GBP/USD rebounded last week as Bank of England Governor Mervyn King said in an interview that the central bank was not trying to depreciate the value of the Pound, but did acknowledge the benefit a weaker currency has had on exports.

In the same interview King indicated he may have voted to increase the BOE’s bond purchase program which currently sits at £375bn. With this in mind Wednesday’s MPC Meeting Minutes have grown in importance. We’ll look to the minutes to see if King’s view that the improved recovery would benefit from another round of stimulus. If we see additional members voting the same way we can increase bets of another round of QE, and subsequent continuation of GBP/USD declines.

This week is full of important domestic data. On Tuesday a report is expected to show CPI tick up to 2.8%. This is important because if CPI hits 3% we’ll get the BOE Inflation letter from the BOE that outlines the central bank’s plans to bring inflation back towards the 2% target. At the same time, the chances of additional bind purchases diminish due to the link QE has with inflation.

On Wednesday a report will show the change in the number of people claiming for unemployment benefits. -5.2k is expected, and the Unemployment Rate to stay at 7.8%.

The Annual Budget Release on Wednesday will also draw the attention of the market as it will provide an insight into the government’s plans for the year ahead. More spending cuts, more spending, or simply more borrowing? These are all questions that will be answered.

Finally, on Friday we’ll see the latest retail sales number. After 2 straight months of contraction analysts are expecting a rebound. 0.5% in the forecast. GBP/USD" title="GBP/USD" width="1585" height="734">

GBP/USD" title="GBP/USD" width="1585" height="734">

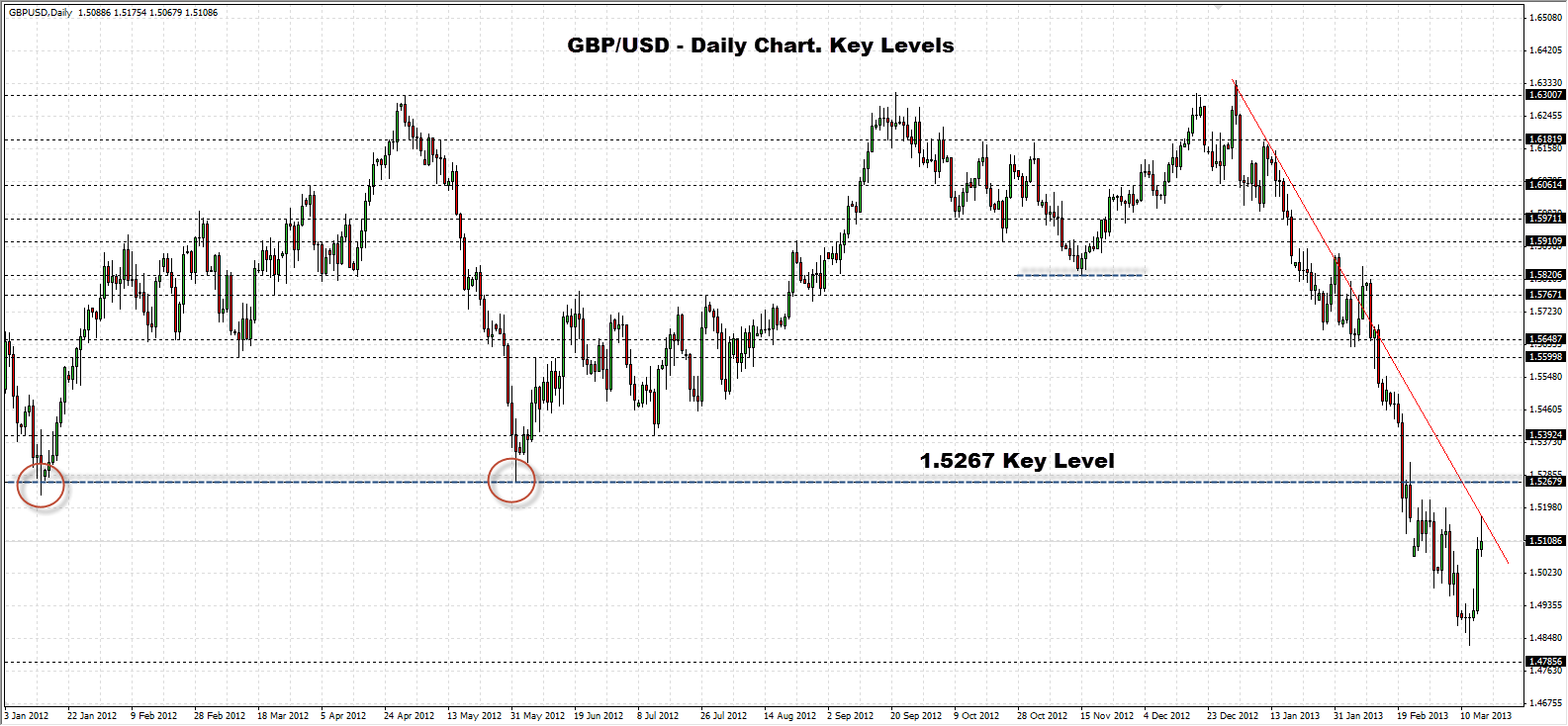

•GBP/USD has now broken to the downside of LONGER term range (1.6300 – 1.5267)

•Decline through support at 1.5820 triggered the bearish price action as expected.

•Recent break of 1.5267 key level is a bearish sign.

•1.4875 key level is next major support.

•Selling off key levels offers high probability set-ups.

•Bearish bias.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GBP/USD: A Rebound On BOE King's Remarks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.