GBP/USD for Friday, September 20, 2013

Throughout the second half of August the GBP/USD slowly but surely drifted lower away from the resistance level 1.57 and back down below 1.55 however this all now seems a distant memory. In the last few weeks it has rallied well and surged higher to move back up strongly through numerous levels which has now been punctuated by a surge higher in the last 48 hours up to an eight month high above 1.6150. The 1.57 level was likely to provide some resistance but it didn’t hold up progress higher that much. It did stall around 1.59 to 1.5950 for a few days before the recent surge higher. A few weeks ago it fell down to a two week low near 1.54 before rallying back towards 1.5550. The week before it did well to maintain its level above the key 1.56 level and in the process moving to a new two month high above 1.57 which has now been surpassed by the present high. It immediately retreated strongly but continued to receive solid support from the 1.56 level before closing below at the end of that week.

Several weeks ago it surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level. A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

Britain’s consumers took a break from shopping last month as spending fell back from the high levels recorded in July. Data from the Office for National Statistics showed that the volume of retail sales dropped by 0.9% in August – mainly as the result of weaker demand for food. The ONS said supermarkets had been particularly busy in July during the hottest of the summer weather but that activity came back to more normal levels in August. After the recent run of strong economic news, the City had been expecting retail sales to grow by 0.4% between July and August, and the pound fell when the figures were released. Food sales dropped 2.7% in August, and there was little evidence of the recent pickup in housing activity helping sales of household goods, which fell by 1.6%.

GBP/USD September 20 at 01:20 GMT 1.6039 H: 1.6141 L: 1.6022GBP/USD Technical" title="GBP/USD Technical" src="https://d1-invdn-com.akamaized.net/content/picdda2db024883943f115f49a5f7fb3024.png" height="231" width="415">

During the early hours of the Asian trading session on Friday, the GBP/USD is consolidating in a narrow range right around 1.6030 after having eased back from its highs near 1.6150. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid resurgence over the last couple of months moving back to above 1.61 and its highest point since January. Current range: Right around 1.6030.

Further levels in both directions:

• Below: 1.5800 and 1.5400.

• Above: 1.6150.

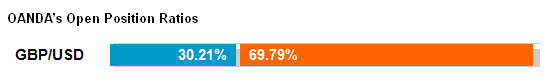

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved slightly above 30% as the GBP/USD has eased back towards 1.60. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 08:30 UK Public Borrowing (PSNB ex interventions) (Aug)

- 10:00 UK CBI Industrial Trends (20th-25th) (Sep)

- 12:30 CA CPI (Aug)

- EU EU & Chinese officials hold summit in Brussels