Yesterday was once again a very profitable trading day for sterling traders, particularly for those who sold GBP/USD. The pound slid to a low of 1.2602 after Bank of England Governor Mark Carney said he is still worried about the impact of Brexit on the economy. Carney said in yesterday’s morning statement that now is not the time to hike rates. In short, his view is still very bearish and with Brexit negotiations having just begun it could be a bumpy road for the U.K. in the next months. In case of any bad headlines, the pound will fall but looking at the technical picture, we currently see chances of a slight recovery from sterling’s low levels.

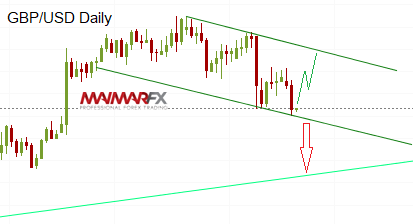

GBP/USD

The currency pair stopped its fall at the lower bound of its recent downward channel. While this does not necessarily mean that further losses are unlikely, that halt just increases the likelihood of a potential pullback towards 1.27 and 1.28. Furthermore, the Relative Strength Index (RSI) approaches oversold territory, underpinning the chances of short-term upward movements. If the pound drops however below 1.2590 we expect accelerated bearish momentum towards 1.2550 and 1.25.

The performance of the EUR/USD is lagging behind since price fluctuations narrowed. The euro declined on the back of a slightly stronger U.S. dollar but the decline was limited to a low of 1.1118. We will now pay attention to a break of 1.11. After the 1.1075-level has been breached, we could see the euro tumbling towards 1.1020. Current resistances are however seen at 1.1150 and 1.12.

Here are our daily signal alerts:

EUR/USD

Long at 1.1140 SL 25 TP 17, 40

Short at 1.1115 SL 25 TP 17, 30

GBP/USD

Long at 1.2670 SL 25 TP 15, 30

Short at 1.2615 SL 25 TP 20, 50

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.