The GBP/USD continues its slide from the last week, touching below 1.53 before rallying recently to move back above 1.53. Prior to the last week, the pound has enjoyed a strong couple of weeks and move to new highs above 1.56. It experienced all sorts of bother at 1.56 as it made several pushes to this significant level however it was turned away with excessive supply. For about a week it ran into a wall of resistance right around the 1.56 level which is very evident in the 4 hourly chart below. This showed how much buying pressure there was on the 1.56 level but equally how well that level provided resistance to any movement higher. The pound had enjoyed a very solid couple of weeks moving from the support level at 1.52 to reach new highs at 1.56, a new ten week high.

It was only a few weeks ago, it found solid support at 1.52 for about a week which greatly assisted the recent surge higher. It had previously run into a wall of supply at 1.53 which had created resistance however it well and truly pushed through this level strongly followed by moving strongly through 1.54 within the following day. The last week however has seen the pound fall strongly and return most of its gains from the last few weeks. About a month ago the 1.54 level provided a little piece of resistance and this level has since been broken as it offered limited support. Now that the pound has drifted back down below 1.54, it may provide some resistance again. During its push to 1.56, the pound was able to find some support at 1.55, although this level has been broken last week. Over the last month or so, the GBP/USD has been experiencing a variety of different levels which have played a role on the price action.

Towards the end of March the GBP/USD was trading within a range roughly between 1.51 and 1.5250 and now on a couple of occasions it has been able to move outside that range and push higher. A few weeks ago, the 1.5350 level was one of significance as it offered resistance before the GBP/USD was able to move higher through to 1.56. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD has completely turned around its fortunes from earlier in the year. After the doom and gloom of the first couple of months of the year, the recent movement higher has seen the pound stop the rot and regain almost half of the year’s losses.

In the US, retail sales numbers were not very exciting. Core Retail Sales posted a second straight decline, as it fell by 0.1%, matching the forecast. Retail Sales fared slightly better, jumping from -0.4% to 0.1%. This beat the estimate of -0.3%. After a bad streak in April, we are seeing better numbers out of the US, notably employment figures. This has raised speculation that the Fed might adjust or even terminate its QE program, in which it buys $85 billion in assets every month. Terminating the QE program is dollar positive, and the US dollar was broadly stronger against all the major currencies on Friday. The markets will be looking for any clues as to the Fed ending QE, which would likely push the dollar higher.

GBP/USD May 14 at 01:50 GMT 1.5325 H: 1.5384 L: 1.5277

During the early hours of the Asian trading session on Tuesday, the GBP/USD is rallying a little higher moving back up above 1.53, after having recently fallen strongly down through 1.54 and to a two week low below 1.53 at the end of last week. Throughout the first part of this year, the Cable fell very strongly from the key resistance level at 1.63 level down to levels not seen in two and a half years and has done well the last month to rally well and move back up above 1.56. Current range: Right around 1.5350.

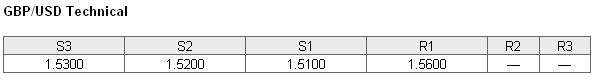

Further levels in both directions:

• Below: 1.5300, 1.5200 and 1.5100.

• Above: 1.5600.

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back up above 50% after the GBP/USD has fallen down to the two week low near 1.53. Trader sentiment has shifted to in favour of long positions.

Economic Releases

- 09:00 EU Industrial production (Mar)

- 09:00 EU ZEW (Economic Sentiment) (May)

- 09:30 AU Treasurer Swan announces Federal Budget for 2013/14 Financial Year

- 12:30 US Import Price Index (Apr)