GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/CHF: short at 0.9265, target 0.9080, stop-loss moved to 0.9120, risk factor *

EUR/GBP: long at 0.7165, target 0.7450, stop-loss moved to 0.7165, risk factor **

EUR/JPY: long at 134.20, target 136.70, stop-loss moved to 135.70, risk factor *

EUR/CAD: long at 1.3490, target 1.3800, stop-loss moved to 1.3525, risk factor *

CHF/JPY: long at 129.50, target 132.10, stop-loss moved to 130.30, risk factor *

Pending Orders

EUR/USD: buy at 1.1285, if filled - target 1.1530, stop-loss 1.1210, risk factor *

GBP/USD: buy at 1.5610, if filled – target 1.5880, stop-loss 1.5530, risk factor ***

USD/CAD: sell at 1.2030, if filled - target 1.1840, stop-loss 1.2115, risk factor **

AUD/USD: buy at 0.8025, if filled - target 0.8295, stop-loss 0.7940, risk factor *

NZD/USD: buy at 0.7435, if filled – target 0.7650, stop-loss 0.7340, risk factor **

GBP/JPY: buy at 186.60, if filled – target 190.00, stop-loss 185.60, risk factor ***

AUD/JPY: buy at 95.60, if filled – target 98.80, stop-loss 94.60, risk factor **

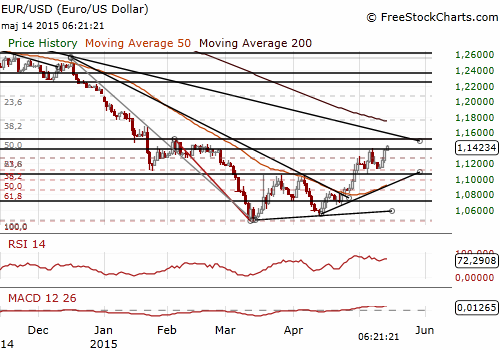

EUR/USD: Weak US Retail Sales Data And Short Squeeze Push EUR/USD Higher

(buy at 1.1285)

- The EUR/USD surged past 1.1400 for the first time since February. Stronger gains of the EUR/USD result from a short squeeze, as many investors still bet on the USD gains. A sharp rise of the EUR/USD is forcing EUR-sellers to close out their short positions, adding to the upward pressure on the EUR/USD.

- But the dominant factor was shockingly poor US April retail sales numbers. US retail sales were unchanged in April vs. median forecast for a 0.2% increase. Retail sales excluding automobiles, gasoline, building materials and food services were also unchanged after an upwardly revised 0.5% increase in March. The so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Core retail sales were expected to rise 0.5% in April after a previously reported 0.4% increase in March. Retail sales have trended weaker despite households getting a massive windfall from lower gasoline prices.

- The US government reported last month that GDP expanded at a 0.2% annual pace in the first three months of the year. The government will release its GDP revision later this month, but trade and wholesale inventory data published last week suggested the economy actually contracted.

- The EUR/USD remains above 10-dma and 100-dma, which is a strong bullish signal. There are some important resistance levels ahead, which in our opinion will be broken after a corrective move. The nearest important resistance levels are double top at 1.1450 (daily high on February 17 and 19) and 1.1514 (50% fibo of 1.2570-1.0457). Our trading strategy is to use dips as buying opportunities. We have placed our bud at 1.1285 and will be waiting for breaking above 50% fibo resistance if the order is filled.

Significant technical analysis' levels:

Resistance: 1.1450 (high Feb 19), 1.1486 (high Feb 6), 1.1499 (high Feb 5)

Support: 1.1340 (hourly low May 14), 1.1250 (10-dma), 1.1202 (100-dma)

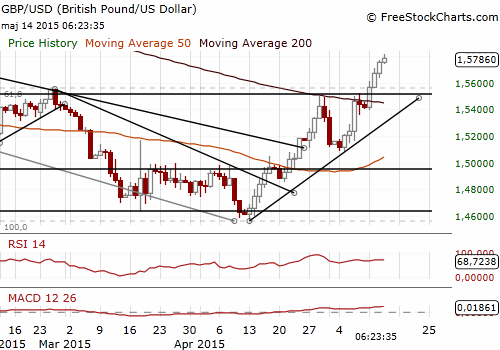

GBP/USD: Next Target 1.5880, But Some Profit Taking On GBP-Longs Possible

(buy at 1.5610)

- Bank of England Governor Mark Carney said it was possible that British interest rates will be higher in a year's time, although it depended on how the economy progresses. He said the GBP strength was a bit of a dampener on growth. Carney signaled he was in no rush to raise interest rates, saying the impact of GBP's rise and low global inflation could last for some time.

- Some other policymakers have indicated they are closer than Carney to voting for rate hikes as Britain's economy continues to grow strongly. On Wednesday, policymaker Martin Weale said the fall in oil prices had given the BoE only breathing space to keep interest rates on hold, while his colleague Kristin Forbes has warned inflation pressures could pick up quickly.

- Wednesday's quarterly economic outlook from the BoE cautiously backed bets in financial markets that it will only start to raise interest rates in around a year's time.

- The GBP/USD extended gains after yesterday’s weaker-than-expected US retail sales data. We should expect profit taking on GBP longs after Carney said the GBP strength would be relevant to interest rate projections. We are looking to get long on the GBP/USD at lower levels. If the order is filled the next target will be 1.5880.

Significant technical analysis' levels:

Resistance: 1.5826 (high Nov 27, 2014), 1.5880 (50% of 1.7192-1.4567), 1.5940 (high Nov 12)

Support: 1.5711 (hourly low May 13), 1.5613 (200-dma), 1.5558 (low May 12)

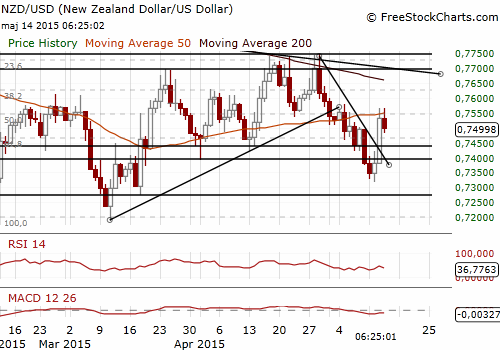

NZD/USD: Rate Cut Expectations Are Diminishing

(buy at 0.7435)

- New Zealand retail sales volumes jumped a seasonally adjusted 2.7% qoq and 5.1% yoy in the first quarter vs. median forecast for a 1.5% qoq and 4.9% yoy gain.

- The rise in quarterly volumes was the biggest since the data series began in September 2003, boosted by an 8.9% rise in electrical and electronic goods. Fuel retailing rose 3.5%, while hardware, building and garden supplies rose 3.9%.

- Markets are pricing a 38% chance that the Reserve Bank of New Zealand will cut its official cash rate by 25 basis points in June. In our opinion there will be no rate cut and it could be a good idea to use current lower levels on the NZD/USD to get long. We have placed our buy order at 0.7435.

Significant technical analysis' levels:

Resistance: 0.7562 (session high May 14), 0.7569 (high May 6), 0.7627 (high May 1)

Support: 0.7478 (session low May 14), 0.7318 (low May 13), 0.7276 (low Mar 18)

Source: Growth Aces Forex Trading Strategies