GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.0935, target 1.1140, stop-loss 1.0860, risk factor **

GBP/USD: long at 1.5305, target 1.5600, stop-loss 1.5190, risk factor **

USD/JPY: short at 124.15, target 122.20, stop-loss 125.10, risk factor **

USD/CAD: short at 1.2490, target 1.2250, stop-loss 1.2590, risk factor **

AUD/USD: long at 0.7655, target 0.7900, stop-loss 0.7555, risk factor **

EUR/CAD: long at 1.3480, target 1.3700, stop-loss moved to 1.3630, risk factor **

CHF/JPY: long at 129.10, target 131.40, stop-loss moved to 130.95, risk factor *

AUD/JPY: long at 95.60, target 98.80, stop-loss 94.60, risk factor **

Pending Orders:

EUR/GBP: buy at 0.7110, if filled – target 0.7240, stop-loss 0.7070, risk factor ***

EUR/CHF: buy at 1.0320, if filled – target 1.0510, stop-loss 1.0225, risk factor **

EUR/JPY: buy at 134.70, if filled – target 137.00, stop-loss 133.60, risk factor ***

AUD/NZD: buy at 1.0450, if filled – target 1.0750, stop-loss 1.0350, risk factor **

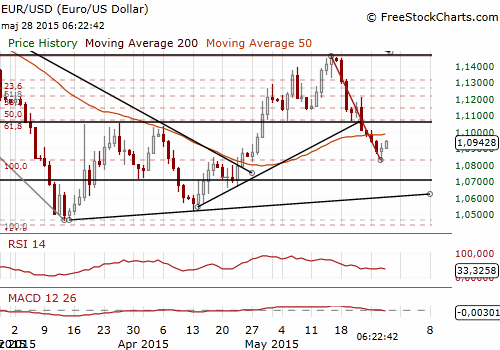

EUR/USD: Back To Our Medium-Term Strategy

(long for 1.1140)

- San Francisco Fed President John Williams (voting this year) said the central bank is likely to start raising interest rates later this year, and will move them to more normal levels over the next few years. He expects above-trend economic growth in the United States for the rest of the year after a weak first quarter.

- But he added: “Despite the clear need to consider all potential tools to avoid a financial crisis, I am unconvinced that monetary policy is one of them.” He said Norway and Sweden have both tried using rate hikes to protect against financial instability, and the result was a rise in unemployment and an unwanted slowdown in inflation.

- Greek economy minister George Stathakis said Greece and its international creditors have converged on key points on a cash-for-reforms deal but talks still have some room to cover before an agreement is clinched. Stathakis said Athens has no “plan B” despite recent threats by some ministers that the cash-strapped government may default on loan repayments to the IMF next month without aid.

- ECB's policy-setting Governing Council member Ewald Nowotny said: “A situation of low interest rates is something that makes sense for a certain period of time but this world of ultra-low interest rates is not a long-term equilibrium. (…) At the end of the day, we will return to, let's say, normal relationships regarding interest rates.”

- The EUR/USD did not fill our sell order yesterday at 1.0965, fell to a day’s low 1.0819 and recovered above 1.0900. The EUR/USD was supported by Nowotny’s comments and signs that cash-strapped Greece may be nearing a deal to secure fresh funding before a loan to the International Monetary Fund falls due on June 5.

- We cancelled our EUR/USD sell order at 1.0965 as the risk of further EUR/USD fall to 1.0740 has diminished. We switched our strategy to “buy EUR” again in our yesterday’s Forex Trading Strategies Summary and today we went long on the EUR/USD at 1.0940. We expect some good news from Greece soon, that could give the EUR/USD a boost. Long position is also in line with our medium-term outlook. As we wrote yesterday we expect the process of narrowing bond yields between US and Germany (and other Eurozone countries) will be continued despite possible Fed hike in September (that has been already priced in).

Significant technical analysis' levels:

Resistance: 1.0972 (23.6% of 1.1468-1.0819), 1.1062 (low May 20), 1.1067 (38.2% of 1.1468-1.0819)

Support: 1.0819 (low May 27), 1.0785 (low Apr 24), 1.0744 (76.4% of 1.0521-1.1468)

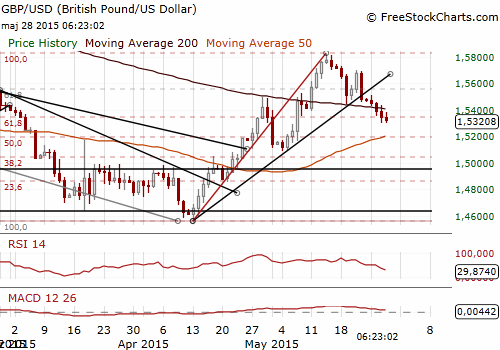

GBP/USD: Get Long At 1.5305

(long for 1.5600)

- The Office for National Statistics said GDP rose by 0.3% in the first quarter, unchanged from an initial estimate.

