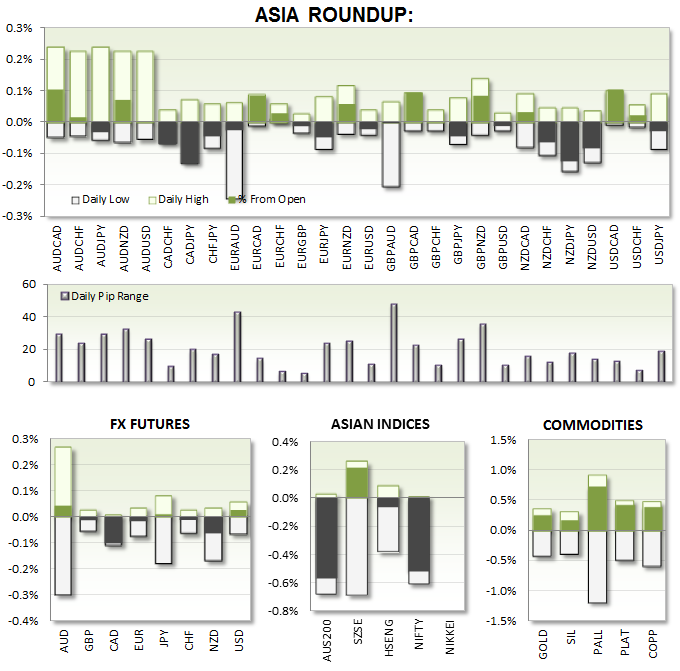

MONEY FLOW:

- AUD was the star of the session, gaining on positive data from retail sales and trade deficit. Profit taking ahead of tonight's data dump saw these gains edge lower towards opening prices, but the Aussie remains up for the day and wihtin clear bullish trend. Expect these trends to resume if tonight's data provides a risk-on environment, or promptly reverse if we enter risk-off.

NEWS:

- AUD: Trade Deficit narrows and not as bad as expected; Retail sales also beat expectations; Both will have a positive impact on Q3 GDP;

- JPY: Want to pursue GPIF reforms ASAP; However no details were provided about the form of changes or the timeframes

UP NEXT:

TECHNICAL ANALYSIS:

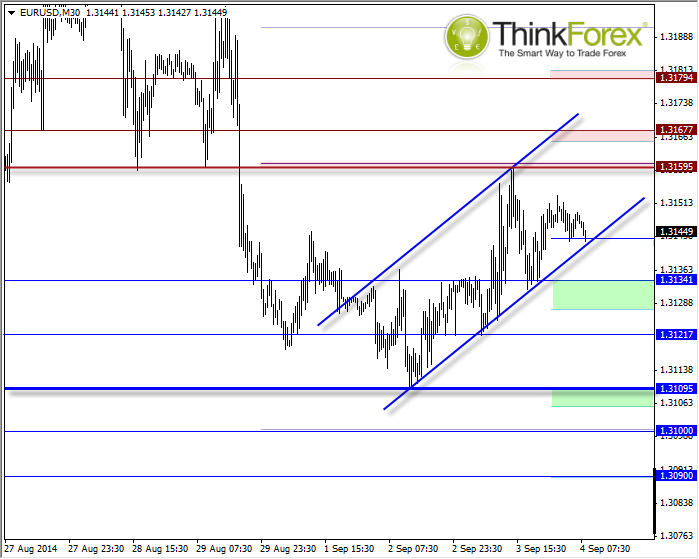

EUR/USD: If you must...

No directional bias here as this is on a lower timeframe prior to a potentially volatile session.

However for those trading the lower timeframes you can use the S/R levels as targets and risk management.

Take note of the bullish channel which if broken becomes a bearish flag. (See GBP/USD intraday charts for a similar example this week and how quickly it broke down).

GBP/AUD: The correct conditions could see a correction

For this to play out we would require a risk off environment (to see NZD and AUD sell off) and for some Hawkish comments from BoE tonight. Thrown in an [unlikely] rate hike from BoE and this one could go up pretty quickly.

Technically D1 is forming a bullish convergence at MS1 support, the lower Bollinger band and also exhibiting bullish divergences on lower timeframes.

Bias:

- Price to remain above the multi-month lows and retrace towards 1.765 and 1.769

Counter-Bias:

- Edge lower with an intraday spike below this week’s lows but hang around current levels. A particularly dovish statement from BoE and appetite for risk should see further downside.