pace of improvement in the unemployment rate continues, we do not rule out this target being met this year. The exact timing of the central bank's first rate hike now hinges upon more qualitative measures such as spare capacity. The central bank's rosier outlook for the economy has driven U.K. yields sharply higher and we believe that they will continue to rise, driving GBP higher.

According to the last CFTC IMM report, speculators have reduced long sterling positions but given the magnitude of the central bank's shift in strategy and outlook, they could revisit that trade. However from a technical perspective, there is quite a bit of resistance above current levels in the GBP/USD. The currency pair ended the North American trading session right below 1.66, a former resistance level. If this level is broken in a meaningful way, then the next point of contention is at the 2 year high of 1.6668 but before the currency pair can test 1.70, it also needs to break through former resistance at 1.6750. So don't expect smooth sailing to 1.70 for the GBP/USD. Instead better opportunities with less upside resistance that could potentially stall the rally can be found in the crosses.

Dollar Vulnerable to Weak Retail Sales

With no U.S. economic data released today, there was very little consistency in the performance of the greenback. The dollar traded higher versus euro, Swiss Franc and Australian dollar but moved lower versus the Japanese Yen and British pound. Tomorrow's U.S. retail sales report and Janet Yellen's testimony before the Senate Banking Committee should lead to more consistency for the greenback but unfortunately the odds favor a sell-off. According to the International Council of Shopping Centers and Johnson Redbook survey, consumer spending slowed in the month of January. Given lackluster job growth, this weakness in demand would not be surprising but would be negative for the U.S. dollar. The bar is already low with economists looking for retail sales to stagnate in January. If it declines, USD/JPY could retreat quickly but the optimism of the central bank should limit the downside for the pair. Federal Reserve President Bullard made some very interesting and specific comments today which would have been extremely market moving for the dollar if Bullard were a voting member of the FOMC this year but he is not. Nonetheless, some of his colleagues who vote in 2014 may share his views. Bullard called for the central bank to drop its unemployment rate threshold and use a qualitative guidance for rates. We believe that come March, Janet Yellen will follow in the Bank of England's footsteps and move away from the 6.5% threshold introduced by her predecessor Ben Bernanke. If the central bank upgrades their growth forecasts in the same manner as the BoE, we could see a similar reaction in the U.S. dollar. Yellen speaks again tomorrow but speaking the testimony before the Senate Banking Committee is less market moving than testimony before the House because most of the urgent questions were asked. The Q&A session is still worth watching along with tomorrow's jobless claims report.

Why is the Euro So Weak?

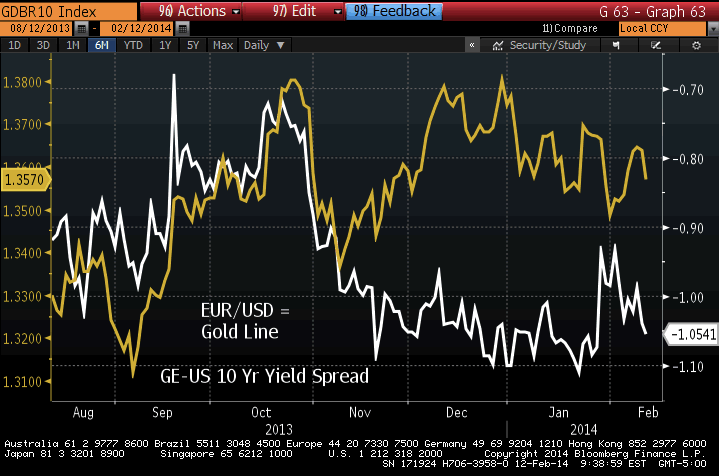

The euro continued to sell-off against the U.S. dollar. A larger than anticipated decline in Eurozone industrial production contributed to the move but a soft number was discounted because of deterioration in Germany, France and Italy. Instead, the primary reason why euro is falling is because the spread between German and U.S. yields grew more negative since the Federal Reserve decided to taper asset purchases for the second month in a row in late January. The rise in 10 year U.S. Treasury yields affects other currency pairs as well but the difference is that yields in Australia and the U.K. for example are also rising rapidly because of their own shifts in monetary policies. With Friday's fourth quarter Eurozone GDP report expected to show slow growth at the end of last year, euro could be poised for further losses against the U.S. dollar. The following chart compares the recent price action of the EUR/USD with the German-US 10 year yield spread.

EUR/USD vs. German 10-Year Yield" title="EUR/USD vs. German 10-Year Yield" align="bottom" border="0" height="242" width="474" />

EUR/USD vs. German 10-Year Yield" title="EUR/USD vs. German 10-Year Yield" align="bottom" border="0" height="242" width="474" />

A$ Hangs Tight Ahead of Employment Report

It was a mixed day for the commodity currencies with the Australian dollar trading lower against the greenback, the Canadian dollar moving higher while the New Zealand dollar remained unchanged. Stronger than expected Chinese trade numbers lifted the commodity currencies when the data was first released but failed to have a lasting impact on the Australian dollar. Nonetheless the data was very good with exports rising 10.6% compared to an estimate of 4.3%. This drove the trade surplus up to $31.86 billion from $25.64 billion in December. The fact that imports from Australia rose 17.7% validates the Reserve Bank's decision to drop its easing bias earlier this month. Unfortunately consumer confidence still needs to catch up as sentiment deteriorated for the third month in a row according to the February Westpac Consumer Confidence report. This weakness reflects the downgraded outlook for the economy and concerns about the upcoming budget. With the employment report scheduled for release, the Australian dollar remains in play over the next 24 hours. We are looking for a rebound in employment because the service and manufacturing sectors added jobs in January according to the PMI reports. Meanwhile the New Zealand dollar shrugged off a decline in credit card spending and slowdown in the PMI manufacturing index. Neither reports should stop the Reserve Bank from raising interest rates next month. As for the Canadian dollar, it received a lift from a larger than expected increase in house prices and rise in oil.

Weaker Data Drives Profit Taking in Yen Crosses

The Japanese Yen traded higher against most of the major currencies today. It is not usual to see profit taking in currencies and equities. Had the Nikkei experienced a stronger rally overnight or U.S. stocks extended higher today, USD/JPY along with other Yen pairs would have probably pressed higher but that did not occur and as a result, profit taking was the main driver behind Yen flows. The rally in the Nikkei was restrained by a larger than anticipated decline in machine orders. Economists had been looking for a pullback in December but the 15.7% decline was 4 times larger than they anticipated. This pullback is consistent with other recent economic reports from Japan that showed the country's recovery losing momentum towards the end of last year. Machine tool orders on the other hand are off to a good start, rising 39.6% in January. Bank of Japan Governor Kuroda said, "fiscal discipline is necessary for sustainable economic growth" and at this stage of the recovery, he is absolutely right. Looking ahead, the Domestic Goods Price index is scheduled for release. Price growth is expected to slow in January. If the recovery does not gain momentum soon, the BoJ may feel the need to preempt the consumption tax hike in April by increasing monetary stimulus.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.