The British pound continues to push hard against the US dollar. GBP/USD has crossed above the 1.52 line in Thursday’s North American session. The pound has taken advantage of disappointing US numbers earlier today, as GDP, employment and housing numbers missed their estimates. In the UK, Nationwide HPI rose 0.4%, just shy of the estimate of 0.5%.

The US dollar is broadly weaker in Thursday trading, following weak US numbers. Unemployment Claims, which often moves the markets, disappointed this week. The key indicator jumped from 340 thousand to 354 thousand. This was well above the estimate of 342 thousand. Preliminary GDP rebounded nicely, climbing from 0.1% to 2.4%. However, this missed the estimate of 2.5%. Pending Home Sales was dismal, posting a weak gain of 0.3%, way off the estimate of 1.3%. The pound took full advantage of the situation, and has crossed above the 1.52 line. The pound has shown some surprising strength, gaining close to two cents against the dollar since Wednesday.

Will the ECB implement negative interest rates? Recently, ECB Mario Draghi and other policymakers have expressed a willingness to consider the idea. At present, the ECB’s deposit rate stands at zero. If the ECB does elect to go for lower rates, it would be the first major central bank to adopt negative interest rates. On Monday, ECB Executive Board member Joerg Asmussen said that the ECB will continue its expansive monetary policy in order to boost the Eurozone economy, but urged caution on the question of negative rates. Asmussen warned that the ECB can’t simply fix uncompetitive economies by changing its monetary policy, such as the adopting negative interest rates. A move in this direction would likely hurt the euro, as investors would move funds out of the Eurozone in search of better rates of return.

In the US, the Federal Reserve hasn’t made any changes to the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing in the currency markets is a reflection of market uncertainty as to what the Fed plans to do. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

GBP/USD May 30 at 16:00 GMT

GBP/USD 1.5206 H: 1.5219 L: 1.5110

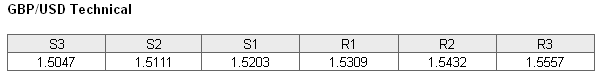

GBP/USD continues to post sharp gains. The pair is testing support at 1.5203. The next line of support is at 1.5111. GBP/USD is facing resistance at 1.5309, a line which appears safe for now. This is followed by resistance at 1.5432.

Current range: 1.5203 to 1.5309

Further levels in both directions:

- Below: 1.5203, 1.5111, 1.547, 1.5000, 1.4873 and 1.4781

- Above: 1.5309, 1.5432 and 1.5577 and 1.57

The GBP/USD ratio is pointing to movement towards long positions in the Thursday session. This is currently reflected in the pair’s movement, as the pound continues to surge and post gains against the dollar. The ratio has a majority of open long positions, indicating a bias towards the pair continuing to move upwards.

The pound is red hot, and has posted sharp gains against the dollar. Will the upward trend continue? We could see more activity from the pair, as the US releases a string of events on Friday. In the meantime, we could see the pair stay close to the 1.52 line.

GBP/USD Fundamentals

- 6:00 British Nationwide HPI. Estimate 0.5%. Actual 0.4%.

- 12:30 US Preliminary GDP. Estimate 2.5%. Actual 2.5%.

- 12:30 US Unemployment Claims. Estimate 342K. Actual 354K.

- 12:30 US Preliminary GDP Price Index. Estimate 1.2%. Actual 1.1%.

- 14:00 US Pending Home Sales. Estimate 1.3%. Actual 0.3%.

- 14:30 US Natural Gas Storage. Estimate 85B. Actual 88B.

- 15:00 US Crude Oil Inventories. Estimate -0.8M. Actual 3.0M.