The British pound started off the week in fine fashion, gaining close to one cent against the US dollar on Monday. The good news didn’t last long, however, as the pound has coughed up these gains and then some, in Tuesday trading. GBP/USD was trading in the low-1.51 level early in the North American session. The catalyst behind the pound’s sharp drop was weak inflation numbers out of the UK, as a host of indicators missed their estimates.

The pound has had a miserable May, and continues to sag against the surging US dollar. The British currency has now shed about four cents against the dollar since the beginning of the month. The pound finds itself struggling in the low-1.51 range, its lowest level since early April. Although the UK has posted solid numbers for some key releases this month, including Manufacturing Production and Claimant Count Change, the markets “aren’t buying” and continue to give a thumbs down to the prospects of the British economy. If market sentiment continues to be negative, we could soon see the pound test the all-important 1.50 level.

Tuesday’s inflation numbers out of the UK were weak across the board, indicating that deflation continues to hobble the struggling British economy. CPI, one of the most important economic indicators, fell from 2.8% to 2.4%, missing the estimate of 2.6%. PPI declined by 2.3%, way off the estimate of -1.2%. RPI climbed 2.9%, but fell short of the forecast of a 3.1% gain. Core CPI rose 2.o%, below the estimate of 2.3%. PPI Output declined 0.1%. missing the estimate of a 0.2% gain. The only indicator to beat market expectations was HPI, which posted a three-month high of 2.7%. This beat the estimate of 2.3%.

The Federal Reserve has not been in the spotlight recently, but that could change if the Fed modifies its current round of quantitative easing, which involves the purchase of $85 billion in assets each month. The Fed will be tempted to act if it feels that the US recovery has gained more traction, giving it some room to ease up on QE. Last week, John Williams, president of the Federal Reserve Bank of San Francisco, stated that the Fed could begin reducing QE this summer and terminate bond buying late in 2013. As the QE program is dollar negative, any moves by the Fed to wind up QE would be bullish for the dollar at the expense of the euro. So traders can expect any new developments (real or rumor) regarding QE to impact on the currency markets. We should get a better idea of where the Fed stands on Wednesday, when the minutes of the FOMC’s last policy meeting, and Fed chairman Bernard Bernanke testifies before Congress.

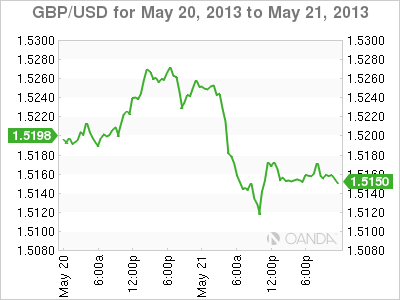

GBP/USD May 21 at 14:40 GMT

GBP/USD 1.5125 H: 1.5263 L: 1.5114 GBP/USD Technical" title="GBP/USD Technical" width="594" height="78">

GBP/USD Technical" title="GBP/USD Technical" width="594" height="78">

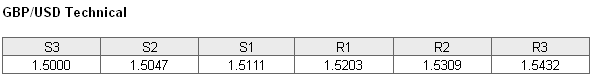

GBP/USD has taken a pounding on Tuesday, losing over one cent. , The pair faces resistance at 1.5203. This line has strengthened as the pair trades at lower levels. This is a followed by resistance at 1.5309. On the downside, the pair is putting pressure on 1.5111. If this line falls, we could see the pound slip deep into 1.5o territory. The next support level is at 1.5047.

- Current range: 1.5111 to 1.5203

- Below: 1.5111, 1.5000, 1.4873 and 1.4781

- Above: 1.5203, 1.5309, 1.5432, 1.5524 and 1.5630

Despite the sharp losses the pound has sustained on Tuesday, the GBP/USD ratio is pointing to movement towards long positions. If this movement continues, it could indicate an expectation that we will see a correction and upward movement by the pair.

The pound continues to slump badly against the dollar, thanks to disappointing inflation numbers out of the UK. We could see the volatility continue on Wednesday, as the US releases key housing numbers while the UK releases Retail Sales and minutes of the BOE’s MPC Meeting. As well, the Federal Reserve releases minutes of its previous policy meeting and Bernard Bernanke testifies on Capitol Hill.

GBP/USD Fundamentals

- 8:30 British CPI. Estimate 2.6%. Actual 2.4%.

- 8:30 British PPI Input. Estimate -1.2%. Actual -2.3%.

- 8:30 British RPI. Estimate 3.1%. Actual 2.9%.

- 8:30 British Core CPI. Estimate 2.3%. Actual 2.0%.

- 8:30 British HPI. Estimate 2.3%. Actual 2.7%.

- 8:30 British PPI. Estimate 0.2%. Actual -0.1%.