GROWTHACES.COM Forex Trading Strategies

Taken Positions

AUD/USD: long at 0.7865, target 0.8080, stop-loss moved to 0.7865, risk factor *

EUR/GBP: long at 0.7165, target 0.7450, stop-loss 0.7090, risk factor **

EUR/JPY: long at 134.20, target 136.70, stop-loss 132.95, risk factor *

Pending Orders

EUR/USD: buy at 1.1190, if filled - target 1.1450, stop-loss 1.1115, risk factor *

GBP/USD: buy at 1.5530, if filled – target 1.5880, stop-loss 1.5420, risk factor ***

USD/CHF: sell at 0.9265, if filled - target 0.9080, stop-loss 0.9345, risk factor *

USD/CAD: sell at 1.2100, if filled - target 1.1950, stop-loss 1.2170, risk factor **

EUR/CAD: buy at 1.3490, if filled - target 1.3800, stop-loss 1.3390, risk factor *

GBP/JPY: buy at 186.35, if filled – target 190.00, stop-loss 185.35, risk factor ***

CHF/JPY: buy at 129.50, if filled - target 132.10, stop-loss 128.40, risk factor *

AUD/JPY: buy at 94.80, if filled – target 97.00, stop-loss 93.80, risk factor **

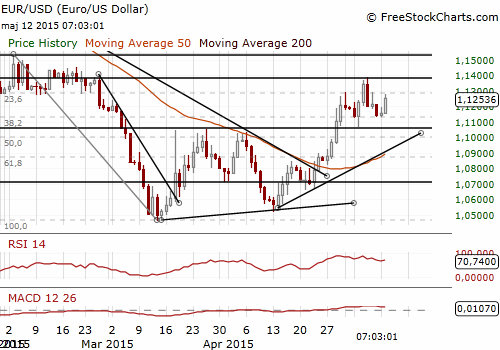

EUR/USD: Greece Paid IMF Debt

(buy at 1.1190)

- Greece paid about EUR 750 million to the International Monetary Fund on Monday. Athens is close to running out of cash and there had been doubt about whether it would pay the IMF or choose to save cash to pay salaries and pensions later this month. Greece's government in recent days had insisted it would honour its obligations, but officials in the past have warned the country may not have enough money to make the payment.

- Germany suggested on Monday that Greece might need a referendum to approve painful economic reforms on which its creditors are insisting, but Athens said it had no such plan for now and others warned a vote could delay vital aid. Greek Finance Minister Yanis Varoufakis said the liquidity situation was urgent and a deal to release further funds was needed in the next couple of weeks.

- Eurozone finance ministers welcomed some progress in slow-moving talks on a cash-for-reform deal between Athens and the IMF, the European Commission and the European Central Bank but said more work was needed to reach a deal.

- Eurozone officials say the real deadline for a deal is end-May to enable parliamentary approval in some Eurozone countries, especially Germany, in time to release the remaining funds before the programme expires at the end of June.

- President of the New York Fed William Dudley, who has a permanent vote on policy, mostly repeated recent comments that the policy tightening will depend on the U.S. economy. He said interest rates would rise later this year. It will likely affect global capital flows and foreign exchange markets, he said, but should not be too surprising to investors.

- The EUR/USD reached yesterday’s low at 1.1131, but is still above important support level of 1.1050. In our opinion the EUR/USD is likely to rise towards the highs last week near 1.1400. We raised our buy order to 1.1190. If filled the target will be 1.1450. We set the stop-loss at 1.1115.

Significant technical analysis' levels:

Resistance: 1.1290 (high May 8), 1.1392 (high May 7), 1.1450 (high Feb 19)

Support: 1.1131 (low May 11), 1.1067 (low May 5), 1.1059 (38.2% of 1.0521-1.1392)

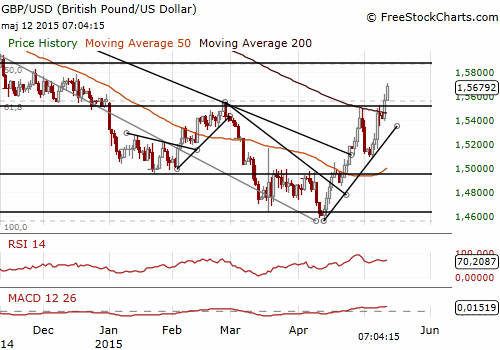

GBP/USD: The Next Target Is 1.5880

- Industrial output rose 0.5% mom and 0.7% yoy in March, the strongest growth since September and above the median forecast of no change, after inching up by 0.1% mom in February.

- Momentum is clearly with the GBP bulls. The GBP has been supported in the past two sessions by the election of the Conservative Party and speculation the Bank of England, which issues its quarterly inflation report on Wednesday, may trigger a change in bets on when it will deliver a first post-crisis rise in interest rates. The GBP/USD broke above 38.2% fibo of July 2014-April 2015 slide and the 200-dma (1.5624). The rate has not been above the average since August last year.

- We have placed our buy order at 1.5530. In our opinion 50% fibo at 1.5880 should be the next target for the GBP bulls.

Significant technical analysis' levels:

Resistance: 1.5753 (high Dec 17, 2014), 1.5785 (high Dec 16, 2016), 1.5826 (high Nov 27, 2014)

Support: 1.5624 (200-dma), 1.5498 (high Apr 29), 1.5393 (low May 11)

Source: Growth Aces Forex Trading Strategies