Investing.com’s stocks of the week

The GBP/USD is moving within a range trading ahead of the UK economic growth data (GDP) for the third quarter of this year, On the other hand, the release of the U.S durable goods orders and the Initial Jobless Claims and new home sales data.

And the Cable declined yesterday due to lower new mortgage loans during the October and Mark Carney' comments in front of the British Parliament who claimed to raise interest rates will be gradually and limited,

But then the pair bounced up due to the decrease of the US consumer confidence index.

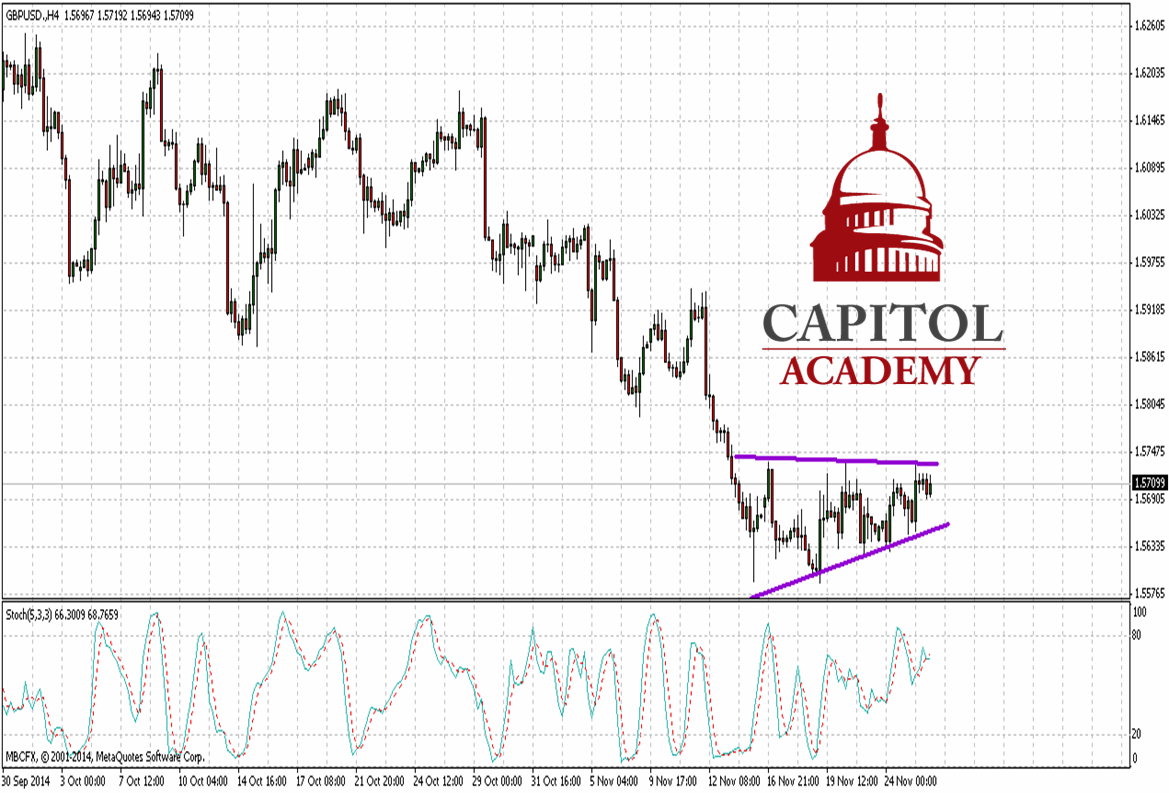

As we have mentioned in our technical analysis of yesterday, the GBP/USD rose to face a barrier at the upper line of the Ascending Triangle on the H4 chart, which repressed good opportunities to enter sell positions from the $1.5732 level, then the prices bounced back toward $1.5693. A break above the upper lien of the Triangle will send the prices high. If the UK economic data are positive, but if the data are negative ,the Cable will contuse its general bearish trend and the key support levels are between $1.5590 and $1.5675.