GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.0740, target 1.1000, stop-loss moved to 1.0740, risk factor *

USD/JPY: short at 119.35, target 117.20, stop-loss 120.20, risk factor **

USD/CHF: short at 0.9600, target 0.9450, stop-loss 0.9670, risk factor ***

USD/CAD: short at 1.2280, target 1.2000, stop-loss moved to 1.2130, risk factor **

AUD/USD: long at 0.7730, target 0.7950, stop-loss moved to 0.7900, risk factor **

NZD/USD: long at 0.7630, target 0.7800, stop-loss moved to 0.7630, risk factor **

EUR/GBP: long at 0.7170, target 0.7350, stop-loss 0.7110, risk factor ***

EUR/JPY: long at 129.00,target 131.10, stop-loss , 129.00 risk factor *

CHF/JPY: long at 124.70, target 126.85, stop-loss 124.00, risk factor ***

AUD/JPY: long at 91.80, target 94.40, stop-loss moved to 94.00, risk factor **

Pending Orders

GBP/USD:buy at 1.5180, if filled - target 1.5540, stop-loss 1.5085, risk factor *

GBP/JPY: buy at 180.70, if filled - target 183.30, stop-loss 179.90, risk factor *

EUR/CAD: buy at 1.3110, if filled – target 1.3350, stop-loss 1.3050, risk factor ***

AUD/NZD: buy at 1.0190, if filled – target 1.0400, stop-loss 1.0090, risk factor ***

EUR/USD: Greece Hopes Support EUR Bulls

(long for 1.1000)

- Greek Prime Minister Alexis Tsipras reshuffled his team handling talks with European and IMF lenders. This move is widely seen as an effort to relegate embattled Finance Minister Yanis Varoufakis to a less active role in negotiations. Varoufakis was sharply criticised by Eurozone finance ministers for both his lecturing style and failure to produce reforms demanded by lenders. Deputy Foreign Minister Euclid Tsakalotos was appointed coordinator of a new team negotiating a reforms deal with lenders. The latest developments suggested Tsipras was ramping up efforts to ease tensions with lenders and strike a deal to unlock aid so Greece can avoid defaulting on payments.

- The EUR hovered near a three-week peak on Tuesday, boosted by renewed hopes that Greece could secure extra funding. Greece faces a Eurogroup meeting of Eurozone finance ministers on May 11, a day before it must pay EUR 700 million to the IMF.

- Austrian Finance Minister Hans Joerg Schelling hopes Greece's new negotiating team will make faster progress in debt talks with international creditors and that negotiations do not go back to square one.

- The European Central Bank Executive Board Member Benoit Coeure said the ECB is making no plans for a Greek exit from the Eurozone.

- We stay EUR/USD long for 1.1000. Later in the day U.S. consumer confidence and housing data will shed more light on the state of the U.S. economy.

Significant technical analysis' levels:

Resistance:1.0932 (55-dma), 1.0954 (high Apr 7), 1.1036 (high Apr 6)

Support: 1.0820 (low Apr 27), 1.0793 (10-dma), 1.0785 (low Apr 24)

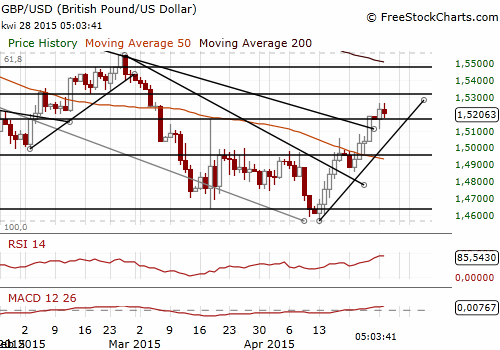

GBP/USD: Profit Taken At 1.5270. Looking To Get Long Again On Dips.

(profit taken, buy again at 1.5180)

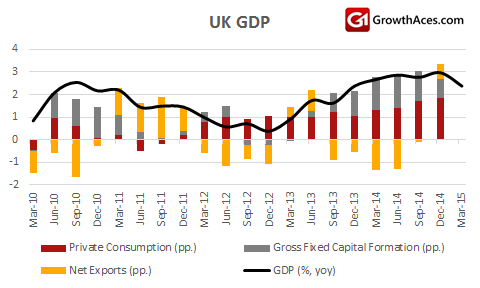

- Britain’s GDP grew by 0.3% qoq and 2.4% yoy in the January-March period compared with the last three months of 2014 when quarterly growth was 0.6% and 3.0% yoy. It was the slowest quarterly growth since the fourth quarter of 2012. The market expects growth of 0.5% qoq and 2.6% yoy.

- The Office For National Statistics said that quarterly growth in Britain's dominant services sector slowed to 0.5% from 0.9% in the October-December period, pushed down by the weakest growth in business services and finance since the end of 2010. Industrial output shrank 0.1% and construction contracted by 1.6%.

- The GBP/USD fell after weak first-quarter GDP data, but the reaction to the data was short-lived and the rate reached the target of our long position (1.4900-1.5270) soon. We are looking to get long again and the next target will be near February’s high of 1.5554.

Significant technical analysis' levels:

Resistance: 1.5321 (76.4% of 1.5554-1.4567), 1.5375 (high Mar 4), 1.5397 (high Mar 3)

Support: 1.5108 (low Apr 27), 1.5052 (55-dma), 1.5029 (low Apr 24)

USD/JPY Little Changed After Rating Downgrade And Weak Retail Sales Data

(short at 119.35)

- Fitch Ratings downgraded Japan's credit rating by one notch to A after the government failed to take steps in this fiscal year's budget to offset a delay in a sales tax increase. The outlook is stable. Andrew Colquhoun, head of Asia-Pacific sovereigns at Fitch said: “One reason why Japan is at single A, which is a low rating, is the fragility around the baseline case for the public debt. The tolerance to fluctuations in growth and interest rates is low.” The government's use of stimulus spending, disappointing economic growth and worries that corporate profit growth is not sustainable are also negative for Japan's rating. Abe's decision late last year to delay a sales tax hike to 10% from 8% that had been scheduled for this year has made it difficult to eliminate the primary budget deficit in fiscal 2020, an important fiscal consolidation target. Japan's public debt, at twice the size of its economy, has the worst debt-to-GDP ratio of any industrialised country. The JPY briefly fell to 119.42 per USD after the announcement of Fitch decision but then pared its losses.

- Japanese Economics Minister Akira Amari said the government would release a bold plan for fiscal discipline this summer to maintain market trust in Japan's public finances.

- Japanese retail sales fell 9.7% in March compared with the same month last year, when sales had surged the most in 17 years ahead of a consumption-tax increase. The market forecast 7.3% drop yoy. The market reaction to the data was limited because we had strong base effects and the reading is difficult to interpret.

- We stay USD/JPY short in anticipation for dovish FOMC statement tomorrow. Layers of resistance continues to weigh heavily on the market between recent 119.44 and 119.67 highs. The tankan and kijun lines are negatively aligned, highlighting the overall bearish structure.

Significant technical analysis' levels:

Resistance: 119.44 (high Apr 27), 119.66 (high Apr 24), 120.09 (high Apr 23)

Support: 118.77 (low Apr 27), 118.53 (low Apr 20), 118.33 (low Mar 26)

Source: Growth Aces Forex Trading Strategies