Taken a look at that GBPUSD as of late? Maybe you should.

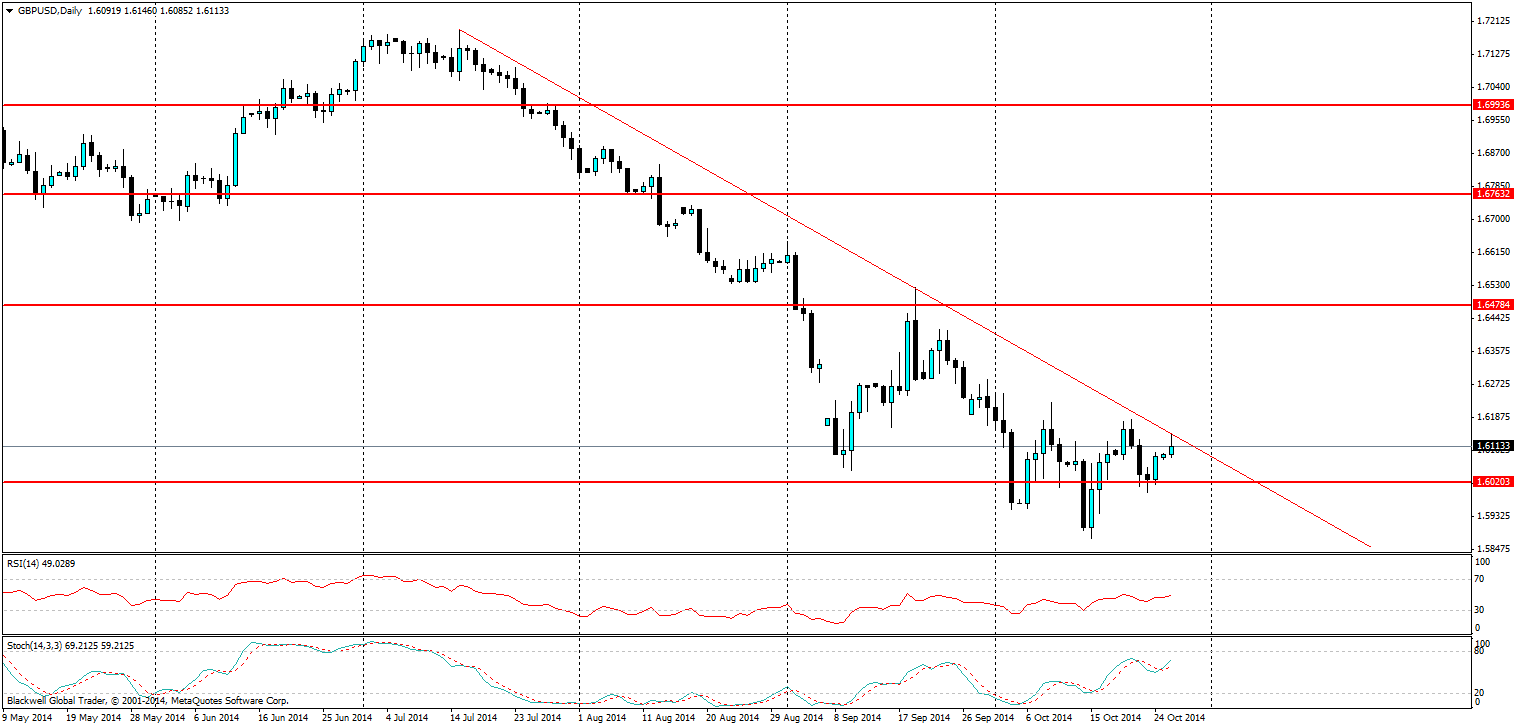

The GBPUSD has been in a steep downtrend for some time, with a nice trend line which has formed and just experienced its 3rd trend line touch today. So what does the week have ahead for the GBPUSD and does it have the ability to actually push through given the global market situation at present?

At present the market is looking very solid, but UK data is likely to be very weak this coming week, with only house prices m/m due out on Thursday. This means we have a return to focus on US data and USD strength which has very much been apparent in the market at present.

With any trade there is danger and the GBPUSD daily chart has some danger.

