Cable saw plenty of downside action late last week as a new BREXIT Poll from the UK Independent had the exit vote at 55%. This started a veritable landslide and saw the pair depressed by over 170 pips before it climbed slightly before Friday's close to finish the session down a meagre 110 pips.

Much of the selling was due to the inevitable repositioning that occurs with the constant changing of risk around the vote and is more symptomatic of the short-term volatile trend of the pair. Regardless, the pair finished the week well down around the 1.4254 mark and likely to face further selling early this week.

The week ahead will continue to provide plenty of volatility for the Cable as it faces not only increasing risk of a BREXIT but also a key rate hike vote from the US Federal Reserve. In particular, expect to see plenty of instability in the week ahead given that a bevy of stakeholders are likely to become increasingly active in pushing their agendas as we move closer towards the vote. Subsequently, the currency will likely move in tandem with the vote sentiment as the pair looks for some direction. In addition, the Federal Reserve is due to meet on interest rates which could also add to the general risk building within the currency pair.

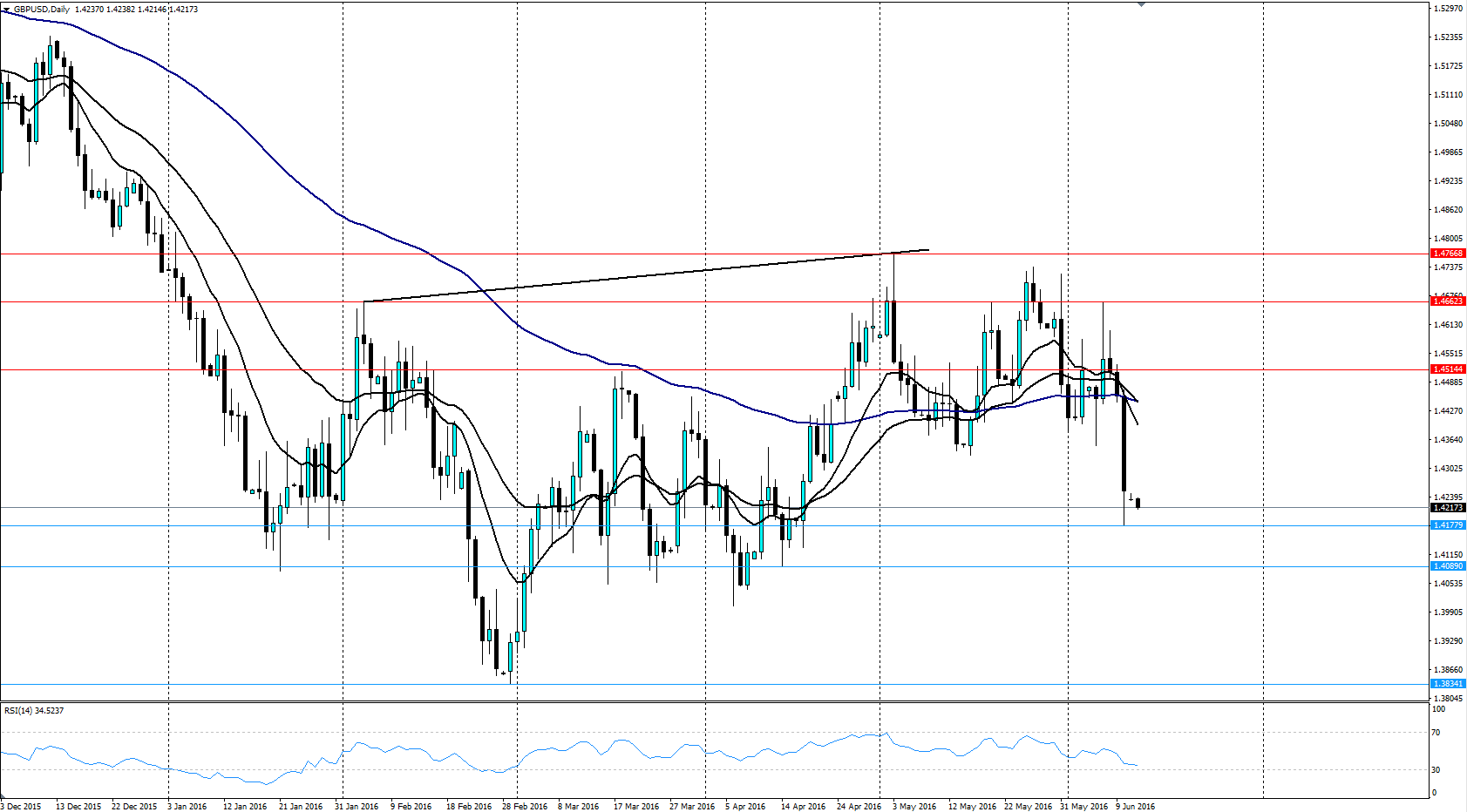

From a technical perspective, last week saw price action turn decidedly bearish and tumble out of the channel as well as below the 12, 30, and 100-day EMA’s. In addition, the RSI Oscillator is also trending lower within neutral territory, and still has some room to move before becoming oversold. Subsequently, our bias remains strongly bearish in the week ahead but watch for any fundamental risk events. Support is currently in place for the pair at 1.4177, 1.4089, and 1.3834. Resistance exists on the upside at 1.4514, 1.4662, and 1.4768.

Ultimately, the week ahead is likely to be dominated by further talk around a potential exit of the European Union. As the June vote looms, it appears clear that the uncertainty around the vote is increasing and that market sentiment is unclear as to the likely outcome.

The latest poll doesn’t help given the large swings within voter sentiment. Therefore, it is highly likely that the fallout from the referendum—regardless of the outcome—will be sharp and unforgiving given the lack of risk being “priced” in. Subsequently, be very careful trading this pair in the lead-up to the historic decision because it really is anyone’s guess as to which way the vote will actually go.