GBP/USD

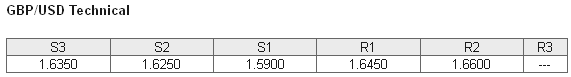

Over the last couple of months the GBP/USD has established and traded within a trading range roughly around the key level of 1.6450, whilst moving down to support at 1.6250 and up to 1.66. Over the last couple of days the pound has rallied higher only to run into resistance around 1.6450 again. A couple of weeks ago, the pound rallied higher and moved to a resistance level at 1.66 which represented a multi-year high before easing back to below 1.6450. A few weeks ago it rallied again trying to break through the 1.6450 level before dropping back to a support level at 1.6350. In late November it did well to break through the long term resistance level at 1.6250 which had established itself as a level of significance over the last few months. This level continues to play a role in providing support. In early November, the pound bounced strongly off the support level at 1.59 to return back to above 1.6250.

Towards the end of October the GBP/USD slowly drifted lower from the strong resistance level at 1.6250 and down to a three week low just around 1.5900 which was recently passed as the pound moved down towards 1.5850 only a week ago. For the week or so before that the pound moved well from the key level at 1.60 back up to the significant level at 1.6250, only again for this level to stand tall and fend off buyers for several days. Throughout September the pound rallied well and surged higher to move back up strongly through numerous levels which was punctuated by a push through to its highest level for the year just above 1.6250 several weeks ago. In the first week of October the pound was easing back towards 1.60 and 1.59 where it established a narrow trading range between before surging back to 1.6250 again.

Back in the middle of August the pound surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level. A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

The Bank of England discussed with top London currency dealers their process for setting foreign exchange rates more than a year before a global investigation into alleged manipulation, according to a document shown to Reuters by the bank. The document, supplied in response to a freedom of information request for details of a meeting on 23 April 2012 of the chief dealers subgroup of the London Foreign Exchange Joint Standing Committee, said there was a brief discussion of "processes around fixes" – referring to the daily setting of benchmark exchange rates – and "extra levels of compliance". Two sources with knowledge of the meeting said the traders told the Bank about online chatroom use prior to the rate-setting. It was not clear how much detail was provided. The subgroup, set up for banks and brokers to discuss broad currency market issues, met at the London offices of French bank BNP Paribas. The time lag between the start of the global probe and the BoE's meeting, at which sources told Reuters traders had disclosed they were exchanging information via chatrooms about client positions, raises questions about whether the Bank should have referred the matter to the regulators. GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="550" height="226">

GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="550" height="226"> GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" width="550" height="231">

GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" width="550" height="231">

GBP/USD January 20 at 01:15 GMT 1.6398 H: 1.6424 L: 1.6395

During the early hours of the Asian trading session on Monday, the GBP/USD is just easing back a little towards 1.64 after finishing last week a little lower. Current range: Right on 1.6400.

Further levels in both directions:

• Below: 1.6350, 1.6250 and 1.5900.

• Above: 1.6450 and 1.6600.

OANDA’s Open Position Ratios

GBP/USD Positions Ratio" title="GBP/USD Positions Ratio" width="474" height="27" align="bottom" border="0">

GBP/USD Positions Ratio" title="GBP/USD Positions Ratio" width="474" height="27" align="bottom" border="0">

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio remains just below 30% as the GBP/USD stays under the level at 1.6450. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 00:01 UK Rightmove House Price Index (Jan)

- 04:30 JP Capacity Utilisation (Nov)

- 04:30 JP Industrial Production (Final) (Nov)

- 15:00 EU Flash Consumer Sentiment (20th-24th) (Jan)