The British pound continues to lose ground in Tuesday trading, as the pair has slipped to the mid-1.50 level early in the North American session. GBP/USD slipped after US CB Consumer Confidence sparkled, posting its best showing in over five years. Richmond Manufacturing Index did not follow pace, as it fell well below expectations. In today’s sole UK release, Bank of England Deputy Governor Paul Tucker speaks at an event in London.

The pound continues to struggle against the dollar, as the first key release of the week looked very sharp. US CB Consumer Confidence jumped from 68.1 points to 76.2, easily surpassing the estimate of 70.7 points. This was the indicator’s best performance since February 2008, and points to stronger consumer confidence in the US economy. If US indicators continue to point upwards, this will likely give the dollar a boost at the expense of the pound.

The US Federal Reserve continues to be in the spotlight, as the markets speculate that the Fed could wind up the current round of QE earlier than expected. Last week, Fed Chair Bernard Bernanke testified before a Congressional committee. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. The bottom line? The Fed is not making any changes to its monetary policy just yet, but that could change if the US economy improves, inflation rises and unemployment falls.

The markets are accustomed to ups and downs in US numbers, which has typified US releases in 2013. Last week saw mixed housing numbers, as Existing Home Sales missed the estimate, but New Home Sales looked very sharp. Unemployment Claims bounced back with a strong release, and the week ended with a rise in Core Durable Goods Orders. The mix of positive and weak releases churned out by the US has made it difficult to assess the extent of the economic recovery. This week has started out in the right direction, with a superb US consumer confidence numbers. Will this week’s other key releases follow suit?

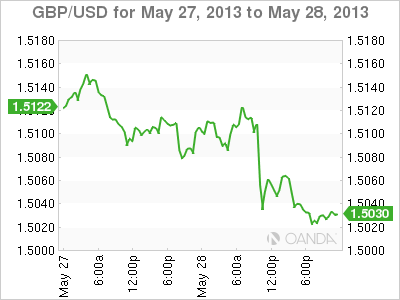

GBP/USD May 28 at 15:00 GMT

GBP/USD 1.5037 H: 1.5134 L: 1.5034 USD/JPY Technical" title="USD/JPY Technical" width="599" height="84">

USD/JPY Technical" title="USD/JPY Technical" width="599" height="84">

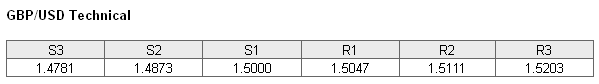

GBP/USD continues to lose ground. The pair is receiving support at the round number of 1.5000. This important line could be tested if the pound continues to weaken. There is stronger support at 1.4873. GBP/USD is facing resistance at 1.5047. This weak line could see further activity during the day. This is followed by resistance at 1.5111.

Current range: 1.5000 to 1.5047

Further levels in both directions:

- Below: 1.5000, 1.4873, 1.4781 and 1.4607

- Above: 1.5047, 1.5111, 1.5203, 1.5309 and 1.5432

The GBP/USD ratio is pointing to an increase in long positions. This is not currently reflected in the pair’s movement, as the pound has posted some losses. The ratio has a majority of long positions, indicating a bias towards the pair reversing direction and moving upwards.

The pound is losing ground in the Tuesday session, courtesy of an excellent US consumer confidence release. We could see GBP/USD move closer to the all-important 1.50 level.

GBP/USD Fundamentals

- 17:00 Bank of England Deputy Governor Paul Tucker Speaks.

- 13:00 US S&P/CS Composite-20 HPI. Actual 10.9%.

- 14:00 US CB Consumer Confidence. Estimate. 70.7 points. Actual 76.2 points.

- 14:00 US Richmond Manufacturing Index. Estimate +2 points. Actual -2 points.