The British pound continues to post gains against the US dollar. GBP/USD has crossed above the 1.56 line in Tuesday’s North American session. In economic news, British Manufacturing Production disappointed, posting a decline and falling short of the estimate. It’s a quiet day in the US, with two minor events on today’s schedule. NFIB Small Business Index jumped to 94.4 points, a twelve-month high. The indicator has risen nicely in 2013, as it began 2013 in the 88-point range. Wholesale Inventories came in at 0.2%, edging the estimate of 0.1%.

The pound has looked very sharp of late, gaining close to four cents so far in June. The British currency benefited from some solid releases last week. However, that hasn’t been duplicated this week, as Manufacturing Production posted a decline of 0.2%, and failed to meet the estimate of 0.0%. There was better news from NIESR GDP Estimate, which posted a respectable gain of 0.6%. On Wednesday, the markets will get a look at Claimant Count Change, and this key employment indicator could affect the direction of GBP/USD.

Taking a look at the US, there was some good news from the S&P ratings agency on Monday, as the well-respected firm revised the US sovereign credit rating from negative to stable. This is an important vote of confidence in the US economy, and means that there is less than a 1 in 3 chance of another downgrade in the next two years. S&P noted that a key factor in its revision was the agreement reached in the US Congress which averted the fiscal cliff crisis, which would have led to $600 billion in automatic tax increases and spending cuts and could have pushed the fragile US economy into recession. In 2011, S&P cut the US credit rating from AAA to AA, and the threat of another downgrade has been a concern of the markets. This news will likely improve market sentiment and could give a boost to the US dollar.

Will the Fed pull the trigger on QE? Much will depend on US employment numbers, which were a mix of good and less good last week. ADP Non-Farm Payrolls slipped badly, as the key employment indicator missed the estimate for the third consecutive month. The indicator posted a reading of 135 thousand, well off the forecast of 171 thousand. Unemployment Claims managed to meet the estimate, but the market reaction was lukewarm. Non-Farm Payrolls was strong, climbing from 165 thousand to 175 thousand. This was above the market forecast of 167 thousand. However, the Unemployment Rate rose edged higher to 7.6%, above the forecast of 7.5%. With speculation growing that the Fed could scale back QE in the next few months, employment figures have taken on added significance. However, the Fed may decide to hold a steady course if the employment picture remains cloudy.

GBP/USD June 11 at 14:20 GMT

GBP/USD 1.5618 H: 1.5618 L: 1.5521

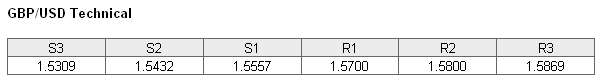

GBP/USD continues to move upwards and has crossed above the 1.56 line. The pound has not been able to consolidate above this line since February – will it retain the upward momentum in this drive? The pair is testing strong resistance at the round number of 1.5700. This line has held firm since February. On the downside, GBP/USD is receiving support at 1.5557. This is followed by a strong support level at 1.5432.

Current range: 1.5557 to 1.5700

Further levels in both directions:

- Below: 1.5557, 1.5432, 1.5309, 1.5203, 1.5111 and 1.5047

- Above: 1.5700, 1.580, 1.5869 and 1.5916

GBP/USD ratio has taken a break and is unchanged in the Tuesday session. This is not reflected in the current movement of the pair, as the pound has moved higher against the dollar. It should also be noted that the ratio is close to a split between long and short positions, indicating a lack of bias from traders as to the direction that the pair might take.

GBP/USD Fundamentals

- 8:30 British Manufacturing Production. Estimate 0.0%. Actual -0.2%.

- 8:30 British Industrial Production. Estimate -0.4%. Actual 0.1%.

- 9:35 British 10-year Bond Auction. Actual 2.37%.

- 11:30 US NFIB Small Business Index. Estimate 93.4 points. Actual 94.4 points.

- 14:00 US Wholesale Inventories. Estimate 0.1%. Actual 0.2%.

- 14:00 British NIESR GDP Estimate. Actual 0.6%.