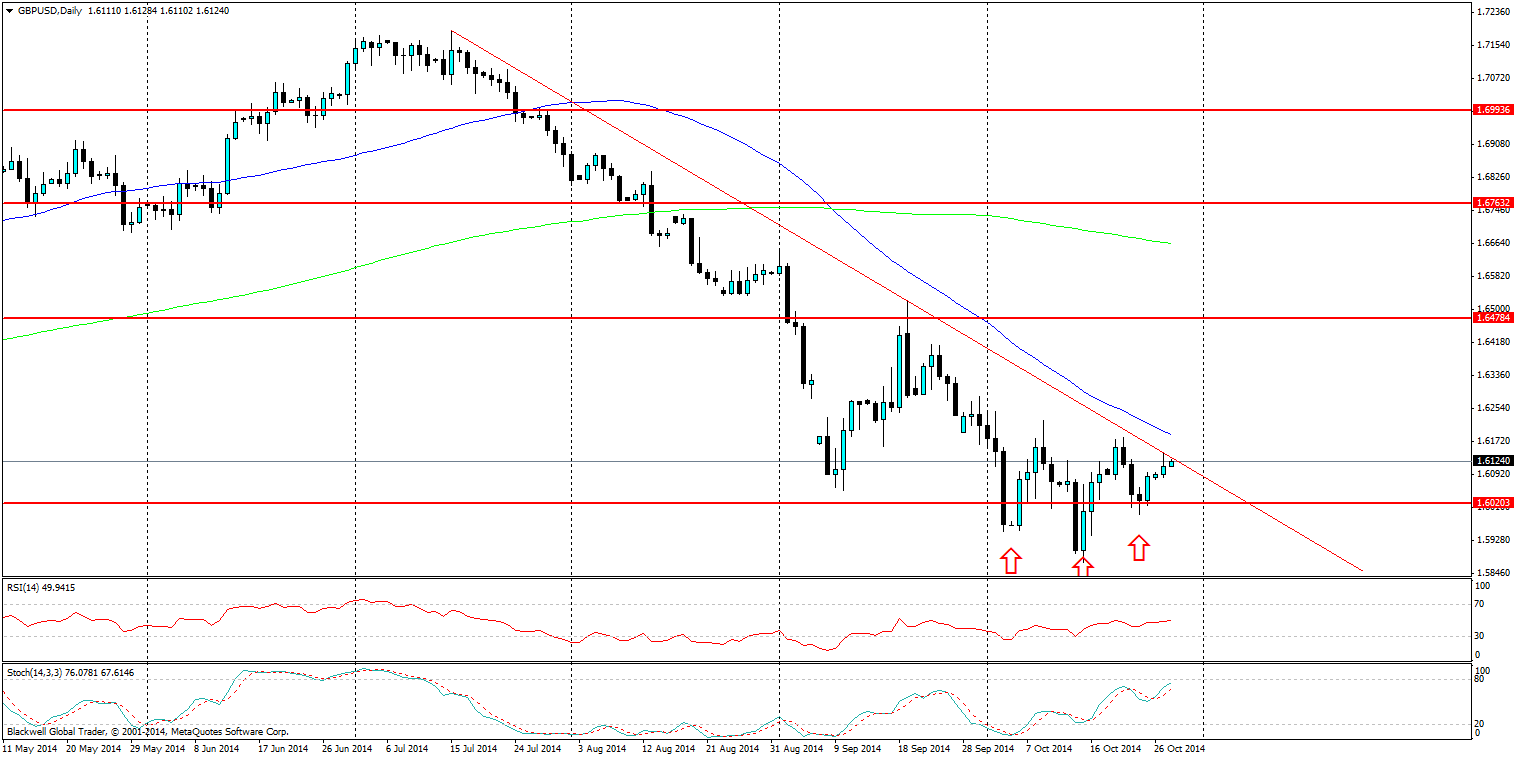

Currently there is also a reverse head and shoulders pattern in play on the charts, and markets are looking to see if it will play out in the current environment.

The head and shoulders pattern could put an end to this pattern in the long run, and market traders should be aware of the possibility of a technical breakout as a result through the trend line. The odds of this happening are 50/50 at best, and traders should play close attention to this possibility.

With the market looking to test the trend line as well as the reverse head and shoulders formation, direction is going to be spelled out in the upcoming 48 hours. What results will most likely determine direction in the week coming with the lack of UK data out to shift markets. Either way it presents one of those rare opportunities where the market can quickly shift and get aggressive and traders can make a decent amount of money.