- The ONS said business investment rose by 1.7% in the first three months of the year, the strongest since the second quarter of 2014, after a decline of 0.9% in late 2014. But trade proved a major drag on the economy, knocking 0.9 percentage points off the quarterly rate of GDP growth, the biggest drag since the third quarter of 2013, due to high imports of oil, machinery and transport equipment. Household spending rose by 0.5%, softening slightly since the end of 2014.

- The Bank of England has said it ultimately expects the first-quarter growth rate to be revised up to 0.5% once final data is available. Last week the BoE forecast that Britain's economy would grow by 2.5% this year. GDP expanded by 2.8% in 2014, its fastest growth rate since 2006 and a bigger expansion than in any other major advanced economy, as Britain caught up on some of the ground lost during the financial crisis.

- The GBP/USD fell after data confirmed that the UK economy grew at 0.3% in the first quarter compared with the previous three months, disappointing those who had expected a higher reading. We cancelled our previous “sell GBP” order in our yesterday’s Forex Trading Strategies Summary and are back to our medium-term outlook. We used today’s fall to get long on the GBP/USD at 1.5305.

Significant technical analysis' levels:

Resistance: 1.5437 (high May 27), 1.5475 (high May 26), 1.5506 (high May 25)

Support: 1.5301 (low May 27), 1.5260 (76.4% of 1.5088-1.5815), 1.5240 (low May 8)

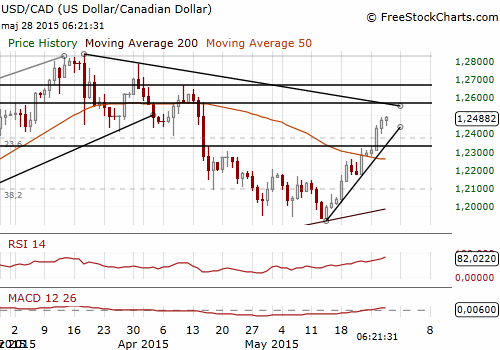

USD/CAD: BOC Kept Rates Unchanged, As Expected

(short for 1.2250)

- The Bank of Canada held its key interest rate at 0.75% yesterday, as widely expected.

- The bank acknowledged that first-quarter US weakness had raised questions about that economy's underlying strength but said it expected a return to solid growth in the second quarter. The outlook for the Canadian economy also remains largely in line with the April Monetary Policy Report. The bank's forecast in April was for 1.8% annualized growth in the second quarter and 2.8% in the third.

- The bank said: “Although a number of complex adjustments are under way, the Bank's assessment of risks to the inflation profile has not materially changed. Risks to financial stability remain elevated, but appear to be evolving as expected.”

- The Canadian dollar regained a little ground against the USD but still ended the day weaker after the Bank of Canada said it is standing pat on interest rates.

- We went short today at 1.2490 and set the target at 1.2250.

Significant technical analysis' levels:

Resistance: 1.2509 (low Apr 9), 1.2522 (high Apr 7), 1.2555 (high Apr 13)

Support: 1.2396 (low May 27), 1.2304 (low May 26), 1.2276 (low May 25)

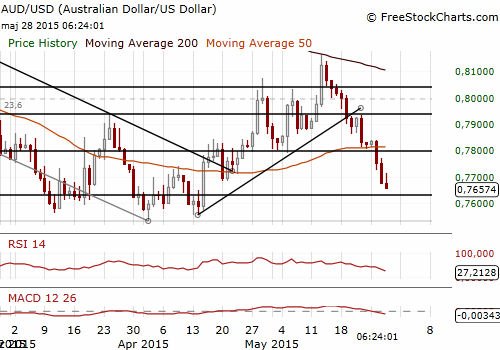

AUD/USD: Get Long At 0.7655

(long for 0.7900)

- The Australian Bureau of Statistics reported investment fell 4.4% to AUD 35.9 billion in the first quarter. That compared to forecasts of a 2.4% drop and was the biggest decline since late 2009. Crucially, spending plans for 2015/16 were on the weak side of expectations at AUD 104 billion, with sectors outside of mining showing little inclination to spend more.

- The news will be a bitter pill for the Reserve Bank of Australia which only just cut interest rates to a record low of 2% in the hope of reviving business spending. In a recent speech, Deputy Governor of the Reserve Bank of Australia Philip Lowe floated one idea for why investment has been so insensitive to policy easing, a phenomenon seen across many developed nations. He suggested firms had not adapted to the new normal of low global returns and now had unrealistic hurdles for their investment projects.

- The central bank holds its June meeting next week and is considered almost certain to hold rates steady this time.

- The AUD/USD fell to a 5-week low on weak business investment data. In our opinion the AUD depreciation lowers probability of another rate cut. That is why we have placed buy offer on the AUD/USD yesterday. We went long on the AUD/USD at 0.7655 today and expect a rise to 0.7900.

Significant technical analysis' levels:

Resistance: 0.7769 (high May 27), 0.7795 (55-dma), 0.7839 (high May 26)

Support: 0.7572 (low Apr 15), 0.7553 (low Apr 13), 0.7534 (low Apr 2)

Source: Growth Aces Forex Trading Strategies