GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: long at 1.0380, target 1.0580, stop-loss moved to 1.0380, risk factor **

Pending Orders

EUR/USD: sell at 1.1140, target 1.0920, stop-loss 1.1220, risk factor **

GBP/USD: sell at 1.5670, target 1.5420, stop-loss 1.5770, risk factor **

USD/JPY: buy at 122.20, target 124.20, stop-loss 121.40, risk factor *

USD/CHF: buy at 0.9360, target 0.9550, stop-loss 0.9280, risk factor *

USD/CAD: buy at 1.2580, target 1.2850, stop-loss 1.2480, risk factor **

AUD/USD: sell at 0.7550, target 0.7350, stop-loss 0.7620, risk factor *

NZD/USD: sell at 0.6860, target 0.6500, stop-loss 0.7020, risk factor *

EUR/GBP: sell at 0.7170, target 0.7000, stop-loss 0.7245, risk factor **

EUR/JPY: sell at 137.20, target 134.00, stop-loss 138.10, risk factor **

GBP/JPY: sell at 193.40, target 190.20, stop-loss 194.40, risk factor **

AUD/NZD: buy at 1.1020, target 1.1400, stop-loss 1.0910, risk factor *

EUR/USD: Greek Saga Off Centre-Stage

(sell at 1.1140)

- With Greece's debt saga off centre-stage, at least temporarily, the spotlight returned to when the US Federal Reserve will begin hiking interest rates. We showed in yesterday’s Market Overview that the market expects the Fed to start raising rates not sooner than in December. But we expect that the hike may take place in September. Fed’s monetary tightening is in stark contrast to the European Central Bank, which is seen continuing with its ultra-loose monetary policies for the foreseeable future.

- Investors will get a chance to hear the latest Fed thinking when Chair Janet Yellen gives her semi-annual testimony to Congress on Wednesday.

- Eurostat said industrial production in the Eurozone fell by 0.4% mom and rose 1.6% yoy vs. expected rise by 0.2% mom. The monthly fall was steepest for energy production, with non-durable consumer good output also down. Production of intermediate goods, capital goods and durable consumer goods was higher in May.

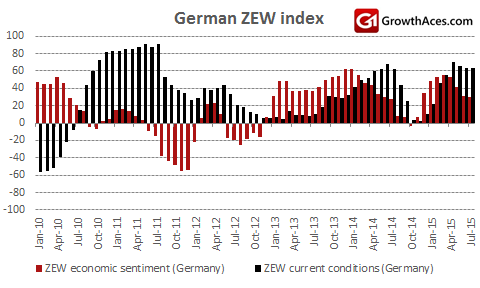

- The ZEW indicator of economic sentiment for Germany declined in July 2015 to 29.7 points from 31.5 points in June, above market expectations for a drop to 29.0 points. The assessment of the current situation in Germany has improved by 1.0 point to 63.9 points. The market expected a fall to 60.0 points.

- Today the focus will be on US retail sales data. The market expects an increase by 0.2% mom, and our forecast is slightly lower (0.1% mom). Yesterday’s drop was slightly stronger than we expected, and our long EUR/USD position reached the stop-loss level at 1.0970 today in the morning of the European session. But this does not change our short-term outlook on the EUR/USD. We still expect the EUR/USD to recover today, and we are going to get short at 1.1140 ahead of Yellen’s testimony Wednesday.

Significant technical analysis' levels:

Resistance: 1.1060 (10-dma), 1.1197 (high Jul 13), 1.1216 (high Jul 10)

Support: 1.0916 (low Jul 7), 1.0915 (low Jun 2), 1.0887 (low Jun 1)

GBP/USD: Time For Rate Hike Is Moving Closer

(sell at 1.5670)

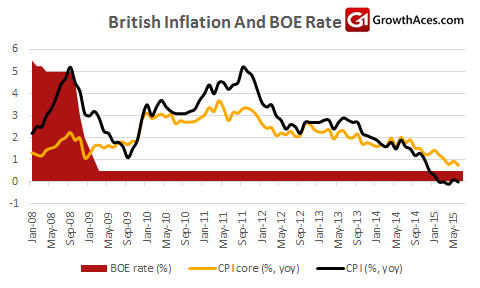

- British inflation fell to 0.0% yoy in June from 0.1% yoy in May. The reading was in line with market expectations. In monthly terms, inflation was also flat.

- The Office for National Statistics said the downward effect from clothing on inflation in yoy terms was particularly marked because June 2014 saw unseasonable rises in prices, whereas this year saw the start of the usual seasonal sales.

- However, an underlying measure of inflation, which strips out increases in energy, food, alcohol and tobacco, fell to 0.8% in June, its joint lowest level since March 2001. This suggests lower oil prices may be having an increasing effect on the cost of other goods and services.

- The Bank of England expects temporary near-zero consumer price inflation to help the British economy by boosting households' spending power, and to have limited effects on how businesses set wages and future prices. British wages have picked up in recent months, and figures due on Wednesday are expected to show earnings excluding bonuses to record their biggest rise since early 2009. The market expects a rise in average weekly earnings by 3.3% yoy vs. our forecast for 3.2% yoy gain.

- Separate data showed that factory gate prices fell 1.5% in June, the smallest drop so far this year. The Office for National Statistics announced that house prices across Britain rose by 5.7% in the 12 months to May, up from 5.5% in April.

- The most important market mover today was a speech of Bank of England Governor Mark Carney. He said: “The point at which interest rates may begin to rise is moving closer with the performance of the economy, consistent growth above trend, a firming in domestic costs, counter-balanced somewhat by disinflation imported from abroad.”

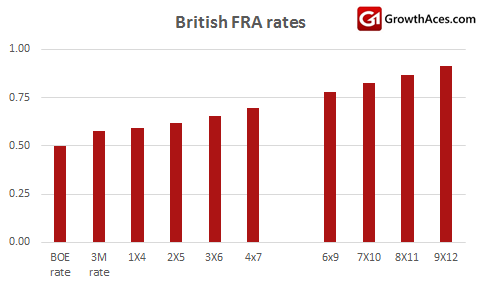

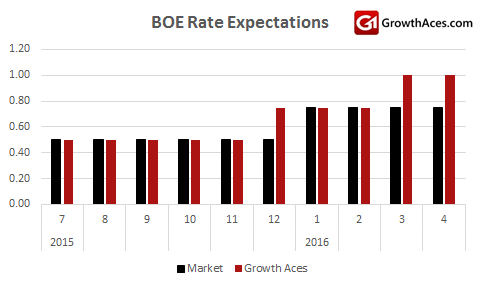

- In our opinion, BOE is likely to raise its rates in December, while the market still sees a hike at the beginning of 2016. (See charts below). That is why the GBP is likely to be stronger in the medium term, especially against the EUR, on expected shift in market expectations.

- But our today’s trading strategy for the GBP/USD focuses on the short-term outlook. We have placed a sell order at 1.5670 and expect lower GBP/USD levels after Yellen’s testimony tomorrow.

Significant technical analysis' levels:

Resistance: 1.5610 (high Jul 7), 1.5627 (high Jul 13), 1.5630 (50% of 1.5930-1.5330)

Support: 1.5427 (200-dma), 1.5366 (low Jul 10), 1.5330 (low Jul 8)

Source: Growth Aces Forex Trading Strategies