GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1140, target 1.1450, stop-loss 1.1045, risk factor *

GBP/USD: long at 1.5460, target 1.5800, stop-loss moved to 1.5500, risk factor *

USD/CHF: short at 0.9375, target 0.9140, stop-loss 0.9460, risk factor **

USD/CAD: short at 1.2200, target 1.2000, stop-loss 1.2290, risk factor ***

EUR/CHF: long at 1.0410, target 1.0580, stop-loss 1.0365, risk factor **

EUR/CAD: long at 1.3550, target 1.3800, stop-loss 1.3470, risk factor *

CHF/JPY: long at 129.10, target 131.40, stop-loss 127.90, risk factor **

AUD/JPY: long at 95.60, target 98.80, stop-loss 94.60, risk factor **

Pending Orders

AUD/USD: buy at 0.7845, if filled – target 0.8100, stop-loss 0.7780, risk factor ***

NZD/USD: buy at 0.7280, if filled – target 0.7500, stop-loss 0.7200, risk factor ***

EUR/JPY: buy at 134.40, if filled – target 136.50, stop-loss 133.70, risk factor *

EUR/USD: Fed Sees June Rate Hike As Unlikely

(long at 1.1140)

- Eurozone PMI Composite amounted to 53.4 in May, according to the flash reading, down from 53.9 in April and the recent peak of 54.0 seen back in March.Growth of new business inflows moderated for a second month running to register the smallest monthly gain since February. Weaker order book growth was centred on the service sector, with manufacturing reporting the strongest inflows of new orders for just over a year, linked to improved export performance.

- The average PMI reading for the second quarter so far points to GDP growth similar to the 0.4% expansion seen in the first three months of the year.

- The Fed released minutes of its April policy meeting yesterday. The central bank debated whether a slew of disappointing data, including weak consumer spending, signaled a temporary slump or evidence of a longer-lasting slowdown, with most participants agreeing economic growth would climb to a healthier pace and the labor market would strengthen. However, Federal Reserve officials believed it would be premature to hike interest rates in June.

- Fed officials flagged a number of concerns including disappointment that falling oil prices did not spur consumer spending as much as had been hoped. The minutes largely reflected the Fed's April policy statement, which pointed to economic softness but described the slow growth as a consequence of transitory factors such as bad weather and a US port disruption.

- Investors now will focus on a Yellen speech on Friday for signs of whether she believes the economy is back on track, or if she nods to the latest batch of weak data.

- The EUR gained against the USD after the minutes from the Federal Reserve's latest meeting. Minutes confirmed the market expectations that the Fed will probably wait until late this year before raising interest rates. The EUR/USD broke the 100-dma at 1.1156 and tested 21-dma at 1.1171. A close above these two important resistance levels will be a bullish signal. We keep our long position opened at 1.1140. Our target is 1.1450.

Significant technical analysis' levels:

Resistance: 1.1247 (10-dma), 1.1326 (high May 19), 1.1449 (high May 18)

Support: 1.1051 (high on Mar 26), 1.0994 (50% of 1.0521-1.1468), 1.0960 (low Apr 29)

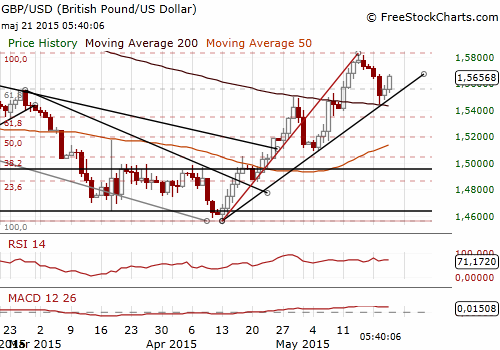

GBP/USD: Retail Sales Data Brought Good News For Our Long Position

(long for 1.5800)

- British retail sales rose 1.2% mom and 4.7% yoy, in April more strongly than expected, recovering from a surprise fall in March. The median forecast was 0.4% mom. The strength of the figures may further ease concerns that a slowdown in Britain's economy seen in the first quarter might be the start of a longer period of weakness. However, the sharp increase in sales was due in large part to a possible one-off surge in purchases of clothing, textiles and footwear which jumped by 5.2% in April from March. This jump in sales was a consequence of warm weather.

- The GBP/USD rose strongly after the retail sales data and is close to Tuesday’s 1.5669 high. A close above this level would be a good signal for our long GBP/USD position taken at 1.5460. We see the scope for gains near the May 14 1.5815 peak. We have raised the stop-loss level to save profits on this trade.

Significant technical analysis' levels:

Resistance: 1.5669 (high May 19), 1.5745 (high May 18), 1.5809 (high May 15)

Support: 1.5525 (hourly low May 21), 1.5473 (low May 20), 1.5447 (low May 19)

Source: Growth Aces Forex Trading Strategies